Crypto markets face weeks of deleveraging in the fallout from the crisis at digital-asset exchange FTX.com, a period of upheaval that could push Bitcoin down to $13,000, according to JPMorgan Chase & Co. strategists.

A “cascade of margin calls” is likely underway given the interplay between the exchange, its sister trading house Alameda Research and the rest of the crypto ecosystem, a team led by Nikolaos Panigirtzoglou wrote in a note.

“What makes this new phase of crypto deleveraging induced by the apparent collapse of Alameda Research and FTX more problematic is that the number of entities with stronger balance sheets able to rescue those with low capital and high leverage is shrinking” in the crypto sphere, the team said Wednesday.

Digital-asset investors are still coming to terms with the rapid unraveling at FTX.com and the concerns swirling around Alameda Research, both founded by 30-year-old Sam Bankman-Fried. There are fears that the potential bankruptcy of FTX.com could lead to contagion that takes down other crypto outfits.

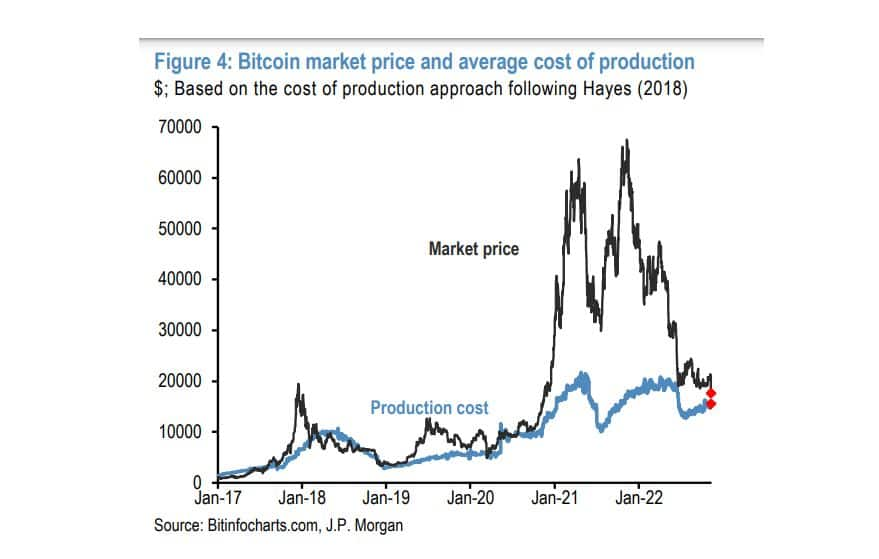

The strategists pointed to Bitcoin’s production cost as a way of calibrating how much further it can fall. The production cost is mainly the electricity needed to operate the powerful computers that run the Bitcoin network.

“At the moment, this production cost stands at $15,000, but it is likely to revisit the $13,000 low seen over the summer months,” they said.

Bitcoin snapped four days declines, including a near 16 percent tumble Wednesday, to edge up about 3 percent to $16,200 as of 9:35am in Singapore on Thursday. The crypto market broadly was steady, but on edge about what other risks might lie ahead.

Bankman-Fried has told FTX.com investors that without a cash injection the company would need to file for bankruptcy, according to a person with direct knowledge of the matter.

The episode is the latest imbroglio to befall virtual coins, exacerbating steep losses this year caused by a withering of speculative ardor under the sobering influence of aggressive interest-rate hikes.

The last big shakeout was in May, when the TerraUSD stablecoin and its sister token Luna imploded. The JPMorgan team said the hit to overall crypto market value this time around is likely to be smaller as the TerraUSD episode already sparked a pullback in risk taking.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.