As inflation wreaks havoc across product segments, consumers have started rationalising their spending on personal and household care purchases while continuing to spend on the food and beverage category, show the results of a recent study conducted by insights and consulting company Kantar Worldpanel.

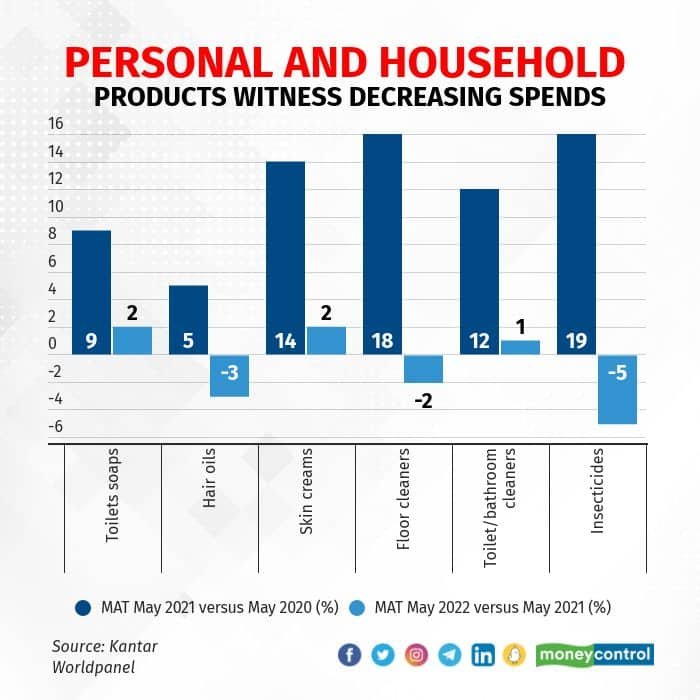

According to the study, the spending on the personal care segment, which includes products like shampoos, conditioners and soaps grew 11 percent on a moving annual total (MAT) basis in May 2021 as compared to the same period in 2020. The spending growth on the category dropped to 1 percent in May 2022 as compared to May 2021.

Similarly, the household care segment, whose spending grew 7 percent in May 2021 on a MAT basis as compared to May 2020, witnessed just 1 percent spending in May 2022 as compared to the corresponding period last year.

The food and beverage category, however, has maintained its growth momentum and registered a spending growth of 6 percent in May 2022 on a MAT basis as compared to May 2021. The segment had seen a spending growth of 8 percent in May 2021 on a MAT basis as compared to May 2020.

“Whenever there are uncertain conditions like an inflation in the market, it is the discretionary categories that are typically hit by most households. That's because households can still manage without the discretionary items for some time, but not without the essentials," said K.Ramakrishnan,Managing Director,South Asia, Kantar Worldpanel.

"It is in this context that we see households trying to hold on to their habits more in the food and beverage sector, which is more essential to them than the personal care or household care," he added.

The study also revealed that consumers have switched to unbranded products or are downtrading in a bid to fight inflation and contain their spending.

For instance, branded edible oils witnessed a volume de-growth of 2 percent in March-May 2022 period as compared to the same period in 2021, showed the study. Sales volumes of unbranded edible oil grew 7 percent in the period.

Other food products such as butter and cheese, and spices also witnessed a similar trend. The sales volumes of branded butter and cheese products degrew by as much as 16 percent in March-May 2022 period as compared to the corresponding period in 2021. Meanwhile unbranded butter and cheese segment grew by 10 percent in March-May 2022 period as compared to March-May 2021. Branded spices volumes saw only 3 percent growth in March-May 2022 period as compared to the same period last year. However, sales volumes of unbranded spices jumped by 8 percent.

The trend was replicated in the household products like toilet cleaners and floor cleaners too. The sales volumes of unbranded toilet and bathroom cleaners surged by 13 percent during March-May 2022 period versus the same period last year, while that of branded segments dropped by 11 percent. Unbranded floor cleaners saw a 16 percent climb in sales volumes in March-May 2022 as compared to the corresponding period last year, whereas the branded products in the category degrew by 6 percent.

Inflation has also increased the promotion-seeking behaviour amongst Indian consumers and more of them are buying FMCG products, which are bundled with deals, discounts and other offers. According to Kantar Worldpanel, about 89 percent of Indian households were buying FMCG products on promotions in March -May 2022 period as compared to 82 percent in the same period in 2021 and 74 percent in 2020.

The trend was reflected across urban and rural households. About 89 percent of urban households, showed the study, were buying products on promotions in March -May 2022 period as opposed to 80 percent in the corresponding period in 2021 and 68 percent in 2020.

In rural India, too, about 89 percent of households showed promotion-seeking behaviour in March-May 2022, while 83 percent of them bought FMCG products based on promotion in March-May 2021 and 78 percent in 2020.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.