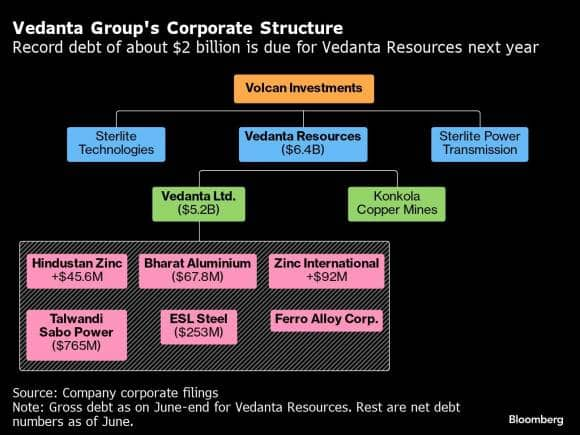

Hindustan Zinc on September 29 informed the stock exchanges that its board has decided to evaluate corporate restructuring alternatives to unlock growth.

The idea behind the restructuring is to create separate entities for zinc, lead, silver and recycling businesses.

With the possible restructuring, the company plans to unlock value for shareholders by creation of businesses which are positioned to better capitalise on their distinct market positions and deliver long-term growth. Along with that, the restructuring will also aim to set up an appropriate capital structure and capital allocation policies, uniquely to each business.

Source: Bloomberg

Source: BloombergThe company will also appoint external advisers to evaluate plans for a potential restructuring.

ALSO READ: Hindustan Zinc eyes jump in output under chair Agarwal Hebbar

Following the news, shares of Hindustan Zinc surged nearly 6 percent to its day's high of Rs 317.50. At 1.52 pm, shares of Hindustan Zinc were trading 5.25 percent higher at Rs 313.60 on the National Stock Exchange.

Volumes in the counter also began picking up as 12 lakh shares changed hands so far, significantly higher than the one-month daily traded average of 4 lakh shares.

ALSO READ: Hindustan Zinc aims to increase production capacity by 50% to 1.5 million tonnes

The news also bode with shares of Vedanta, the company that holds a 65 percent stake in Hindustan Zinc, as it also soared nearly 7 percent. The stellar gains not just helped shares of Vedanta snap a seven-day losing streak but also see its best day in 2023 so far.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before making any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.