In order to promote growth and investment, Finance Minister Nirmala Sitharaman on September 20 slashed the effective corporate tax from 30 percent to 25.17 percent, inclusive of all cess and surcharges for domestic companies. However, the move, effective from April 1, is subject to the condition that they will not avail any other incentive or exemptions.

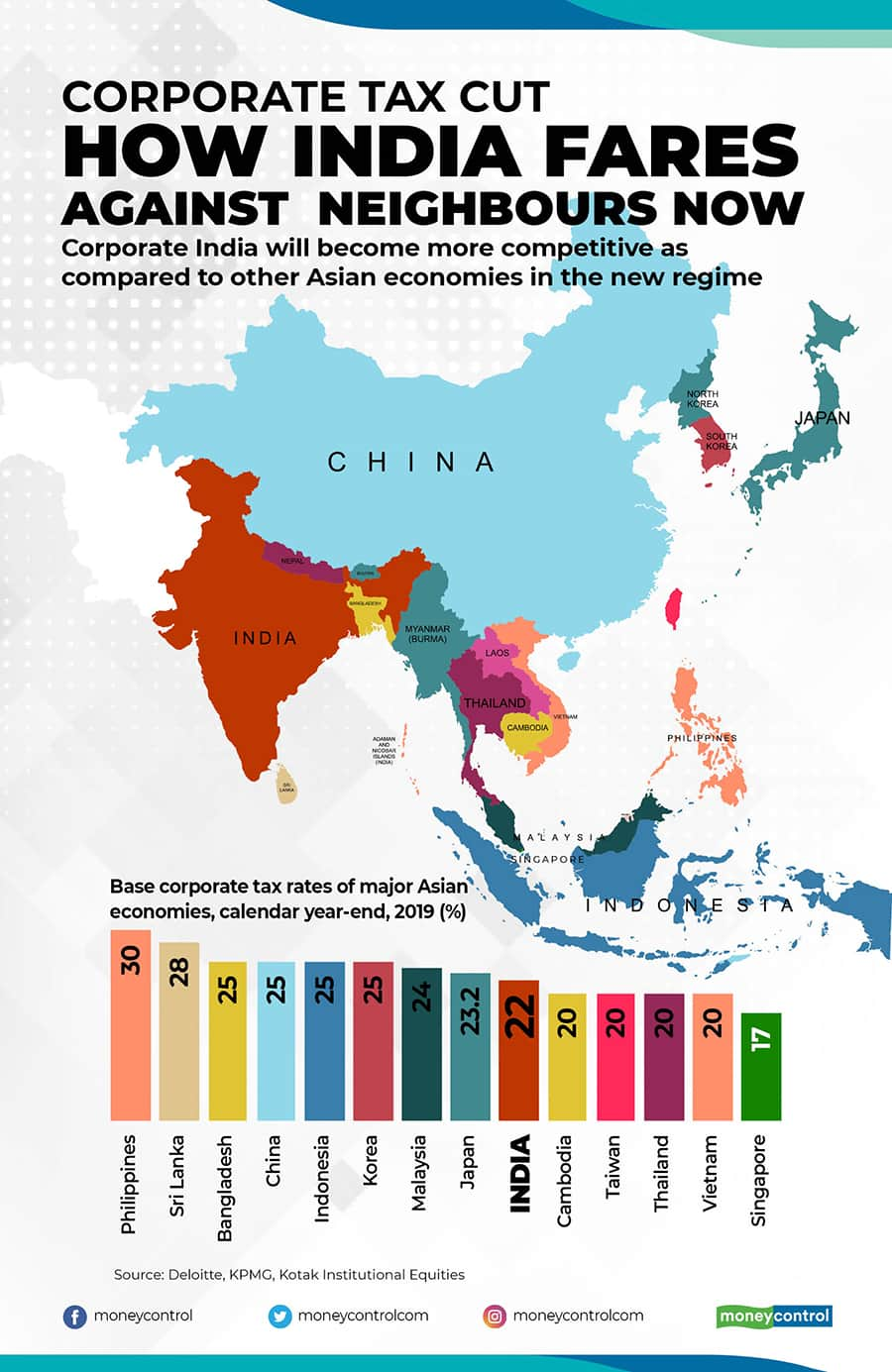

In effect, the corporate tax rate will be 22 percent for domestic companies if they do not avail any incentive or concession. The changes in the Income Tax Act and Finance Act will be made effective through an ordinance.

Sitharaman said the revenue foregone on reduction in corporate tax and other relief measures would be Rs 1.45 lakh crore annually.

Companies opting for the 22 percent income tax slab will now not have to pay the Minimum Alternative Tax (MAT).

Nirmala Sitharaman press conference LIVE: Govt to forego Rs 1.45 lakh cr/year on reduction in corp tax, other measuresNew domestic manufacturing companies incorporated after October 1 can pay the income tax at the rate of 15 percent without any incentives, the finance minister said. This means the effective tax rate for new manufacturing companies will be 17.01 percent, inclusive of all surcharge and cess.

Companies can opt for lower tax rate after the expiry of tax holidays and concessions that they are availing now, she added.

The government has also decided not to levy the enhanced surcharge introduced in Budget 2019 on capital gain arising from sale of equity shares in a company liable for the securities transaction tax (STT).

Also, the super-rich tax will not apply on capital gains arising from sale of any security including derivatives in hands of foreign portfolio investors (FPIs).

In another relief, the minister said listed companies which had announced buyback of shares prior to July 5 would not be charged with super rich tax.

Also, the companies have now been permitted to use their 2 percent CSR spend on incubation, IITs, NITs, and national laboratories.

Sitharaman expressed confidence that the tax concessions would bring investments in Make in India, boost employment and economic activity, leading to more revenue.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.