Fifty basis points worth of rate increases during the course of FY19 was always on the cards. The surprise element was the timing of the first hike.

The Reserve Bank of India, by announcing a 25-basis-point increase (repo rate at 6.25 percent and reverse repo rate at 6 percent) has put near-term speculation to rest and provided much-needed relief to the market with its overall neutral stance.

Interestingly, all six members of the monetary policy committee (MPC) voted for a 25-basis-point rate hike, underscoring the concern about inflation that was apparent in the minutes of the previous meeting.

Why a hike now?RBI alluded to the sudden jump in core inflation as one of the primary reasons for the rate action.

The central bank talked about inflation firming up in several pockets like transport and communication, clothing, household goods and services, health, recreation, education, and personal care and effects.

The recent round of the RBI's survey of households reported a significant rise in households' inflation expectations, by around 90 basis points for three months from now and 130 bps for one year from now.

In addition, manufacturing firms polled by RBI reported input price pressures and an increase in selling prices in Q1 FY19 and wage pressure in the organised sector.

Furthermore, since MPC's last meeting in early April, the price of the Indian basket of crude surged from $66 a barrel to $74. This, along with an increase in other global commodity prices, has resulted in a firming up of input cost pressures as borne out by the survey of manufacturing firms.

Consequently, RBI has revised upwards its inflation projection (CPI) for both the first and the second half of FY19.

Source: Moneycontrol Research

Is growth making a comeback?The central bank sounded more bullish on growth in near term, but left the overall growth forecast unchanged. It alluded to sharp acceleration in investment and construction activity in recent times.

With improving capacity utilisation and credit offtake, the RBI believes that investment activity will remain robust. It is also optimistic about a recovery in exports in light of buoyant global demand, and sounded optimistic on rural and urban consumption gaining strength.

However, while it increased its growth forecast for the first half of the current fiscal year, it cut its forecast for the second half (the high base of H2 FY18 could partially explain this).

How should markets read this?The rate hike should comfort the rupee and counter imported inflation emanating from a surge in global commodity prices. The upward revision in inflation trajectory partially factors in the probable hike in minimum support prices (MSP).

Since the base effect will lend some positive relief to the inflation numbers in the second half of the fiscal, depending on the data points, this rate hike may well be construed as front-loading of the rate action.

The RBI may go for another rate hike in August or October and remain quiet for the remainder of the fiscal.

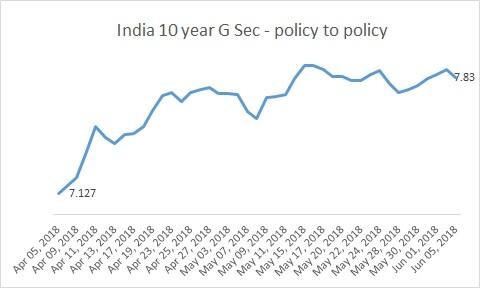

The market had already priced in a rate hike, with the yield on the 10-year government bond hardening significantly since the last policy, despite several announcements designed to bring it down.

Money had become costlier with banks hiking their lending rates along with upward revision in deposit rates. So the move doesn't come as a surprise.

Source: Reuters

With the event risk out of the way, the market should start focusing on what it ought to -- the earnings trajectory.

Easing the pain with several other announcementsTo encourage affordable housing, housing loan limits for priority sector lending have been raised from Rs 28 lakh to Rs 35 lakh in metropolitan centres (cost of the dwelling unit up to Rs 45 lakh) and from Rs 20 lakh to Rs 25 lakh in other centres (cost of dwelling unit up to Rs 30 lakh).

Though rates have hardened, this decision will provide some measure of relief to a large section of home buyers borrowing from banks.

As a prudent regulator, the RBI is mindful of the higher delinquency in low-ticket housing loans (up to Rs 2 lakh) and may increase the loan-to-value ratio or risk weight in that segment.

In a move that will bring cheer to banks, RBI has increased the quantum of statutory liquidity ratio, which can now be construed as a part of liquidity coverage ratio, effectively giving them a little more headroom to lend.

The loan recovery criterion of 180 days past the due date (instead of 90 days) for GST-registered MSME (micro, small and medium enterprises) has been extended to non-GST-registered ones as well, subject to the condition that they get registered by January 1, 2019.

In view of the continuing rise in yields of government securities, treasury losses of banks can be equally spread over a period of four quarters, starting the quarter ending June. This is an extension of the relaxation that was in force for the past two quarters.

Finally, in line with global practices, the initial margin on securities for the central bank's liquidity adjustment facility would be according to residual maturity of the security, and not uniform.

In sum, the rate hike removes a key event risk from the market and the front-loading of the action should help rein in inflationary expectations without upsetting the green shoots of recovery.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!