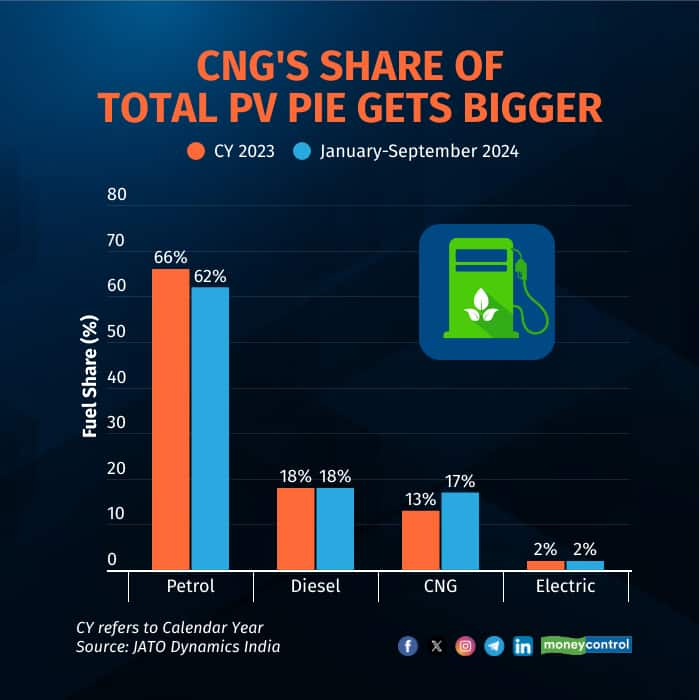

The share of Compressed Natural gas (CNG) Passenger Vehicles (PVs) has increased to 17 percent of PVs sold during January-September 2024, per JATO Dynamics India, an auto analytics firm. CNG vehicle sales grew nearly 50 percent to 5,50,812 units during the first nine months of this calendar year.

According to industry observers, the sale of CNG vehicles is increasing due to lower ownership costs, improved performance, more dispensing stations, and a wider range of offerings. At present, India has more than 7,000 gas dispensing stations, which will go up to 17,500 by the end of 2030, they said.

“With over 40 percent of sedans now running on CNG, there is a definitive shift in consumer preferences. Our analysis reveals that CNG adoption in sedans has risen from 10.8 to 41.5 percent in the last five years,” said Ravi Bhatia, MD, JATO Dynamics India.

The total number of CNG variants in the PV market has also increased from 65 to 97 now, he said, and added that the sale of petrol variants has correspondingly declined, with their share down to 61 percent in H1 FY25, from 65 percent in FY19.

Also, with the higher uptake of gas-driven PVs, the proportion of diesel-fired vehicles has halved, from 36 percent in FY19 to 18 percent of PVs sold (January-September '24), per JATO Dynamics.

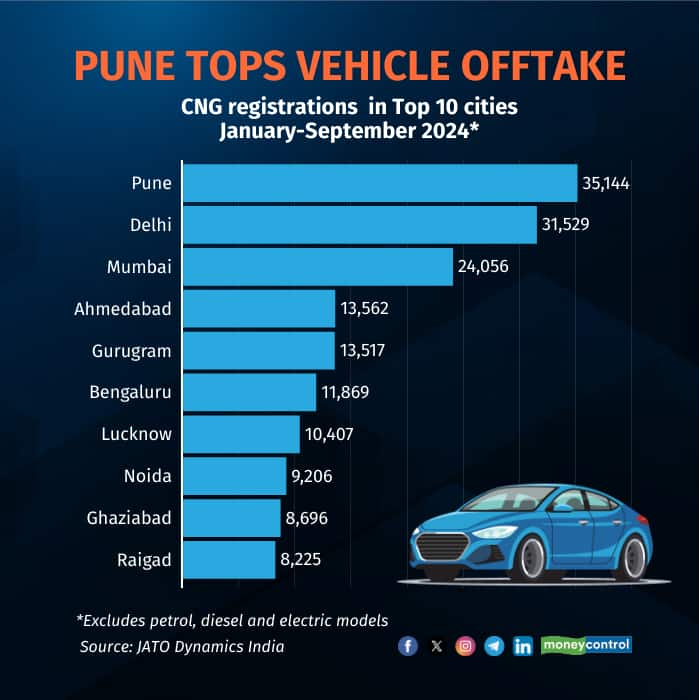

While Pune leads in CNG sales (35,144 units), Delhi is second with 31,529 units, followed by Mumbai at 24,056 units. Ertiga tops the CNG charts with 84,580 units, followed by WagonR at 67,092 units.

A FADA (Federation of Auto Dealers Association) official, speaking off the record, said the organisation feels CNG vehicles could outnumber the sale of diesel-powered ones during this calendar year, provided gas prices remain stable.

With the increasing preference for gas-fired vehicles, most manufacturers are looking to augment their presence in the CNG segment.

For instance, PV market leader Maruti expects CNG variants to comprise 30 percent of its sales in FY25. With the rollout of gas-powered variants of the next-generation Swift and Dzire, the company expects to sell 3,00,000 units of CNG vehicles in FY25.

“The (lower) total cost of ownership of a CNG vehicle makes a huge difference. Further, if you're buying a product backed by a huge service network, which we have, the customer has peace of mind, which no other OEM can provide. All these things are making a difference,” Maruti Suzuki Senior Executive Officer (Marketing and Sales) Partho Banerjee told Moneycontrol.

Banerjee said that Maruti is running two dedicated assembly lines — one for ICEVs and another one for CNG vehicles.

Another carmaker, Hyundai Motor India, is prioritising the development of CNG vehicles owing to a significant rise in demand. CNG models drove 11.4 percent of the company's sales in FY24, up from 9.1 percent FY22.

“The introduction of the Hy-CNG Duo is aimed at meeting the customer demand for ample space along with high mileage and safety. This has helped us achieve the highest-ever monthly CNG vehicle sales of 8,621 units in October 2024," Tarun Garg, the company's COO, recently said in a statement.

Tata Motors has also seen massive growth in CNG vehicle sales. The homegrown carmaker sold 91,000 units in FY24, up from around 41,000 units in the previous fiscal.

“The data clearly indicates that fuel is becoming a key purchase criterion,” said Bhatia, and added, “This gives rise to the question: will 100 percent of the fleet operators / taxis convert from CNG to electric? How will that impact OEMs, and how will they navigate this transition?”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.