The Bank of Japan decided against making more adjustments to its yield curve control program, prompting a sharp slide in the yen as it tried to contain speculation over policy normalization fueled by December’s shock move.

The central bank kept its main policy settings unchanged, leaving its negative interest rate at -0.1% and 10-year bond yields around 0%, according to its latest policy statement Wednesday.

The BOJ stated its intention to continue large-scale bond buying and to increase them on a flexible basis as it showed its intention to double down on defense of its yield curve control program for now.

While almost all 43 economists surveyed had forecast the stand-pat decision, many of them had said they couldn’t rule out the possibility of back-to-back action.

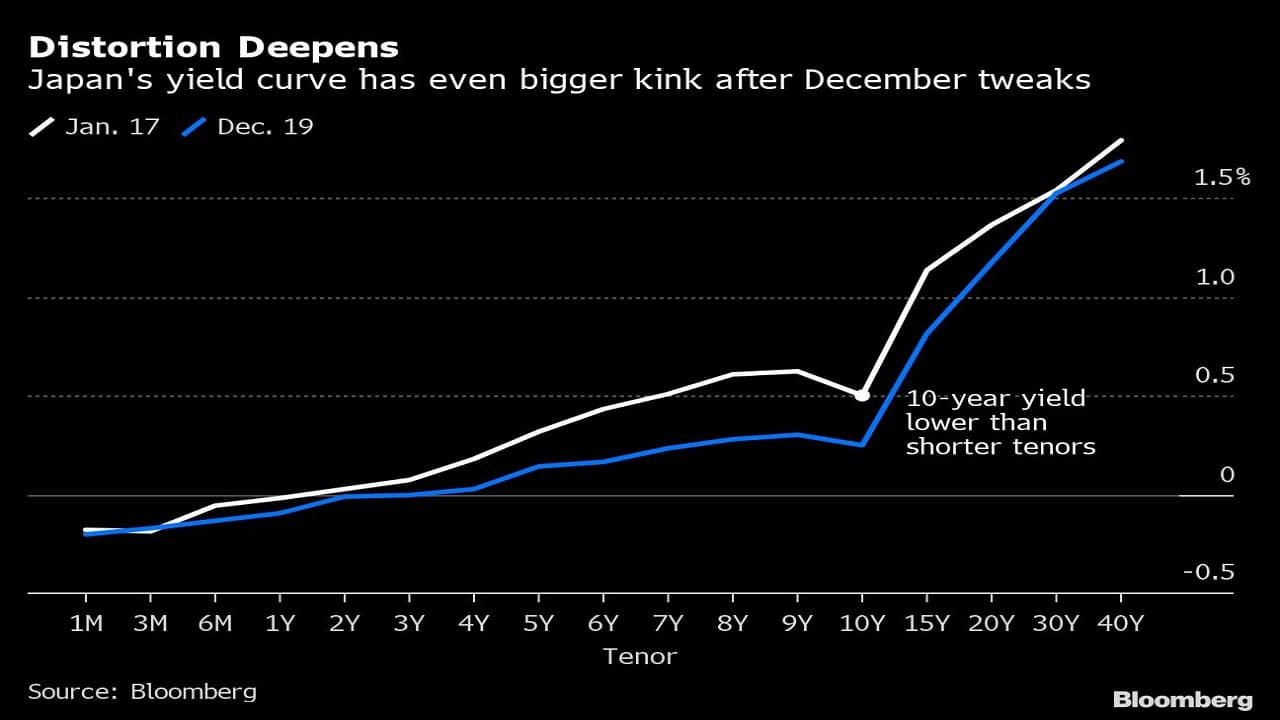

After the BOJ unexpectedly widened its 10-year yield target band last month, Governor Haruhiko Kuroda’s massive easing program has come under the fiercest market attack in his decade-long term.

While Kuroda insisted that December’s move aimed to improve market functioning, it only fueled speculation over more changes. Some believe there will be more action even before the governor steps down in April.

Wednesday’s decision suggests that the BOJ isn’t seeking an immediate exit or a looser grip on bond yields.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.