The US is considering options including sanctions on Russia’s top producer of aluminium as the White House seeks to punish Moscow for its military escalation in Ukraine, media reports said.

According to Bloomberg, the US is eyeing three options: an outright ban, increasing tariffs to levels so punitive they would impose an effective ban, or sanctioning the company that produces the nation’s metal, United Co Rusal International PJSC.

Reacting to this, Aluminium soared as much as 7.3 percent on the London Metal Exchange (LME) - one of the biggest intraday moves on record - before settling 3.1 percent higher to $2,305 per tonne on Wednesday. Shares of Alcoa, the largest US producer, closed 5.3 percent higher after gaining as much as 8.6 percent in New York trading. Shares of Indian producers of aluminium, Hindalco, Vedanta and NALCO, inched up by 2-3% in opening trading.

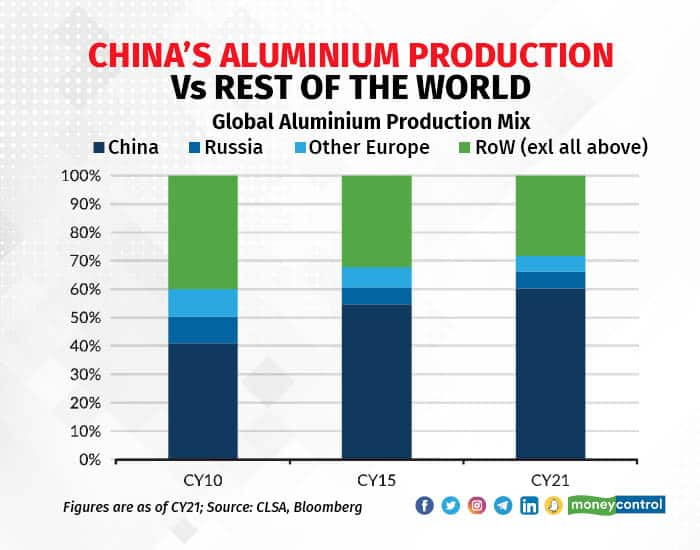

US relies on a steady flow of aluminium imports from Russia, the world’s second biggest aluminium producer, trailing only China, for supplies of the metal that goes into manufacturing everything from automobiles to aircraft and appliances.

“The inability to trade Russian aluminium would impact supply and would have predicable effects on the industry,” president of the Aluminium Association of the United States, Charles Johnson, said at an industry event in Washington. Russia contributes to overall 6% of overall global production as per CY21, as per CLSA’s note.

“This (sanctions) could work out in favour of India as demand for aluminium in international markets is huge,” said Gaurang Shah of Geojit Financial Services said. “We are positive on Hindalco and Vedanta stocks from a long-term perspective and expect 15 percent upside from the current levels.”

Though knee-jerk reaction of this move is perhaps evident. But another analyst isn’t reading much into the situation. Amit Dixit, Vice President-Research, ICICI Securities, said he did not expect “a lasting impact of this development but definitely expects a lot of news flow” around it.

This Development Follows:

LME, the world’s oldest and largest market for trading industrial metals, said on September 29 it was considering a consultation on whether Russian aluminium, nickel and copper should continue to be traded and stored in its system. (link-Sanction worries spark fresh inflationary concerns for aluminium makers (moneycontrol.com)

Goldman Sachs warned a day later that any ban would stoke inflationary pressure in Europe as it will inflate the price of the metal in the near term.

Lastly, this isn’t the first time that the US would be putting up with a sanction. In 2018, US buyers scrambled after the Donald Trump administration announced sanctions against Moscow-based United Co Rusal, the largest producer outside China, which led to a spike in aluminium prices.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.