Dalmia Bharat’s wholly owned subsidiary – Dalmia Cement has entered into an agreement to acquire the cement, clinker and power plants of Jaiprakash Associates having a total cement capacity of 9.4 million tonnes (along with a Clinker capacity of 6.7 million tonne and Thermal Power plants of 280MW). The plants are situated in Madhya Pradesh, Uttar Pradesh, and Chhattisgarh.

The plants have been bought for an enterprise value of Rs 5,666 crore.

The transaction is subject to due diligence, requisite approvals from lenders/JV partner of Jaiprakash Associates and regulatory authorities.

Back in In October, Jaiprakash Associates and Jaiprakash Power Ventures had announced plans to divest their cement business as well as some non-core assets to reduce debt.

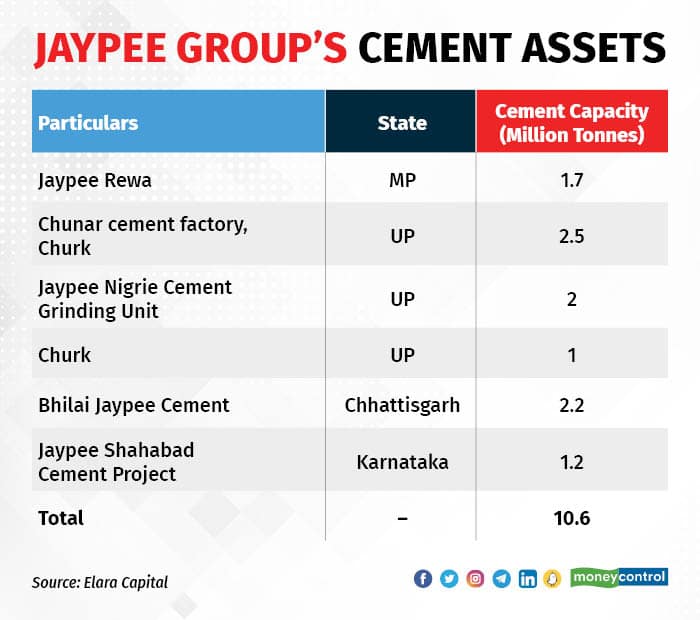

Background:According to the annual report of Jaiprakash Associates, Jaypee Group (including Jaiprakash Power Ventures) at present has an installed cement capacity of 10.55 million tonnes per annum and 339MW of captive power.

More than 50 percent of Jaypee Group’s cement capacity is located in the central Indian market. Of the total cement capacity, 1.2 MTPA (in South India) is under expansion, although it has been on hold for some time.

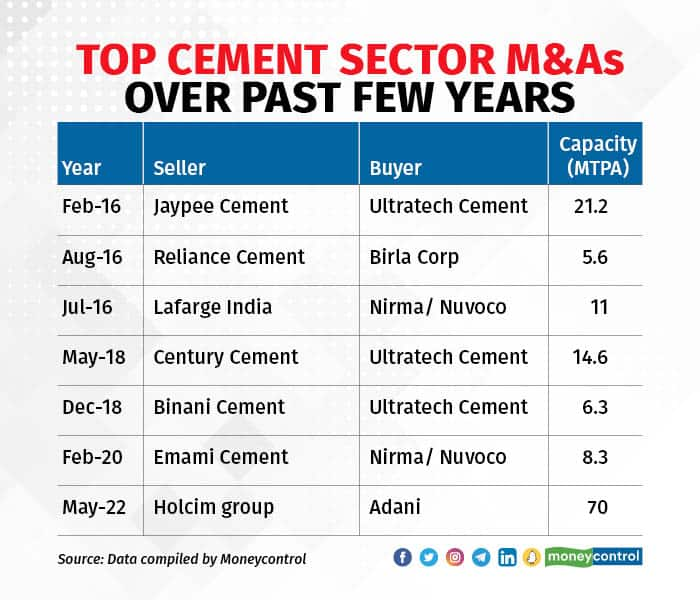

Further, this isn’t the first time that Jaiprakash Associates is selling a cement plant. In 2016, Jaypee Cement sold a 21.2 MTPA plant to Ultratech Cement for an Enterprise Value/Tonne (EV/T) of $115.

Ultratech Cement has been the torchbearer of the industry’s inorganic expansion. Adani too has been aggressively scaling up, but Dalmia too with the latest acquisition has racheted up.

This should be widely positive for Dalmia Bharat's subsidiary- Dalmia Cement. Acquisition of Jaypee assets would ensure entry into high-growth and new markets of Uttar Pradesh and Madhya Pradesh (Central region) for Dalmia, which would help it diversify from existing markets of South and East. It also has a presence in North Eastern Region and Western Region.

The acquisition will enable Dalmia to expand its footprint into the Central Region and will represent a significant step towards the realisation of its vision to emerge as a Pan India Cement company with a capacity of 75 million tonne by FY27 and 110‐130 million tonne by FY 2031.

This is expected to be marginally negative for Central region players such as Prism, Heidelberg and Birla Corp as the Central region may get more competitive with the entry of Dalmia.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.