Indian carriers have shown a marked increase in their share of international air traffic in the first quarter of 2024-25 (April-June), carrying 46 percent of all incoming passengers, a significant rise of more than 1000 basis points compared to pre-pandemic levels and 250 basis points higher than in 2023-24.

Similarly, 45.3 percent of all outgoing international passengers from India flew on domestic carriers, again reflecting over 1000 basis points higher than pre-pandemic levels and 80 basis points higher than the previous year.

This increase is attributed to the Indian government’s decision to restrict additional bilateral flying rights for foreign airlines, a policy that has allowed domestic airlines, particularly IndiGo and Air India, to expand their international operations.

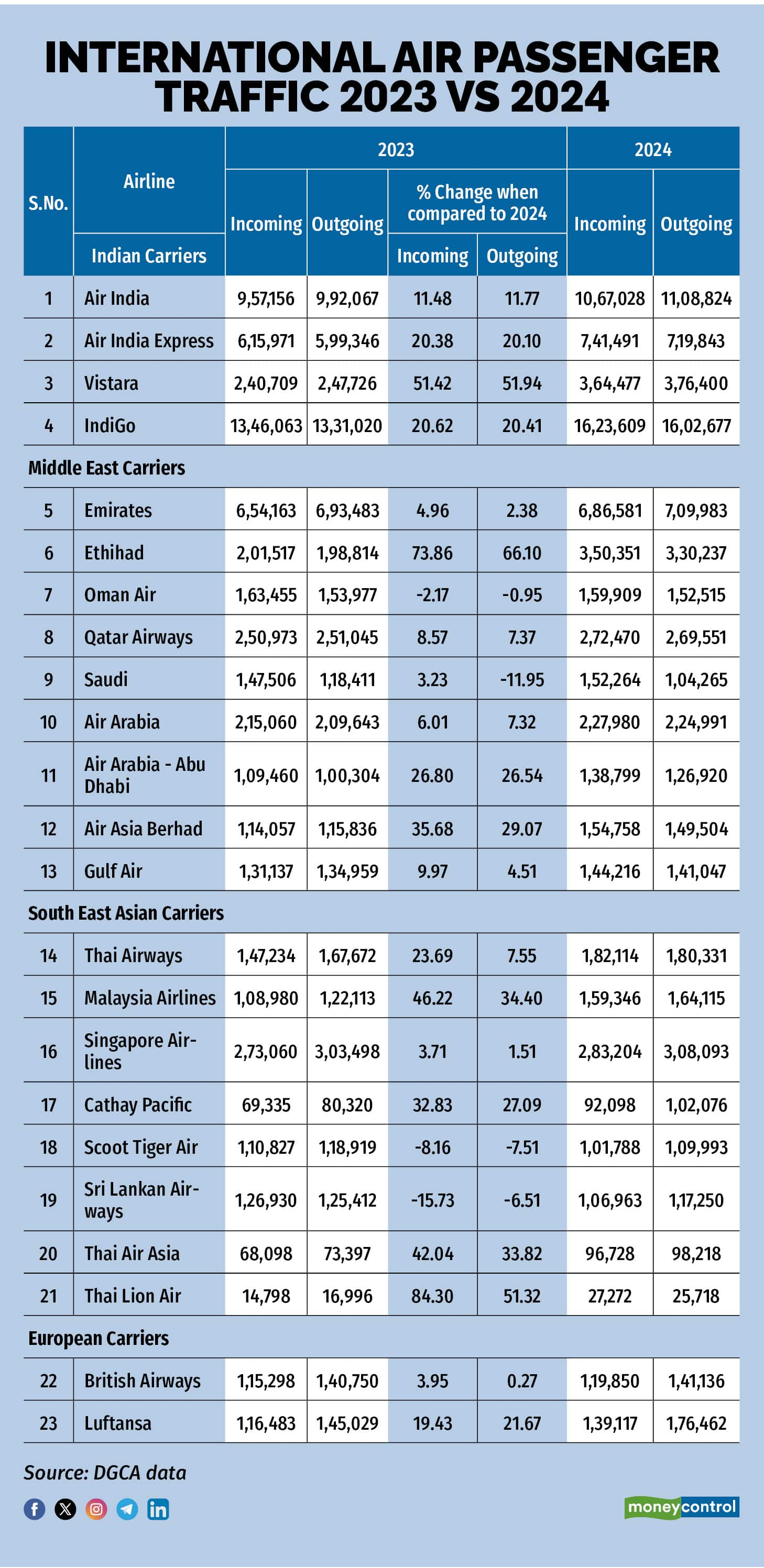

As a result, both airlines saw around a 20 percent increase in international passenger traffic, both inbound and outbound, during the first quarter of 2024-25, compared to the same period last year. In contrast, foreign carriers reported a more modest 8.5 - 11.2 percent rise in international traffic.

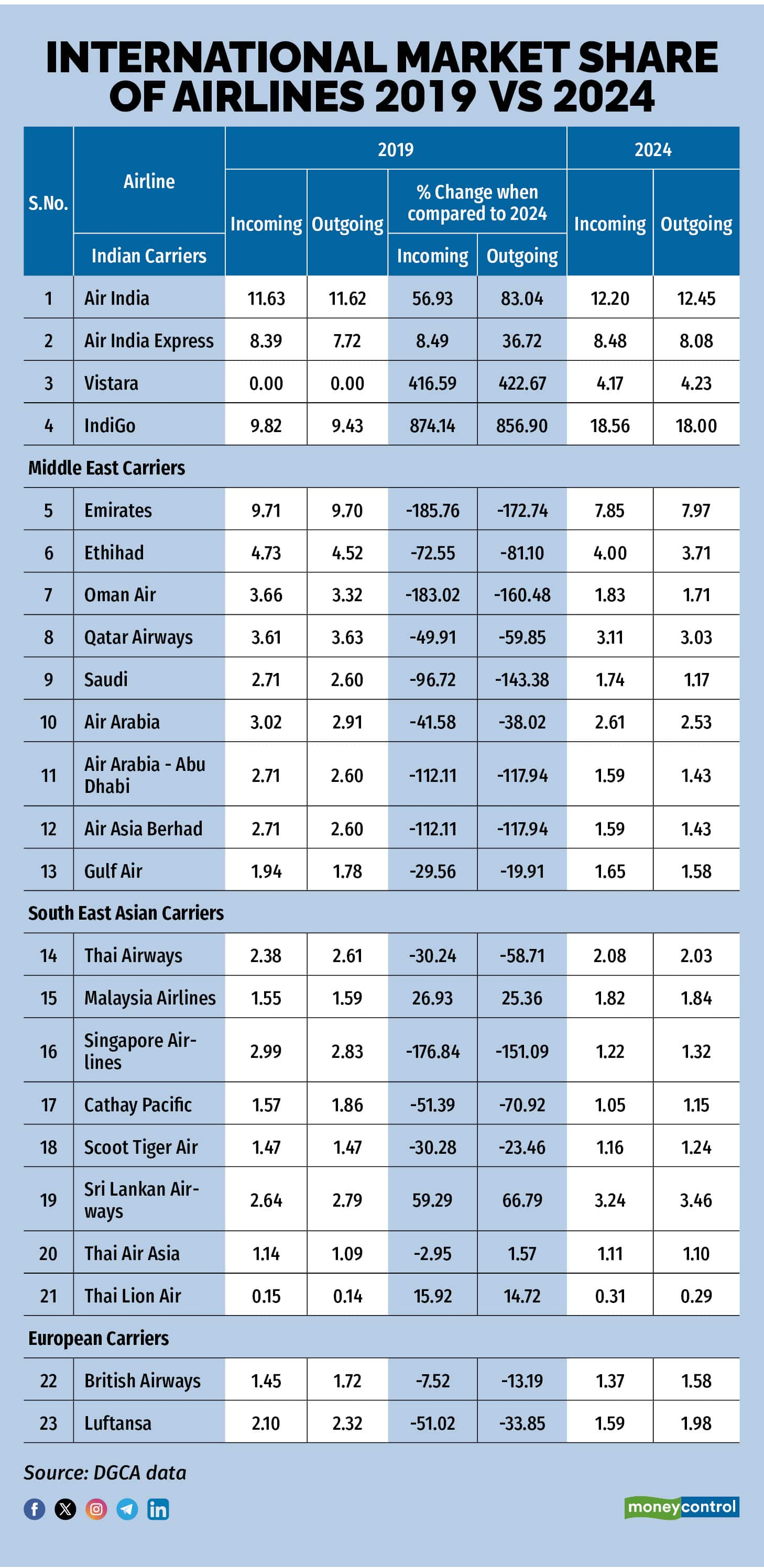

The Air India Group, which includes Air India, Vistara, and Air India Express, recorded a 46 percent increase in international passenger traffic compared to pre-pandemic levels, while IndiGo has more than doubled its international traffic since the pandemic.

These figures illustrate the growing dominance of domestic carriers, who have capitalised on the government’s restrictive policies on foreign carriers.

International Air Passenger Traffic 2019 vs 2024

International Air Passenger Traffic 2019 vs 2024

Middle Eastern carriers lag behind

Despite this growth for Indian airlines, many foreign carriers, particularly from the Middle East, have yet to return to pre-pandemic traffic levels in India.

Carriers such as Emirates, Etihad Airways, Oman Air, Qatar Airways, Saudia, Air Arabia, and Gulf Air are flying fewer passengers to and from India compared to pre-pandemic times. These airlines are pushing for additional bilateral flying rights on historically profitable routes, such as between Delhi and Dubai or Mumbai and Dubai.

International Air Passenger Traffic 2023 vs 2024

International Air Passenger Traffic 2023 vs 2024

Tim Clark, President of Emirates, emphasised in June at the IATA AGM that the Indian government's restrictions could limit options for Indian travelers on international flights.

He argued that restricting the number of seats available to foreign airlines would not be effective in the long term and could have negative effects on India's economy.

Not all domestic carriers are happy about the unchanged bilateral flying rights, carriers such as IndiGo and Akasa Air that are eyeing more international airport slots have also asked the government to consider renegotiating flying rights.

Akasa Air founder Vinay Dube and IndiGo CEO Pieter Elbers both echoed similar sentiments, advocating more bilateral rights to enhance trade and connectivity, particularly with the Middle East.

Higher flying rights will present an opportunity for players like Akasa and IndiGo to deploy additional capacity on international routes, as bilateral rights if increased will symmetrically be increased for airlines of both countries involved.

In contrast , Air India, led by its CEO Campbell Wilson, is opposed to granting more bilateral rights to foreign carriers, arguing that it would stifle the growth of Indian airlines’ long-haul operations to North America and Europe.

Air India's stand comes at a time when the airline is looking to avoid a price war with Indian carriers on international routes, where it enjoys historical airport slots.

Wilson highlighted Air India's massive investment in over 4,50 new aircraft, worth over $50 billion, and warned that granting more rights to foreign carriers could undercut the return on this investment.

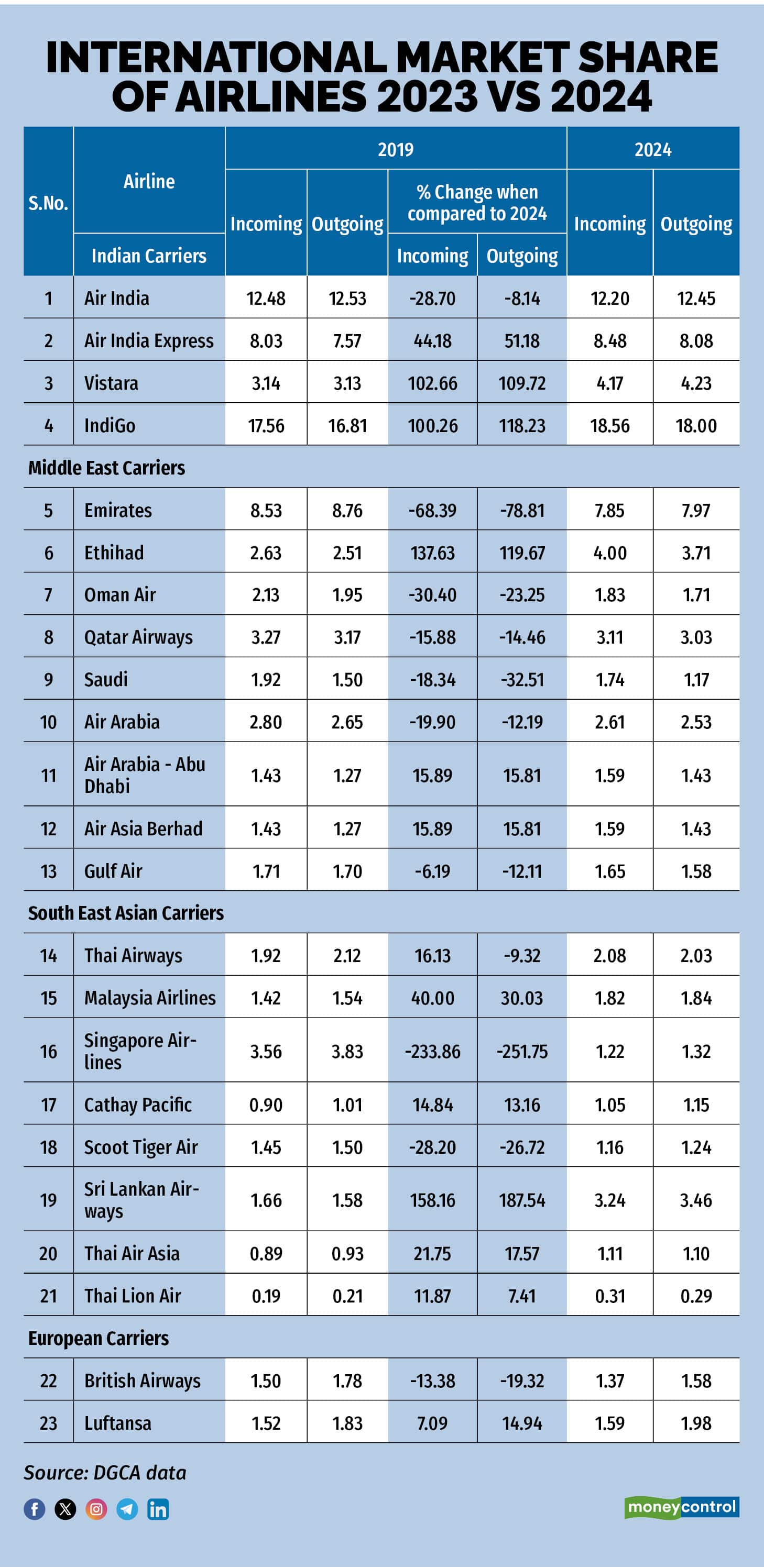

International Market Share of Airlines 2019 vs 2024

International Market Share of Airlines 2019 vs 2024

The rise of Southeast Asia

In contrast to Middle Eastern airlines, South Eastern carriers such as Singapore Airlines, Malaysia Airlines, Thai AirAsia, and Thai Lion Air have seen a surge in passenger traffic between India and their respective countries.

According to DGCA data, these airlines have reported a 10 -130 percent growth in international passenger traffic to and from India in Q1 of 2024-25.

The India-Thailand route alone saw 11.6 lakh passengers in direct flights during this period. Thailand, a tourism-dependent economy, added Indians to the visa-free entry category in November 2023, and this programme has been extended until November 2024. In the first half of 2024, 1.04 million Indian tourists visited Thailand, and the country is expected to surpass the 2019 figure of 1.9 million tourists by the year-end.

International Market Share of Airlines 2023 vs 2024International Market Share of Airlines 2023 vs 2024

International Market Share of Airlines 2023 vs 2024International Market Share of Airlines 2023 vs 2024

India has become the fourth-largest source of tourists for Thailand, behind Malaysia, China, and South Korea.

Popular tourist destinations like Bali, Singapore, and Kuwait have also seen a 60 -70 percent year-on-year increase in bookings by Indian travelers.

Additionally, newer short-haul destinations such as Azerbaijan, Georgia, and Vietnam are emerging as favoured spots for Indian tourists, according to Aloke Bajpai, Chairman & Group CEO of travel company Ixigo.

This reflects a broader trend of Indians travelling more frequently to South-East Asia, buoyed by favourable visa policies and increasing flight options from domestic and foreign carriers alike.

Top International Destinations Booked 2024

Top International Destinations Booked 2024

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!