BUSINESS

RBI should put depositor interests first at Lakshmi Vilas Bank

Regulator needs to restore depositor trust, introspect on overhaul of its supervision system

BUSINESS

Delay in RBI MPC meeting shows blasé attitude towards economy

The RBI has been at the forefront of the fight against economic distress also because the Centre’s Rs 20-lakh crore stimulus package leaned heavily on bank lending

BUSINESS

No country for small firms

Small firms have been struggling for the past five years, RBI analysis shows

BUSINESS

The Acharya-Rajan formula to reform Indian banks

New paper suggests a sequence of reforms to overhaul the Indian banking system

BUSINESS

Rise in Mudra NPAs a sign of what lies ahead

While the economic slowdown is convenient to blame for this pile-up of Mudra bad loans, remember that directed banking by the state is an equally potent reason

BUSINESS

Is there more steam left in the rupee rally?

A current account and balance of payments surplus could continue to support the rupee even if the RBI resumes buying dollars

BUSINESS

Will loan restructuring criteria leave out deserving companies?

Ultimately, a lot depends on how quickly demand will recover and to what extent

BUSINESS

Relief for borrowers should not come at the cost of undermining banking system

A strong banking system is a necessary condition for sustainable and broad-based economic recovery

BUSINESS

Will bond yields sustain below 6 percent after RBI moves?

For yields to remain below 6 percent, RBI should be ready to absorb Rs 2-3 lakh crore of government paper and this should be announced sooner rather than later

BUSINESS

No surprises in Moody’s downgrade of SBI

SBI is a proxy for the Indian economy. Given the expected deep economic contraction due to the COVID-19 pandemic, it would be a surprise if SBI maintains asset quality and profitability in the coming 12-18 months

BUSINESS

RBI directive on ad-hoc reviews: Is there more than what meets the eye?

The central bank has pulled up lenders for not sticking to rules when it comes to renewal or review of credit facilities

BUSINESS

The first step to revive power sector is maintain sanctity of contracts

UP’s move asking power generators to offer discounts to recover dues is just adding insult to injury

BUSINESS

A one-time restructuring plan is welcome

RBI seems to have learnt from the lessons of the past, sets tighter boundaries for recast scheme

BUSINESS

A tough call for MPC in its last meeting

Can the MPC afford to see through this spike in inflation because demand is poor and inflation will eventually trend down?

BUSINESS

Stressing about bank capital

Macroeconomic shocks could lead to capital levels falling below 7 percent for multiple banks

BUSINESS

RBI Financial Stability Report: Notes for investors

Only when the pandemic runs its course and various loan moratoria or restructurings end, can we get a true picture of bank books

BUSINESS

Review | Urjit Patel book no tell-all; it is strictly for students of Indian economy and banking

The former governor of the RBI minces no words in describing the bad loan mess in government-owned banks. He does not spare any stakeholder, and rightly so

BUSINESS

Should India use forex reserves to recapitalise banks or fund infrastructure?

It is better to save forex reserves for a rainy day as the pandemic poses a huge unknown

BUSINESS

Why the government should listen to Raghuram Rajan

Former RBI governor predicts that bank NPAs will rise to unprecedented levels.

BUSINESS

Das Kapital| RBI governor wants banks to improve buffers, but where will the money come from?

Meeting the minimum capital requirement is necessary, but not a sufficient condition for financial stability, said Das

BUSINESS

Deepak Parekh, KV Kamath too join chorus for a one-time loan recast. Should RBI listen?

Moral hazard is the biggest problem with loan restructuring schemes. But extraordinary times call for extraordinary measures

BUSINESS

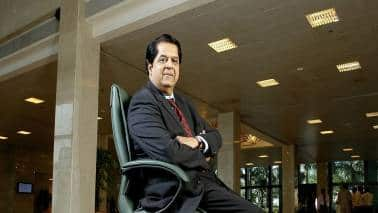

Why the ebullience of KV Kamath is justified

It’s true that the Indian economy is indeed recovering fast, but other factors need to click for this recovery to be sustainable

BUSINESS

The risks of trading like Robinhood

These fresh retail investments will likely turn tail even when slightly spooked, thus adding more volatility to the market

BUSINESS

Credit raters seeking to withdraw ratings yet another red flag for impending NPA surge

Banks may have to set aside more capital for these loans because loans that are unrated or sub-investment grade carry higher risk weights