BUSINESS

As mid & smallcaps kick off 2026 on a rough note, is this the time to spot multi-bagger jewels?

With broader markets under pressure and valuations cooling, experts weigh opportunity against patience in the mid- and small-cap space.

BUSINESS

Budget 2026 Wishlist: Beyond LTCG & STT, focus on growth levers

As global uncertainty clouds sentiment, market experts want the Budget to look beyond tax tweaks and focus on reviving private consumption, capex and economic risk-taking

BUSINESS

Shadowfax leans on value-added services as it takes on a crowded logistics market

The company sees a strong growth pipeline from existing clients and new D2C additions, while aspiring for mid-teens EBITDA margins over the long term.

BUSINESS

Our dharma is to beat the benchmark, says ICICI Prudential AMC CEO Nimesh Shah

As ICICI Prudential AMC launches its Rs 10,600 crore IPO, CEO Nimesh Shah says the company’s focus remains firmly on performance over size - beating the benchmark, growing SIP-led inflows and building new profit engines through alternatives and real estate.

BUSINESS

From showstopper to slump: Can Tata’s Trent regain its market mojo?

A 40% YTD slide, slowing growth and fierce value-fashion competition test one of India’s hottest retail stocks

BUSINESS

Wakefit says profit turnaround is no flash in the pan as it ramps up offline push

The home-solutions brand plans faster furniture-led growth and a major Tier-2 retail rollout as its Rs 1,289-crore IPO opens for public subscription.

BUSINESS

Hotels may not be a compelling premiumisation play as room for growth narrows, say market experts

Massive room additions and high capex may test the premiumisation thesis as margins and real returns may come under pressure

BUSINESS

Festive spark for QSR, but recovery still half-baked? Experts weigh in

QSRs will benefit from India’s consumption growth,but health trends, competition and high capex keep investors cautious, say experts. Product innovation, operating leverage, and GST 2.0 benefits are the key drivers for margin expansion, they say.

BUSINESS

Funds build cash, valuations bite: Why midcaps may stay on the backfoot

A tactical cash build-up by domestic funds ahead of January earnings and stretched valuations are among the reasons why the broader market momentum seems to have paused. Experts feel large-caps may continue to outperform in the near term as investors prioritise safety over momentum.

BUSINESS

Bihar election verdict more of a stabiliser than catalyst for stock market, say experts

NDA’s stronger-than-expected performance in Bihar state elections have reinforced policy continuity and lent further political stability to the ruling NDA alliance. Investors are looking beyond the headlines to developments relating to India-US trade deal, welfare economics, and sector-specific triggers.

BUSINESS

Honasa shares glow after Mamaearth swung to profit: Can the premium pivot spark a re-rating?

A return to profit, stronger margins and rapidly scaling young brands have signalled a turnaround at Honasa Consumer, but the next chapter may hinge upon its premium bets such as Lumineve and Fang, as analysts weigh of solid execution can deliver a sustained re-rating.

BUSINESS

No chill for AC stocks as unseasonal weather dampens demand, delaying demand recovery

Muted guidance, lower margins and shorter summer have left India’s air conditioning industry struggling. Experts now say the long-awaited recovery may be pushed further away to FY27.

BUSINESS

PhysicsWallah’s Prateek Maheshwari: Pricing is a choice not a strategy; profitability coming very soon

Affordable education, expanding offline network and improving margins to drive next leg of growth, says Co-founder Prateek Maheshwari

BUSINESS

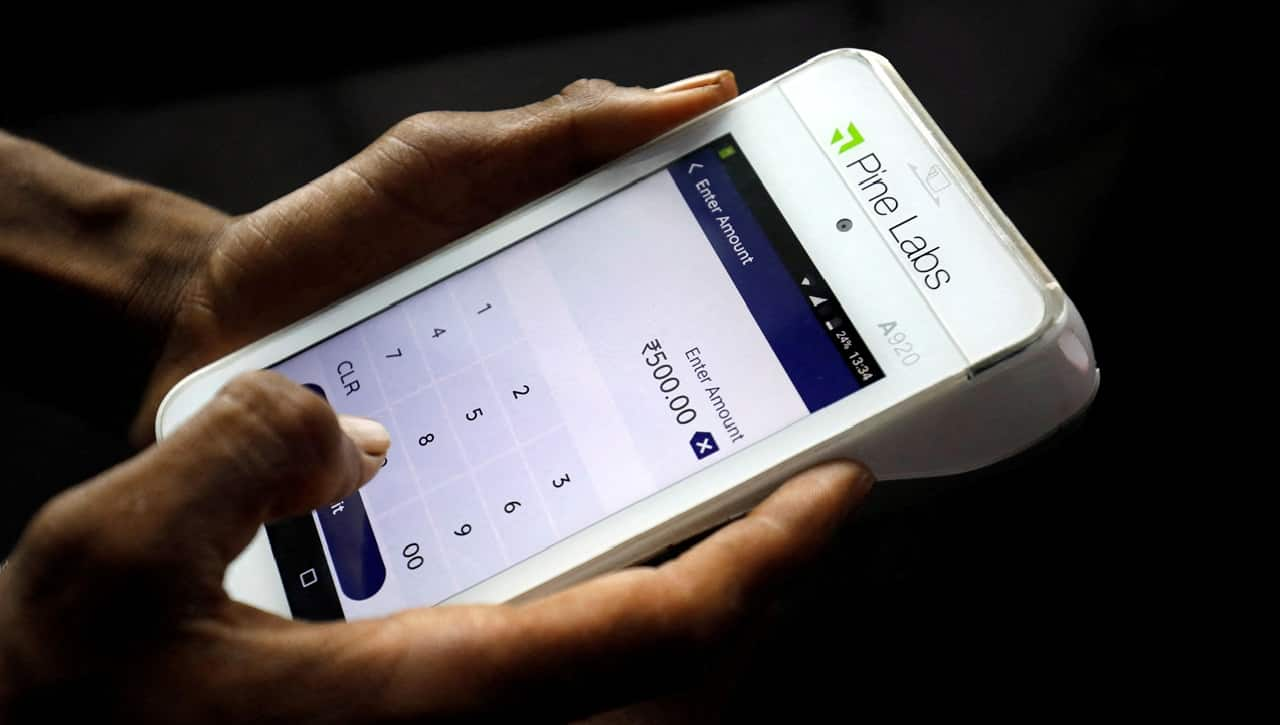

Beyond PoS: Pine Labs sees future growth from digital checkouts and fintech push

Over the past three to four years, Pine Labs has begun scaling up globally, entering South-East Asia, the Middle East, Africa and more recently, the US. The CEO and MD said these markets are already showing strong traction.

BUSINESS

Muhurat picks for Diwali 2025: Siddarth Bhamre selects a cement champ, snacking star and a colourful play

Samvat 2082: From JK Lakshmi Cement’s solid gains to Bikaji’s festive crunch and Kansai Nerolac’s bright comeback - Asit C Mehta’s Siddarth Bhamre shares his Dhamakedar Diwali bets

BUSINESS

Diwali Stock Picks 2025: HDFC Securities identifies top three high-beta rockets to fire up your portfolio

As Indian markets reset for Samvat 2082, Devarsh Vakil, Head of Prime Research at HDFC Securities, shares his top three 'Dhamakedar' stock ideas - MSTC, Northern Arc and Sheela Foam - poised to deliver high-risk, high-reward returns in the year ahead.

BUSINESS

Diwali stock picks 2025: MOSL’s Siddhartha Khemka puts the spotlight on three cracker stocks

Diwali Stocks to Buy: Motilal Oswal’s Siddhartha Khemka shared his three Pataka Picks for a bright and profitable Samvat 2082.

BUSINESS

Diwali Stock Picks 2025: A growing exchange, promising ancillary play and logistics firework

Diwali Stocks to Buy: Moneycontrol’s Dhamakedar Diwali Stocks showcases three high-conviction stock ideas picked by market expert Narendra Solanki of Anand Rathi to add sparkle to your portfolio.

BUSINESS

Diwali Stock Picks 2025: Gaurang Shah’s top bets to add sparkle to your portfolio in Samvat 2082

Diwali Stocks to Buy: Gaurang Shah of Geojit Financial Services sees Sensex and Nifty hitting fresh highs by the end of 2025, driven by policy reforms, trade deal and revival in consumption. BEL, Eternal (Zomato) and Jio Financial Services are his top three Diwali picks.

BUSINESS

LG Electronics India IPO: 10 levers that could power its next growth wave

From premium appliances to global exports, LG is eyeing bold moves as investors rush to grab a piece of its blockbuster IPO

BUSINESS

WeWork India CEO Karan Virwani says planning to add around 20,000 desks this fiscal

From occupancy to enterprise clients to AI adoption, CEO Karan Virwani outlines how WeWork india is building scale without compromising profitability.

BUSINESS

Tata Capital CEO says IPO to boost Tier-I capital, targetting affordable housing and vehicle finance for growth

MD & CEO Rajiv Sabharwal said the Tata Capital IPO is expected to boost the Tier 1 capital of the NBFC from 12.8% to over 22%, while reducing the leverage to below 5x. The company plans to improve profitability by increasing exposure to high-margin products such as affordable housing, micro home loans, equipment finance and leasing.

BUSINESS

While MPC poll sees a pause in October, some street voices hoping for an accommodative stance

Some market veterans believe that more than the rate cut, investors may find support from a change in stance by the central bank, signalling a dovish tilt by the RBI.

BUSINESS

Data centres poised for explosive growth, experts see opportunities in diversifying across ecosystem

Investors eyeing India’s data centre boom should diversify across the entire ecosystem, including renewable energy, power, real estate, telecom and technology providers, according to top money managers.