After a multi-year boom driven by surging travel demand and premiumisation, India’s hotel sector may be nearing a point of saturation. Industry experts caution that while structural demand for travel and leisure remains healthy, a massive supply pipeline could soon challenge the bullish narrative around hospitality stocks.

Since the post-pandemic recovery, hotel chains have expanded aggressively on the back of record occupancies and rising average room rates (ARRs). But this supply surge, they warn, could soon weigh on profitability and returns.

“There’s going to be huge supply over the next 36 months. Every hotel has announced 5,000 rooms. This space will get very crowded in a year’s time, and everyone is overstimulating local demand,” said Ajay Srivastava, CEO, Dimensions Corporate Finance Services.

Aggressive capex cycle underway

India’s hotel inventory is set to expand substantially over the next three years, as both listed and unlisted players ramp up capacity across metros and leisure destinations.

Indian Hotels Company Ltd (IHCL) aims to add 22,000 keys over the next few years to its current operational count of 28,273, including 4,000 through the ownership route and 18,000 via asset-light management contracts. Under its Accelerate 2030 strategy, the company plans to double its portfolio to over 700 hotels and consolidated revenue to Rs 15,000 crore by FY30.

Lemon Tree Hotels, meanwhile, has outlined plans to scale up to 35,000-40,000 rooms (including pipeline) within the next three years. Renovation of 1,600 keys is in its final phase and expected to complete in 15-18 months.

Chalet Hotels continues to pursue an asset-heavy strategy, focused on developing upper-upscale and luxury hotels. The company has outlined Rs 2,500 crore in capex over the next three years to add roughly 650 rooms between FY25 and FY28.

Also Read: Exporters feel the pinch as the rupee strengthens against euro, pound, other key currencies

Limited room for growth

While the hotel upcycle was well-supported by post-pandemic demand and rising domestic incomes, Srivastava believes the next leg of growth may not be as lucrative.

“Hotels can normatively grow, yes, but the space is getting crowded. You can fly to many overseas destinations and get cheaper and better-quality holidays. The local market is overestimating demand,” he noted.

Echoing this view, Kuunal Shah, Fund Manager at Carnelian Asset Management said the post-Covid surge in demand and pricing power has largely played out.

“Post-Covid pent-up demand has already played out. Occupancies recovered, ARRs improved and the sector generated strong cash flows. Now, a lot of new inventory is coming onstream, with nearly 6–7 percent of total room capacity expected to be added over the next 18 months,” Shah said.

“Occupancies may hold up, but ARRs are likely to soften as supply builds up. Consolidation is underway, with smaller players exiting and larger chains dictating pricing, leaving limited scope for further rate hikes.”

Return metrics at risk

Even as revenues remain buoyant in the near term, profitability may come under pressure. Srivastava warns that inflation-adjusted returns could turn flat or even negative as capacity floods the market.

“Premiumisation is there, but will you get return on your capital? Our inflation isn’t zero, it’s closer to 8-10 percent. If your returns are below that, you’re effectively making nothing,” he said. “Hotels will make decent returns now, but a year down the line you’ll see the curve turning down sharply because the supply coming into the market is humongous.”

Also Read: SEBI weighs margin reduction in cash trades; key panel takes up proposal

Stocks aren’t looking cheap either

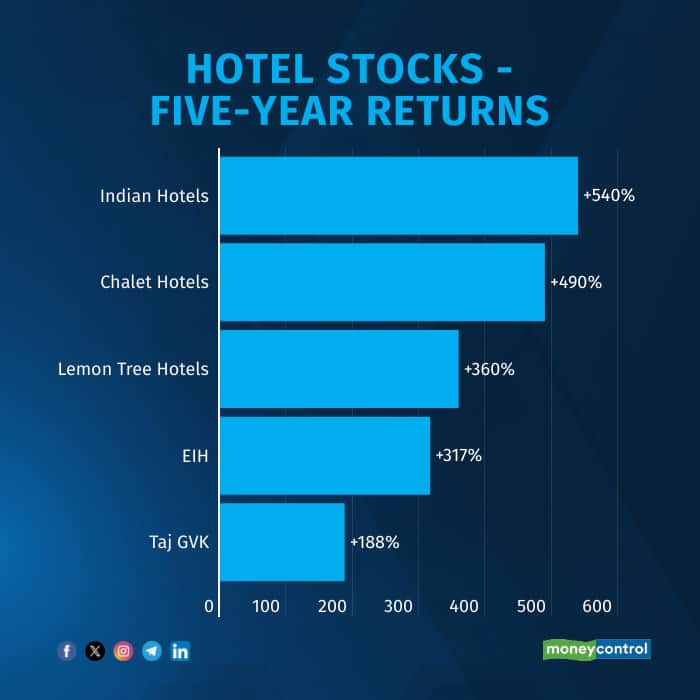

Analysts believe that the sector’s strong post-pandemic performance has already been reflected in stock prices, with hotel shares delivering stellar multi-year gains. On a one-year forward P/E basis, hotel stocks are trading well above their historical averages, leaving limited margin of safety.

These elevated multiples suggest that any moderation in occupancy or average room rates could trigger a rerating, especially as fresh capacity hits the market over the next 12–18 months.

“Hotel stocks are trading at elevated valuations, and the next couple of years could be a period of cyclical consolidation where returns remain muted due to supply-driven correction in room rates,” said Shah.

Check-in to reality

For now, hotel stocks may still find support from strong near-term earnings and festive demand. But as supply balloons and inflation eats into real returns, the investment case for hotels as a premiumisation play looks less compelling.

“The big boom is over! You’ve got to be careful what you’re buying,” Srivastava cautioned.

.

.

In short…

The hotel story is intact, but the next phase could be marked by moderation, margin pressure, and lower returns rather than runaway growth.

“The next 7-10 years may be promising, but don’t expect great returns over the next couple of years,” said Shah.

Investors betting on premiumisation may need to temper expectations as India’s hospitality market enters a more competitive phase.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!