BUSINESS

Godrej Consumer Products: Category push, sharper core portfolio take focus

In the short term, GCPL may face pressure on margins due to higher raw material prices

BUSINESS

ITC: The wait gets longer for value unlocking

Investors need to keep an eye on volume growth in cigarettes and FMCG businesses

BUSINESS

For this industry leader, rising steel output is good news

With lower share of trading revenues and increasing share of services revenues, VIL’s margins are likely to remain higher and much stable

BUSINESS

Marico: Outperformance likely to continue

Investors should look out for growth in foods portfolio and recovery in discretionary categories

EARNINGS

IFGL Refractories: Fortunes tied to steel cycle

IFGL is a proxy play for the increased production of steel, which is likely in FY22 and FY23

ENTERTAINMENT

Indiamart Intermesh: Market size offers the growth canvas

Second wave of COVID likely to impact growth in the near term

EARNINGS

ITC: What can reverse the underperformance despite its cheap valuation?

Higher dividend yield to protect valuation on the downside for ITC

EARNINGS

SIS: Post COVID recovery and shift to organised players, strong tailwinds for investors

The newly passed labour reform bills is among the biggest legislative reforms for labour-intensive services like SIS

TRENDS

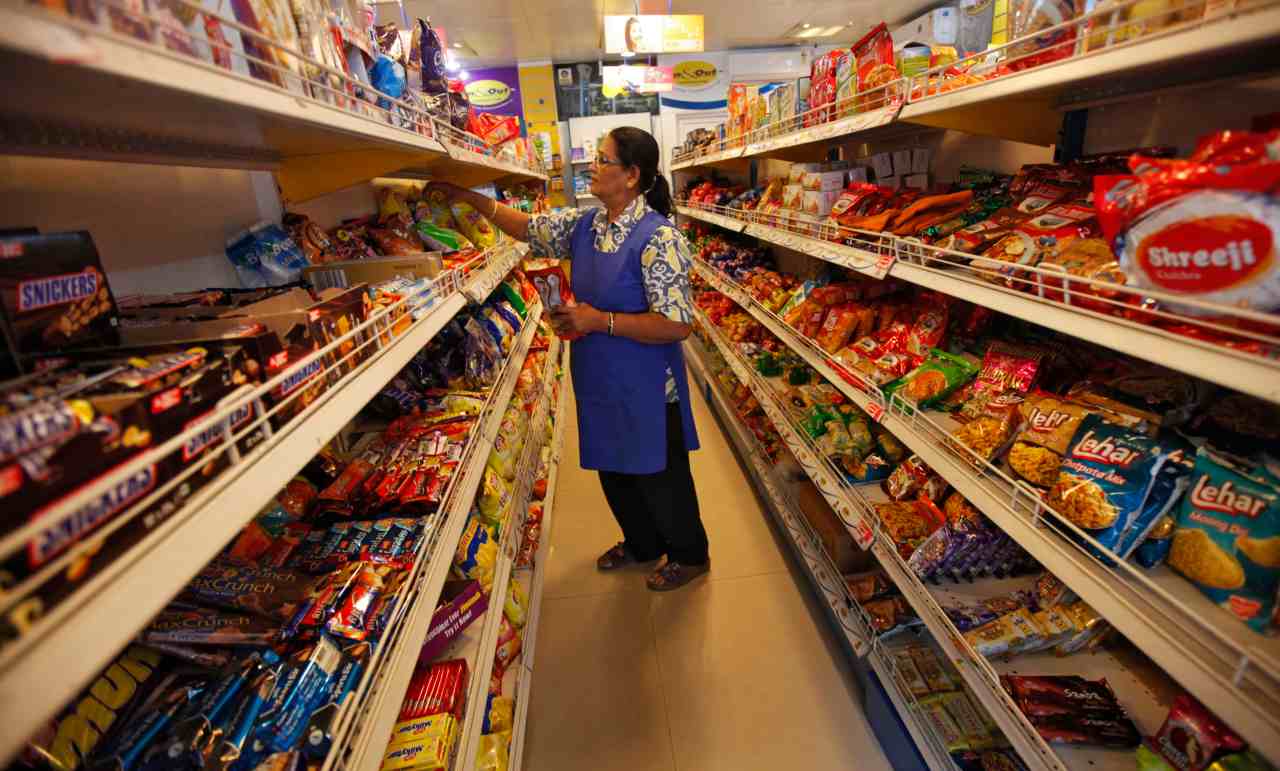

How will COVID-19 and consumer sentiment impact FMCG stocks in FY22?

Players such as Dabur and Britannia are likely to gain big on the back of product strength, wider distribution network and higher revenues from rural markets

EARNINGS

Man Industries: Higher order book provides better revenue visibility

Investors of Man Industries should watch out for oil prices and increased spending in water infrastructure

BUSINESS

IFGL Refractories: Demand from steel industry, completion of capex to drive earnings

IFGL has recommended a dividend of Rs 2.50 per share in FY20, and we expect a higher dividend payout or a buyback, thanks to higher cash surplus

BUSINESS

ITC: Higher dividend yield to protect stock downside

Recovery in cigarette business holds the key to re-rating of ITC

BUSINESS

Discovery Series | CCL Products (India): A perfect blend to sip

BUSINESS

Is Mrs Bectors Food the right bite for the investor?

Bectors' IPO comes at a discount to the valuation of Britannia and other players on a trailing earnings basis

BUSINESS

Should investors participate in the Vedanta delisting?

Reverse book-building for delisting of Vedanta begins from October 5

BUSINESS

General Atlantic-Reliance Retail deal: Value unlocking in retail continues

Deal with General Atlantic marks the third monetisation in Reliance Retail

BUSINESS

KKR-Reliance Retail deal: Value unlocking story continues

Deal with KKR marks the second monetisation in Reliance Retail

BUSINESS

Nalco: Cost leadership puts it in a safe place for long term

Nalco, with an integrated set-up, lowest cost curve in terms of alumina production and captive power supply is likely to remain competitive

BUSINESS

ITC: Do good dividend yield and reasonable valuations make it a winner?

Higher incidence of tax on cigarettes by the government can affect ITC’s profitability

MONEYCONTROL-RESEARCH

Tata Metaliks: A preferred stock to play the water infrastructure opportunity

BUSINESS

Can Titan regain its mojo?

BUSINESS

Britannia: Advantage Supply Chain

BUSINESS

Dabur Q4: Is elevated rural exposure Dabur’s Achilles heel?

BUSINESS

Can this steel major continue to put up a brave face during challenging times?