BUSINESS

Market churn will separate men from boys in PSUs, India story has legs: Kotak’s Nilesh Shah

This is a market where reasonably valued stocks probably will outperform more expensive valuation stocks, he said.

BUSINESS

Q&A | If you have cash, buy good small caps on correction: Shankar Sharma

Sharma believes that the bull market is supported by rally in smallcaps and the trend is here to stay

BUSINESS

We remain fully invested on a positive outlook on economic growth and corporate fundamentals: Harsha Upadhyaya of Kotak AMC

Valuations are not cheap, so policy comfort and evidence of better-than-average earnings growth will be key drivers, he says.

BUSINESS

Samir Arora on exit poll: Markets should rally, chances of negative surprise on Tuesday bleak, looking to increase net longs

As long as BJP secures enough seats to form a government, it will establish a sense of continuity in the market, said Samir Arora.

BUSINESS

Exit polls set to ignite market euphoria: Big gains on the horizon with Gift Nifty showing a 780 point gain

Market veterans foresee an initial surge and sustained growth as investors celebrate policy continuity and future reforms

BUSINESS

Markets will see an explosion, but next week will mark the grand final for 'Modi stocks': Sushil Kedia

Euphoric markets will take all stocks up, but a week later, market will become more discerning, according to Kedia

BUSINESS

Exit poll to boost near-term market sentiment; investors eyeing policy reforms roadmap: Nilesh Shah Q&A

A sustained market growth depends on the new government's implementation of significant reforms within the first 100 days

BUSINESS

Vikas Khemani on Exit Poll : Markets should rise on short covering, poll outcome to strengthen India’s case

'The conviction around India's growth story is very, very high. With this event(NDA returning to power for third straight time), it only gets strengthened,' says Vikas Khemani of Carnelian Capital

BUSINESS

MC Poll Position: Adverse election outcome could derail retail party, cause sharp fall in smallcaps: Bouyant Capital’s Jigar Mistry

Numbers are easier to predict than human psychology. While earnings drive long-term market performance, in the medium term, market movements are influenced by earnings plus the re-rating or de-rating of PE multiples.

BUSINESS

MC Exclusive: $5.2 billion inflows could chase HDFC Bank in August MSCI India Index rebalancing, predicts Macquarie

Finally, the technical overhang on HDFC Bank stock may be coming to an end

BUSINESS

Sushil Kedia shares a trading strategy that commands 90% strike rate for gains

Sushil Kedia says buying into market weakness ahead of election is a sure-shot strategy for gains.

BUSINESS

Current pullback an opportunity to buy, Nifty faces strong resistance, says Sushil Kedia

Investments in mid-cap IT stocks, have the potential to rise by 30-35%, the ace trader said.

BUSINESS

The cost-benefit analysis does not enthuse us to hedge: Ashish Gupta of Axis Mutual Fund

The CIO says he doesn't want to position for an outcome but prefers a longer-term outlook, adding that the fund's forte is spotting business opportunities and trading based on business cycles.

BUSINESS

Less than 25% probability of 20% upmove: US-based hedge fund manager who asked Buffett about India lays out post-election return expectations

India faces risks from escalating oil prices, declining exports if the US slows, and potential market-unfriendly reforms from a new government. However, the banking and financial sectors offer promising opportunities, with high promoter stakes in Indian companies providing investor confidence.

BUSINESS

Rs 30 trillion opportunity; Rs 1 trillion profit pool. Can this create value? Tanmaya Desai of SBI MF takes on hard questions

While the emergence of electric vehicles is an opportunity in terms of the potential to replace existing vehicles, this will come at a colossal economic cost as the existing IC investments will be written-off even as new investments are made in the EV technology.

BUSINESS

India question makes it to Berkshire Annual meeting; Buffett says, “a more energetic management” could consider the opportunity

The question for Berkshire is if it has some kind of advantage in pursuing those (unattended) opportunities, against people who are managing other people’s money and getting paid based on assets, Buffett said.

BUSINESS

Warren Buffett on US debt, inflation, current markets, India, global investing, AI and more at Berkshire Annual Meeting 2024

Warren Buffett led Berkshire's 2024 Annual Meeting, addressing US debt, market views, and AI concerns. Highlights included Buffett's investment principles, Berkshire's capital allocation plans, and lessons on leadership and success.

BUSINESS

Rising US yields spark concerns for global equities amid economic uncertainty. What this means for Indian markets

Investors react to unexpected inflation surge and sluggish GDP growth, fearful of stagflation

BUSINESS

MC Explains: Why Vix has gone all 'thanda'

India Vix fell by 20% on April 23. What this signals and here's what traders should do

BUSINESS

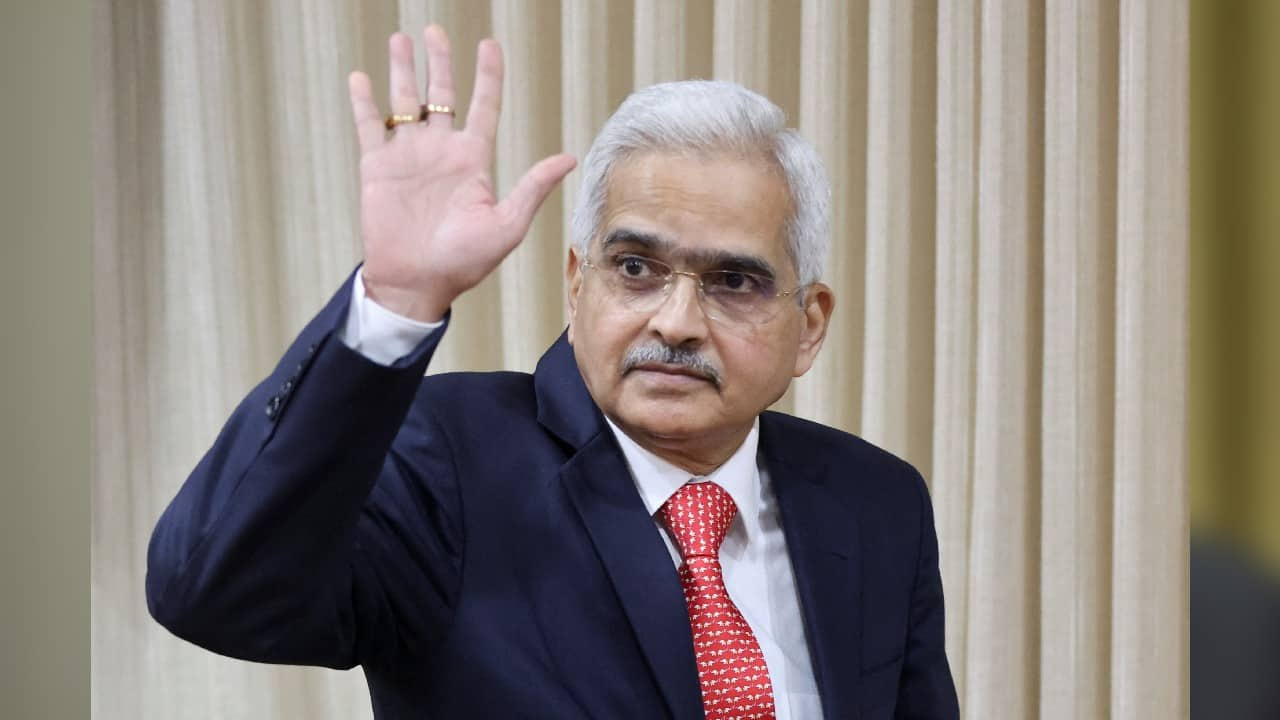

What the RBI governor's comments imply about corporate growth, profitability, foreign flows

RBI policy meet: The central bank held repo rate steady at 6.5 percent, in line with expectations. Here's a look at the top takeaways from the governor's speech

BUSINESS

MC Exclusive: Daniel Kahneman on why optimism is as bad as pessimism, when to call it quits and other insights into decision-making

In his last exclusive conversation with Moneycontrol, Kahneman spoke about learnings through his career, decision making and his pioneering work as a psychologist for the Israeli Defence Forces, which is applicable across professions, even today

BUSINESS

Neelesh Surana’s wealth formula: Buy when near term is impaired and long term intact

In a rare media interaction, Mirae Asset’s maverick CIO talks about his investment strategy

BUSINESS

MC Exclusive: SBI MF CIO R Srinivasan says illiquidity could command premium; negative on stocks down the Mcap curve

In an exclusive conversation with Moneycontrol, chief investment officer, R Srinivasan, talks about SBI Mutual Fund’s Smallcap Scheme Stress Test report, and more.

BUSINESS

SBI Smallcap Fund can meet 25% redemption in 4 days based on ‘available liquidity’ instead of AMFI formula, says CIO

On the liquidity Stress Test overall, Srinivasan said investors need to be aware of the risks however improbable it may be