BUSINESS

Borrowing from friends to repay loans? Why it may cost more than you think

It may seem like a quick fix, but turning to friends to cover your loan repayments could lead to long-term financial and personal trouble.

BUSINESS

How to submit your ITR without Form 16 for AY 2024-25

This is what salaried taxpayers can do if their employer did not give them Form 16 this year.

BUSINESS

Should you take a home loan? What to weigh before deciding

Home loans allow you to buy assets but also come with long-term money ties—understanding both sides can lead you to make smarter choices.

BUSINESS

Personal loans explained: What they are, and how to use them wisely

A personal loan can become a quick solution if you are having a cash flow issue, but you need to be aware of its fees, EMIs, and repayment terms before you apply for one.

BUSINESS

Do you have tax relief on personal loans? This is what the law says

Personal loans are not necessarily tax-deductible, but in some cases, you can claim benefits—depending on how you use the money.

BUSINESS

Paying loan EMIs with a credit card: Smart move or risky bet?

Certain websites facilitate credit card payment of EMI, but with an expense and with risks. Know when it is worth it.

BUSINESS

How's your credit score? A 2025 borrower's guide

Your credit score decides everything from loan approvals to interest rates. Learn how to calculate a healthy score in 2025 and how to improve it.

BUSINESS

Which of these assets is best suited to take a loan in 2025? FDs or gold or shares

Your choice of collateral could impact interest rates, processing time, and loan amount—know the pros and cons before mortgaging assets.

BUSINESS

Form 16 figures not aligning with Form 26AS? Do this to avoid income tax dept's notice

Mismatch between Form 16 and Form 26AS can result in scrutiny—here's the way to correct it before filing your ITR.

BUSINESS

Can Indian tech startups save on taxes legally by relocating to Dubai?

Moving overseas may be appealing—but tax residency and laws of Indian income continue to matter.

BUSINESS

Are debt mutual funds a smart bet during an interest rate cut cycle?

Falling rates can boost returns from debt funds—but timing and risk profile matter.

BUSINESS

How to access and read your Annual Information Statement (AIS) for ITR filing

The AIS offers a detailed snapshot of your financial transactions—here’s how to use it to file your return correctly.

BUSINESS

Filing your ITR as a salaried employee? Watch out for these costly mistakes

Common errors can derail your return—here’s how to get it right the first time.

BUSINESS

Credit score myths you should stop believing in 2025

Credit score myths aren't treating your finances kindly—here's what you need to know

BUSINESS

Forgot your Aadhaar number? Here’s how to recover it instantly online

You can simply recover your Aadhaar number or enrolment ID through your mobile or email.

BUSINESS

How to order PVC Aadhaar cards online for your whole family using one mobile number

You can now quickly order PVC Aadhaar cards for the whole family online even if just one number is registered

BUSINESS

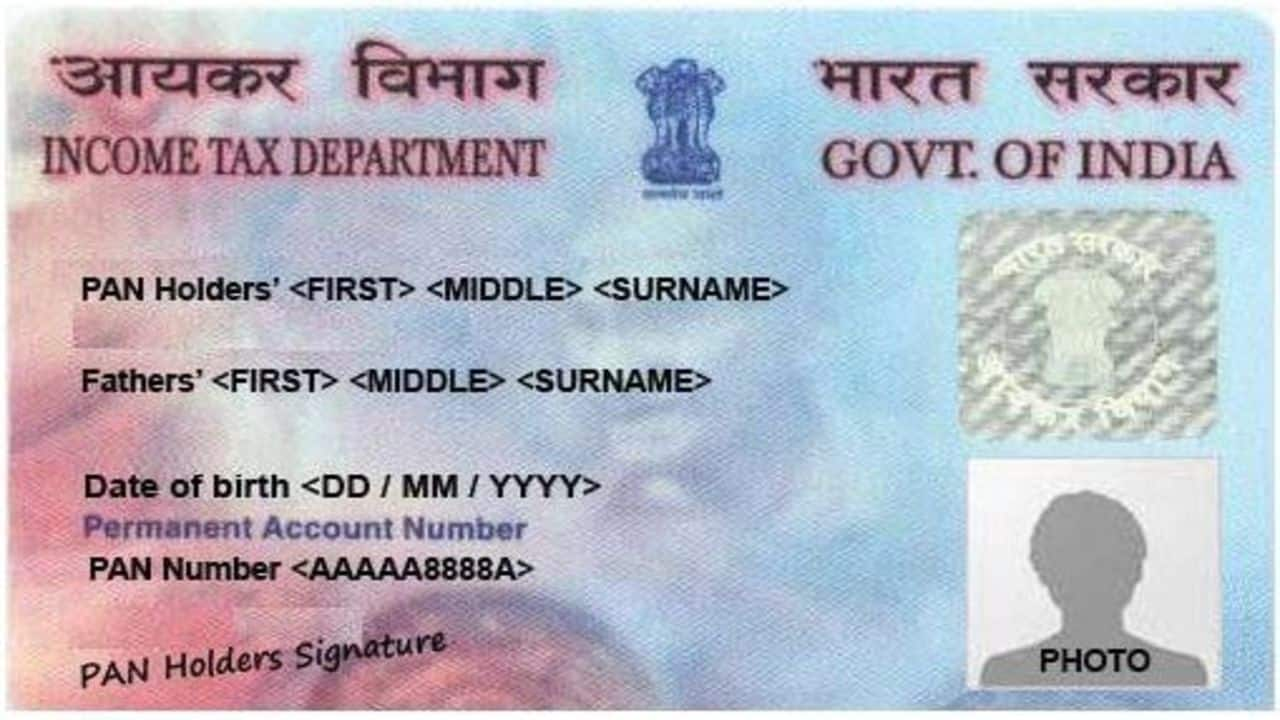

Get a ₹5 lakh personal loan with just your PAN card: A step-by-step guide

Sudden cash crunch? Here's how you can get a personal loan of ₹5 lakh instantly with your PAN card.

BUSINESS

Does becoming a guarantor impact your CIBIL score? Here's what you need to know

Being a guarantor to a loan is a serious financial commitment that can have its impact on your credit record.

BUSINESS

Why bucket strategies won’t save your retirement from sequence risk

A popular method for managing withdrawals may not offer the protection you think it does.

BUSINESS

Filing ITR without Form 16? These are the documents you can use instead

If your company does not provide you with the Form 16, you can submit the income tax return using these alternatives.

BUSINESS

Gold hits 26 record highs in H12025; here are best ways to buy the precious metal

Experts recommend allocating only a small portion (5–10 percent) of the portfolio to precious metals, including silver

BUSINESS

ITR 2024-25: Seven common mistakes to avoid while filing income tax returns

Start by choosing the right form. For instance, selecting ITR-1 instead of ITR-2 will be seen as trying to conceal income that you ought to have disclosed in ITR-2.

BUSINESS

In volatile markets, investment managers are navigators, not predictors

One of the greatest assets of an investment manager in times of turmoil is discipline. During times of panic or greed that sweep through the market, there is a risk that investors will be tempted to make reactive decisions

BUSINESS

ITR-2 online utility released: Filing returns? Here's why you must verify your AIS and Form-26AS first

Since the AIS and Form 26AS contain the complete history of a taxpayer’s transactions, nothing will go unnoticed — any non-disclosure can invite notices from the income tax department.