BUSINESS

SIDBI, Kerala Infrastructure Investment Fund to raise Rs 6,500 crore through bond issuance

On December 20, Bank of Baroda, National Bank for Agriculture and Rural Development (NABARD), and the Indian Renewable Energy Development Agency (IREDA) will float bonds aggregating to Rs14,500 crore.

BUSINESS

Bank of Baroda, NABARD, IREDA to float Rs 14,500-cr bonds on Dec 20

Market sources also said that on December 21, National Bank for Financing Infrastructure and Development (NaBFID) will also issue bonds worth Rs 10,000 crore.

BUSINESS

IRFC raises Rs 2,980 crore at 7.67% coupon through 10-year bonds

On December 12, Moneycontrol reported that the company will auction these bonds on December 13.

BUSINESS

Bank of Maharashtra raises Rs 259 crore from Tier-II bonds at 7.99% coupon

The bonds have been rated 'AA+' by CARE and Acuite Ratings.

BUSINESS

IRFC to raise up to Rs 3,000 cr via 10-year bonds on December 13

The bonds have been rated 'AAA' with 'Stable' outlook by CRISIL, ICRA and CARE.

BUSINESS

Bank of Maharashtra to float Rs 1,000-cr bonds on Dec 12

On November 23, Moneycontrol citing sources reported that bank will raise Rs 1,000 crore in early December.

BUSINESS

REC plans to raise up to Rs 6,000 crore through bonds

The bonds have been rated ‘AAA’ by ICRA and India Ratings

BUSINESS

Bank of Baroda raises Rs 5,000 crore via 10-year bonds at 7.68% coupon

The bonds have been rated 'AAA' with a 'Stable' outlook by CRISIL and India Ratings. The minimum application size of the bonds is Rs 1 lakh and in multiples of Rs 1 lakh.

BUSINESS

India's bond market norms: How they have evolved over the last decade

As per SEBI data, corporate bonds outstanding in 2014 were Rs 16.49 lakh crore, which increased to Rs 44.16 lakh crore in 2023. Similarly, government borrowings through G-Secs, which stood at Rs 5.79 lakh crore in 2014, climbed to Rs 15.43 lakh crore in FY24

BUSINESS

MC Exclusive: Govt approves online bond platform providers' application to form industry body

Around 16-18 bond portals, including IndiaBonds, GoldenPi, The Fixed Income, Wint Wealth, BondsKart, BondsIndia, Bond Bazar, Grip Invest, and Aspero, are members of the association.

BUSINESS

Bank of Baroda expects 40-50 bps impact on CAR post RBI credit risk rules: MD & CEO Debadatta Chand

This came after the Reserve Bank of India (RBI) last week raised the risk weight on consumer loans of banks and NBFCs by 25 percent on November 16 to curb the proliferation of unsecured consumer loans

BUSINESS

RBI to meet banks on November 24 for CBDC pilot review

The RBI had in December 2022 started the retail pilot of its digital currency.

BUSINESS

BoB targeting 10 lakh CBDC users over next 3-4 months

Bank of Baroda has seen daily transactions grow from 200-300 to over 2,000 a day

BUSINESS

SBI clocks over 9 lakh CBDC transactions since December 2022, says official

The RBI started the pilot testing of CBDC in November last year in the wholesale segment and later in December it was extended to retail segment.

BUSINESS

Bank of Maharashtra plans Tier-II bonds to raise Rs 1,000 crore in early Dec

Earlier today, Moneycontrol reported that State-owned lender Canara Bank plans to float bonds worth Rs 5,000 crore on November 24.

BUSINESS

Banking system liquidity deficit rises to 5-year high on tax outflows

A Kotak Mahindra Bank report dated November 20 said that there is expectation of Rs 1.5 lakh crore outflow on the account of GST and Rs 65,000 crore due to auctions

BUSINESS

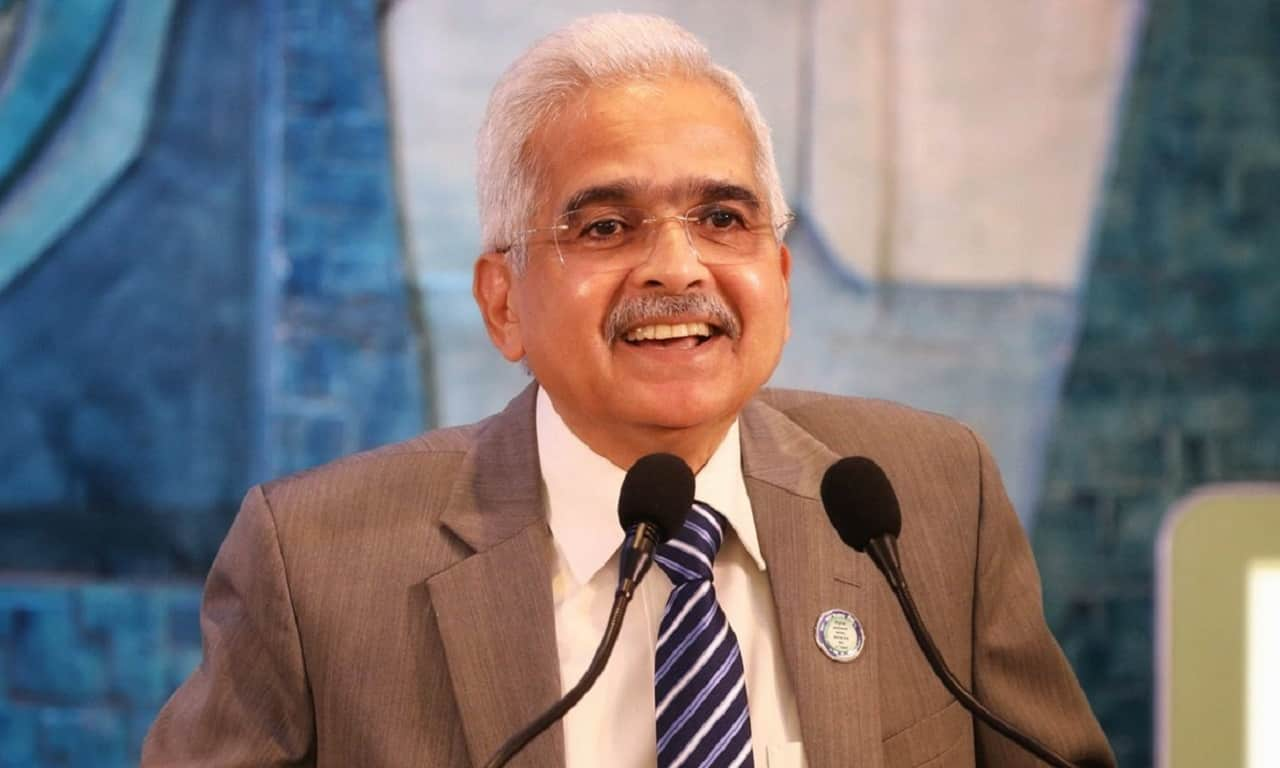

High attrition: RBI not to get into banks' micromanagement, says Governor Das

Last month, Das had said the central bank was watching the issue of attrition in banks "closely".

BUSINESS

RBI Governor says banks, NBFCs need to be watchful of stress building up

Banks needed to be watchful of exposure to NBFCs, while NBFCs need to diversify their funding sources to minimise risks, Das has said

BUSINESS

RBI Governor Shaktikanta Das reaffirms commitment on inflation fight; says MPC must remain watchful

Price stability and financial stability are both important in the economy however, excessive focus on one at the cost of other can generate potential stress, Das said.

BUSINESS

Banks increase investment in 91-day T-Bills over one year on high economic uncertainty

Simultaneously, banks have reduced their ownership in 182-day T-Bills by six percent and 364-day T-Bills by around 10 percent.

BUSINESS

Corporate bond yields for NBFCs to rise after RBI action on consumer loans, say experts

The central bank increased the risk weight on consumer loans of commercial banks and NBFCs by 25 percentage points.

BUSINESS

MC Explains: RBI tightens consumer loan norms for banks and NBFCs

The central bank increased the risk weight for consumer credit, which means banks and NBFCs must set aside more capital against such loans.

BUSINESS

MC Explains: What is RBI order on Bajaj Finance, what does it mean for NBFC

Bajaj Finance has said that it will review its documents in accordance with RBI guidelines and ensure compliance. A report by CLSA, however, said the non-issuance of a Key Fact Statement does not appear to be a major violation.

BUSINESS

FPI investment in debt so far in November at 27-month high

FPI investment in debt so far in November at 27-month high.