BUSINESS

Central, state PSUs account for 40% of delayed MSME payments

As of March 2024, the amount of delayed payments to Micro, Small, and Medium Enterprises, adjusted for inflation, stood at Rs 7.34 lakh crore

BUSINESS

RBI’s rupee defence at 3-year high, $38 billion sold in January–September

The rupee has depreciated 4.10% in the calendar year and 4.26% this fiscal, according to Bloomberg data

BUSINESS

Nabard, PFC pull bond issues as investors demand higher coupons

Investors wanted to lock in higher rates ahead, expecting a rate cut by the RBI which meets for its bi-monthly policy review in the first week of December

BUSINESS

Japan bond yields rise, but no immediate spillover seen on Indian bond market

Japan is one of the world’s largest creditor nations and plays an important role in capital flows to other countries. Thus, rising yield can influence other markets in a significant way.

BUSINESS

Rupee ends 17 paise up at 89.24 against US dollar on RBI support

On November 21, the local currency depreciated to a record low of 89.49 against the US dollar due to outflows from foreign investors from Indian equities, uncertainty over a US-India trade deal, and absence of RBI's support sparked the slide in the rupee.

BUSINESS

ED records statement of industrialist Vikas Garg in Rs 190 crore customs duty fraud

The probe concerns the alleged duty-free import of goods shown as exports on paper but diverted to the domestic market, causing an estimated Rs 190 crore loss to the government.

BUSINESS

Indian rupee hits record low of 89.46 against US dollar on high greenback demand

With this fall, the local currency is down by 0.86 percent against the US dollar as compared to November 20. Indian rupee has seen a biggest intra-day fall of 67 paise, which is highest since May 8, 2025, when it depreciated 89 paise.

BUSINESS

MC Poll: RBI MPC may cut rates by 25 bps in December meet as low inflation offers comfort

The MPC will meet between December 3 and 5 for another round of rate setting deliberations.

BANKING

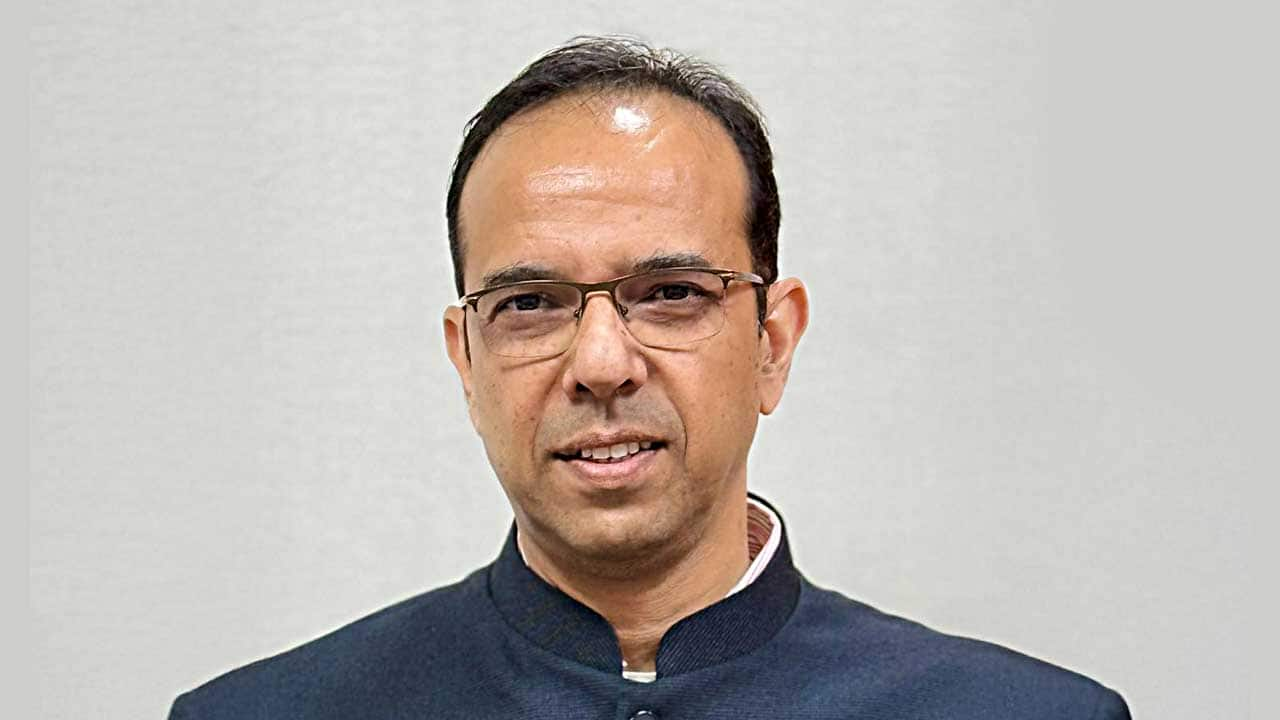

Government in talks with 7-8 countries for UPI inter-linkage, hopes to conclude next year, says DFS Secretary M. Nagaraju

Nagaraju said past decade has been one of the most transformational in the BFSI.

BUSINESS

SBI Chairman CS Setty suggest creating National Financial Grid to connect credit bureaus, UPI, e-KYC

He added that Unified Lending Interface (ULI) itself can transform the national financial grid.

BUSINESS

India needs to double investment to reach $30 trillion economy by 2047, says NaBFID MD Rajkiran Rai

He added that today most of this investment, the heavy lifting is being done by the government.

BUSINESS

FPIs give positive response for Indian bonds inclusion in Bloomberg Global Index: Sources

Sources added that the announcement for the inclusion of Indian bonds in Bloomberg index, is likely to made by the Bloomberg in January

BUSINESS

Equity markets have impressed but IPOs increasingly turning into exit vehicles: CEA

This undermines the spirit of public markets, top economist V Anantha Nageswaran said

BUSINESS

Fusion Finance's covenant breach concerns resolved, expect normal audit remarks from FY27, assures CEO

Fusion Finance's CEO said the first tranche of rights issue of Rs 400 crore was fully utilised for disbursements, and not for write-offs. The second tranche of the rights issue will be received by December, which too will be utilized for disbursements.

BUSINESS

India's record low retail inflation in Oct opens space for rate cut if H2FY26 growth weakens

India’s retail inflation eased sharply to 0.25 percent in October, its lowest level in the current series that began in 2013, down from 1.44 percent in September.

BUSINESS

Banking system liquidity gains wiped out by RBI’s forex intervention, credit growth

Even as factors such as currency in circulation increase, forex interventions and increase in credit demand have been major drivers of a reduction in systemic liquidity. That said, liquidity still remained in the surplus zone -- at around Rs 2.11 lakh crore -- resulting in money market rates staying in the lower end of the curve.

BUSINESS

Can banks absorb a rate cut in December?

According to Ace Equity data, state-owned lenders have seen a 6-60 bps reduction in NIMs between Q4FY25 and Q2FY26. Similarly, private banks saw a reduction in NIMs of 6-41 bps, and small finance banks by 10-8 bps.

BUSINESS

All you need to know about Non-Deliverable Forward market

NDFs are commonly used by investors to mitigate currency risk in emerging market economies, when the underlying currency is volatile.

BUSINESS

RBI ramps up defence of rupee near record lows, curbs excess volatility

Market participants said such operations reflect the RBI’s intent to smooth volatility rather than defend any specific level of the currency, ensuring stability amid periods of excess speculative pressure.

BUSINESS

Banks' CD issuances fell sharply by 58 percent in October on comfortable liquidity

Punjab National Bank, SIDBI, Axis Bank, IDFC First Bank and Bank of India remained top five issuers in October raising around Rs 37,490 crore.

BUSINESS

Benign CPI inflation revives rate cut hopes, RBI to weigh growth data before decision

According to economists, the recent easing of inflation cannot be interpreted as a signal of weak demand or an imminent growth slowdown. The drop in inflation is likely due to supply-side improvements and favourable base effect rather than a broad-based economic slowdown.

BUSINESS

Digital frauds rising since July; digital Infrastructure may able to contain, says DG T Rabi Sankar

He said that banks need to treat fintechs as partners in innovation and create mutually beneficial or symbiotic strategic partnerships with this ecosystem.

MARKETS

SEBI chairman hopes Finance Commission will provide incentives, guidance to states & local bodies to issue municipal bonds

He said that so far in last few years, municipal bonds worth of Rs 3,500 crore issuances have taken place.

BUSINESS

India needs ‘big and world class’ banks, work on PSB consolidation has begun: FM Sitharaman

On October 15, Moneycontrol have reported that India's banking sector is headed for another round of public sector bank consolidation with the government working on a mega merger that could see smaller lenders being merged with larger banks.