BUSINESS

RBI MPC | Is RBI preempting liquidity tightening in later part of December?

RBI cut repo rate by 25 bps and announced OMOs plus a USD/INR swap to inject durable liquidity ahead of December tax outflows, easing rate and liquidity stress.

BUSINESS

Rupee falls 13 paise after RBI announces $5 billion 3-year USD/INR buy sell swaps

The local currency was trading at 89.98 against the dollar after opening at 89.85

BUSINESS

Why is rate cut a tough call for RBI? Six factors to track in the December MPC meeting

Experts are of the view that the central bank will announce some measures on the liquidity front such as Open Market Operations (OMO) purchases to support banking system liquidity during time when the activity in the forex intervention has increased after rupee crossed 90-mark.

BUSINESS

Bond markets expect OMO purchase announcement in RBI's Dec monetary policy

The central bank has so far conducted Rs 27,280 crore worth of OMO purchases in the secondary market. According to RBI data, the central bank conducted Rs 14,810 crore OMO purchases between November 10 and November 13, and Rs 12,470 crore between November 4 and November 7.

BUSINESS

Indian rupee closes above 90-mark on likely intervention by RBI

The local currency closed at 89.9750 against the US dollar, as compared to 90.4115 at open and 90.1913 at previous close against the greenback.

BUSINESS

Rupee’s tariff war test: weaker, yet far more resilient than past crashes

According to Bloomberg data, the Indian rupee depreciated 5.06 percent between December 31, 2024, and December 3, 2025. It has become the worst-performing currency among Asian peers.

BUSINESS

RBI’s silence in forex market may set stage for monetary policy surprise

According to a source, the RBI may have intervened at the certain level of 90.16-90.17 against the US dollar in spot forex market on December 3, and again at 90.27-90.29, to curb sharp depreciation.

BUSINESS

Why INR at 90/USD is a big concern for RBI's monetary policy committee meeting

The Rupee opened at an all-time low on December 3 and crossed the 90-mark against the US dollar on persistent equity outflows and uncertainty around the India-US trade deal.

BUSINESS

Only foreign parasitic trees to be cut; Kumbh preparations on fast track, says Nashik municipal chief

As part of Kumbh planning, we are laying six utilities together -- water supply, sewerage, storm water drainage, MNGL gas pipeline, electricity transmission and optical fiber. All will be laid first and then the road will be constructed, Khatri said.

BUSINESS

Amid Nashik Kumbh protests, Maharashtra govt seeks way out of tree-cutting controversy, says CM Devendra Fadnavis

The tree cutting plan has triggered protests from local residents and environmental activists, who have questioned the necessity of large-scale tree felling and demanded alternative arrangements that would minimise ecological damage.

BUSINESS

Nashik Municipal Corporation to issue green bonds worth Rs 200 crore in Jan-Feb, says Commissioner Manisha Khatri

On December 1, Nashik Municipal Corporation listed its bonds on the National Stock Exchange of India (NSE).

BUSINESS

'Right time' to unlock value for Maha's govt entities says CM Devendra Fadnavis

Fadnavis called it the 'right time' to unlock value in government entities and corporations, and the listings will be carried out in a phased manner to ensure a smooth transition to the market.

BUSINESS

INR or Repo rate: What will be the bigger priority for RBI ahead of MPC?

The depreciation in the local currency is highest in last three years due to tariffs related impact leading to higher demand for dollars among importers and outflows of funds from domestic equity market.

BUSINESS

17 of 20 experts back December rate cut despite GDP uptick; banks’ margins at risk

The RBI has so far reduced repo rate by 100 bps from 6.5% to 5.55 between February and June. After that, it RBI has maintained a status quo in the August and October policies.

BUSINESS

RBI consolidates 3,809 circulars into master directions, scraps 5,673 obsolete norms, to improve ease of compliance, says DG Murmu

Murmu furher said that any circular issued midway during the year will now be added as an amendment to the concerned master direction, and all master circulars will be updated within a period of one year.

BUSINESS

Indian bond yield rises 5 bps after GDP accelerates to a six-quarter high of 8.2% in Q2

India’s economy extended its strong run for a third consecutive quarter, growing at a six-quarter high of 8.2 percent in July–September (Q2FY26) compared with 7.8 percent in the previous quarter.

BUSINESS

FIMMDA members elects six new directors from PSU, private banks after SRO recognition, say sources

From the PSU space, State Bank of India, Union Bank of India and Bank of Baroda have secured representation. On the private sector side, the elected directors are from HDFC Bank, Axis Bank and ICICI Bank.

BUSINESS

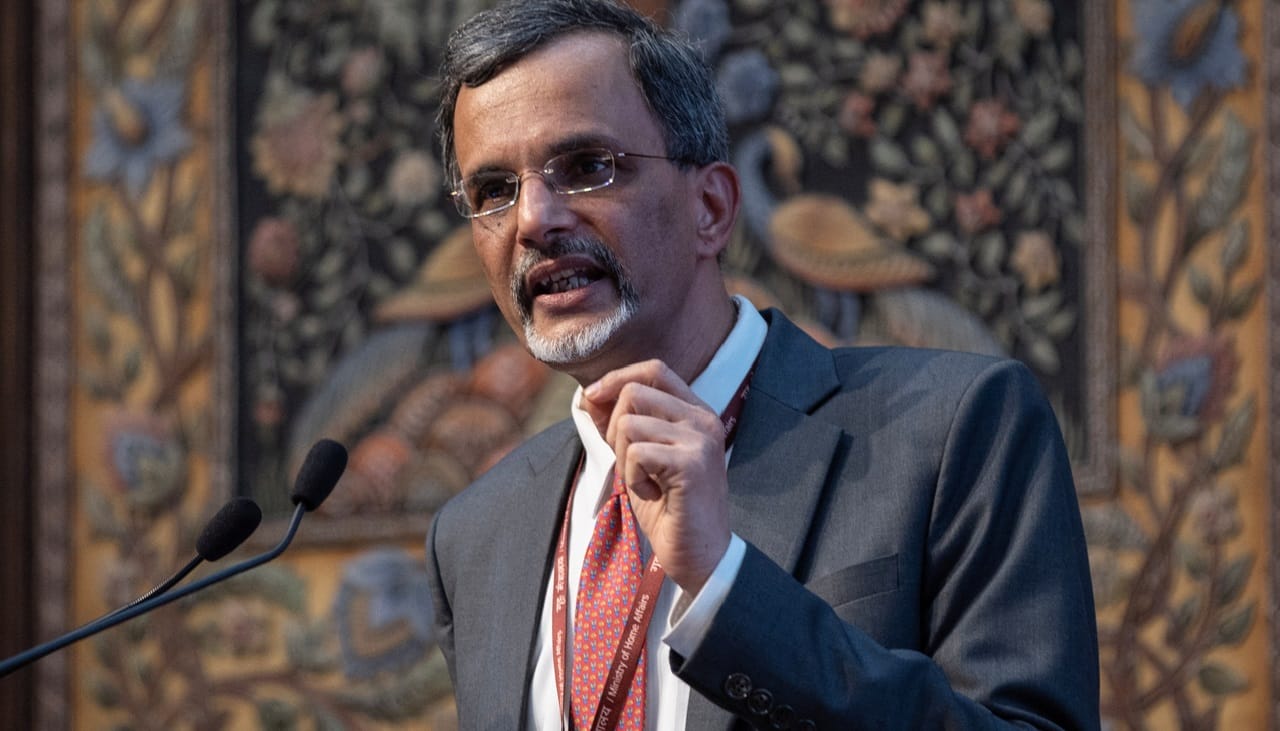

India’s debt market task ahead is to enable funds for mid-sized corporates, municipalities, says CEA Nageswaran

The next phase of regulation now will move on to smarter rules and not necessarily more rules, he added

BUSINESS

Bond market split on RBI’s rate cut outlook, issuances and coupon demand diverge

This week Rs 25,023 crore has been raised through corporate bonds. Corporates and banks raised Rs 15,193 crore via BSE’s electronic book platform and Rs 9,830 crore on NSE’s EBP

BUSINESS

Two big banks seek pension fund licences amid rising growth potential, says PFRDA chairman

An additional 0.1 percent incentive has been offered if 80 percent of customers are new to the scheme. This threshold has not yet been achieved, but once business gains momentum, pension funds are expected to actively pursue this incentive, Ramann said.

BUSINESS

Corporates, banks raise over Rs 8,000 crore via corporate bonds in primary market

Of the total fund raising, majority of the funds has been raised by IRFC worth Rs 2.981.65 crore and ICICI Bank worth Rs 3,945 crore.

BUSINESS

NBBL aims to process 1 billion monthly transactions over next 3 years, says NBBL CEO

Last month, the company crossed 260 million transactions, a 10x growth over the last few years, Noopur Chaturvedi has said

BUSINESS

Rupee down 3.5% since March; RBI sells $38 billion to steady currency: FinMin

Indian rupee weakened 3.5% vs US dollar between March and October 2025, as RBI sold nearly $38 billion to stabilise the currency amid global volatility and mixed flows.

BUSINESS

RBI uses multi-model, forward-looking framework to sharpen inflation, growth forecasts, says Deputy Guv Poonam Gupta

The bi-monthly policy resolutions of the Monetary Policy Committee provide projections for inflation and growth up to four quarters ahead, Gupta said.