BUSINESS

Credit growth unlikely to improve till H2 FY26 despite 100 bps repo rate cut

The cut in the cash reserve ratio is expected to infuse Rs 2.5 lakh crore into the banking system which, banks hope, will improve lending sentiments during the upcoming festival season.

BUSINESS

Rupee surges 77 paise, sees biggest single-day gain in a month as oil prices tumble

Brent crude, the global oil benchmark, plummeted 3.19% to $69.20 per barrel in futures trade as US President Donald Trump announced that Iran and Israel agreed to a ceasefire

BUSINESS

'Meeting-by-meeting' decisions needed, given the uncertainty, says RBI MPC member Saugata Bhattacharya

Given the present, evolving, and likely continued elevated levels of uncertainty, rate actions will have to be based on incoming data and an assessment of the associated macro-financial environment, Saugata Bhattacharya said during an interview.

BUSINESS

Inflation to determine further rate cut trajectory, says RBI MPC member Nagesh Kumar

In view of difficult external circumstances requiring support to economic growth, and a favourable inflationary outlook providing headroom for further rate cuts, the case for a 50 basis points cut in the repo rate had become stronger at the June MPC meeting and hence received wide support, Kumar said in an interview.

BUSINESS

RBI's gold reserves increase by $16.23 billion so far in 2025 amid rising uncertainty

The total gold held by the RBI was 879.58 metric tonnes as of March 31, 2025, compared to 822.10 metric tonnes as of March 31, 2024, reflecting an increase of 57.48 metric tonnes over the year, according to the RBI’s annual report.

BUSINESS

RBI's change in norms for NBFCs led to HDFC- HDFC Bank merger, says Deepak Parekh

The former HDFC chairman said ICICI Bank once made an offer to take over the mortgage lender but it was declined. On a podcast with ICICI Bank’s former chief, Chanda Kochhar, he recalled his most memorable experiences with the banking regulator

BUSINESS

Deepak Parekh bats for SLR cut to free up more funds to lend

The demand for SLR comes after the RBI has cut cash reserve ratio by 100 basis points to improve liquidity

BUSINESS

Indian rupee may breach 87-mark amid heightened global uncertainties

Experts believe that the excessive volatility in the rupee may prompt the Reserve Bank of India (RBI) to intervene in the market to curb volatility. If Indian rupee breaches the 87-mark, it would be first time since mid-March this year that it will touch that level.

BUSINESS

RBI MPC minutes: Members saw strong case for rate cut to aid growth on benign inflation view

Baseline outlook for FY26 inflation largely comfortable. Core CPI trends show underlying inflation pressures contained, says MPC member Rajiv Ranjan

BUSINESS

HDB Financial's MD & CEO explains discounted valuation for the IPO

HDB Financial to raise Rs 12,500 crore through IPO for which bidding will take place between June 25 and June 27

BUSINESS

RBI ramps up scrutiny on treasury operations, derivatives books in private, foreign banks

The central bank has increased scrutiny of the derivatives books of private and foreign banks, sources said. Scrutiny of other banks has increased after the IndusInd Bank earlier this year reported a Rs 1,959.8-crore discrepancy in its derivatives portfolio

BUSINESS

Mumbai Police’s EoW registers fresh case in New India Co-operative Bank for alleged Rs 24.93 cr fraud

The accused bank officials formed a criminal conspiracy and sanctioned loans to Harinder Pal Singh's Percept Group companies to the tune of Rs 77 crore, without completing due diligence, says the complaint

BUSINESS

RBL Bank appoints Yes Bank's Sanjiv Roy to head wealth management business

The bank is also exploring opportunities to partner with a few wealth management companies to start the operations, sources told Moneycontrol

BUSINESS

Why RBI wants to align call money rate to repo rate

Market participants said call money rates should be lower than the repo rate, but that excessively lower rates could lead to inflation.

BUSINESS

RBI seeks market view on aligning short-term rates to repo rate

The gap between the repo and overnight call money rates suggest that banks are availing of cheaper funds from the market than from the RBI’s liquidity operation.

BUSINESS

Rising crude oil prices warrants careful observation from RBI on inflation

Usually, as per economists, an increase of $10 per barrel on crude oil prices leads to about 0.4%-0.6% increase in inflation. Barclays in a report said that the sharp ~USD10/barrel increase in crude oil prices since the escalation in Iran-Israel conflict over the past week, if it continues, would put further upside pressure on prices in June.

BUSINESS

PSU lenders paid 10% more insurance premium to deposit guarantor DICGC in FY25

The increase in bank deposit insurance cover paid by banks comes at a time when a cooperative lender - New India Co-operative Bank - has been facing regulatory action by RBI.

BUSINESS

PSU banks raised Rs 1,814 crore in green deposit in FY25, majority used for renewable projects

Bank of Baroda raised higher funds through green deposits than its PSU peers, raising Rs 1,063.44 crore in FY25, followed by Punjab National Bank raising Rs 394.31 crore, Canara Bank raising Rs 134.71 crore, and State Bank of India raising Rs 105.92 crore in FY25.

BUSINESS

After a year, RBI rejects all bids on sovereign green bonds at weekly bond auction

The last time the RBI rejected bids on the sovereign green bonds was on May 31, 2024, as per central bank’s database.

BUSINESS

PSU banks earn 15% higher commission from selling insurance, MF products in FY25

The bulk of the fees or commission has come from selling life insurance policies followed by non-life insurance policies, Moneycontrol has found

BUSINESS

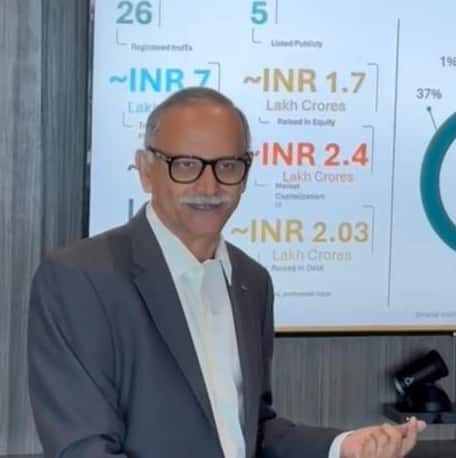

Privately-listed InvITs must aim to list to attract investors, says Bharat InvITs Association CEO

As of March 2025, there are 26 InvITs are registered with Securities and Exchange Board of India (SEBI). Of this, 21 are privately listed and only five are publicly listed.

BUSINESS

PSU bank chiefs see 52-66% y-o-y jump in FY25 salaries

In FY25, state-owned banks’ profitability rose sharply due to higher income from lending, treasury gains and lower provisioning for bad loans.

BUSINESS

State-owned banks beat private lenders in CASA ratio for first time in a decade

As stress persists for banks on the deposit mobilisation front, a few banks have tapped the short-term debt market to raise funds through certificates of deposits.

BUSINESS

Foreign investors pull out over Rs 2,700 crore from Indian bonds as RBI rate cut narrows spread

The spread between India and US bonds stands at 187 bps, which is one of the lowest. Usually, when the spread narrows, foreign investors pull back funds from emerging economies and park it in less risker destinations.