The heads of state-owned banks saw a healthy rise in salaries in 2024-25, with the increase ranging between 52 and 66 percent over the previous fiscal year. This was after these banks reported rising profitability and improved asset quality.

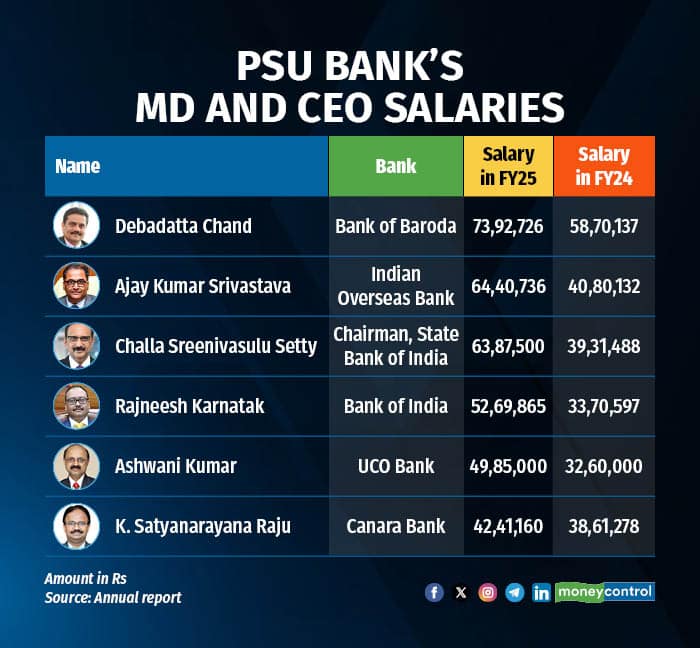

According to a Moneycontrol analysis of annual reports, managing directors and chief executive officers of public sector banks took home salaries in the range of Rs 42 lakh to Rs 81 lakh in FY25.

Debadatta Chand, MD and CEO of Bank of Baroda, earned Rs 74 lakh in FY25, one of the highest in this cohort.

This was followed by Indian Overseas Bank MD and CEO Ajay Kumar Srivastava's Rs 64.40 lakh, and State Bank of India Chairman Challa Sreenivasulu Setty's Rs 63.87 lakh.

Setty got Rs 26. 97 lakh as basic pay and dearness allowance of Rs 14.36 lakh in 2024-25.

PSU Bank's MD and CEO salaries

PSU Bank's MD and CEO salaries

“The Managing Director & CEO and Executive Directors (whole time directors) are paid remuneration by way of salary as per rules framed by the Government of India. At present the Bank has no Stock Option Scheme,” Bank of Baroda said in its annual report.

Further, Bank of India’s MD and CEO Rajneesh Karnatak drew Rs 52.69 lakh remuneration in FY25, compared to Rs 33.71 lakh in FY24, as per the lender's annual report.

Canara Bank and UCO Bank’s chiefs took home Rs 42.41 lakh and 49.85 lakh, respectively, in FY25.

In FY25, state-owned banks’ profitability increased sharply due to higher income from lending, treasury gains and lower provisioning for bad loans.

Lower provisioning was one of the main factors because asset quality at these banks has improved significantly and in fact, they reported better asset quality than peers in the private sector.

Moneycontrol reported that for the first time in a decade, state-owned banks beat private sector banks on the current account and savings account (CASA) ratio and asset quality front in FY25.

As per a CareEdge report, as of March 31, 2025, gross non-performing assets (NPAs) of state-owned banks ]improved significantly, declining by 17 percent year-on-year to Rs 2.94 lakh crore, reflecting the continued strengthening of asset quality. On the other hand, private banks' gross NPAs rose by 5 percent to Rs 1.21 lakh crore as of March 31, 2025.

Net NPAs of state-owned banks improved by 23.3 percent on-year to Rs 0.60 lakh crore as on March 31, 2025, while net NPAs of private banks rose 13.6 percent on-year to Rs 0.33 lakh crore, driven by stress seen in the microfinance and unsecured segments.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!