BUSINESS

Canara HSBC Life banks on new agency, digital channels for next leg of growth amid IPO launch

No fresh fund infusion planned; insurer to fund expansion through internal accruals, says CEO Anuj Mathur

BUSINESS

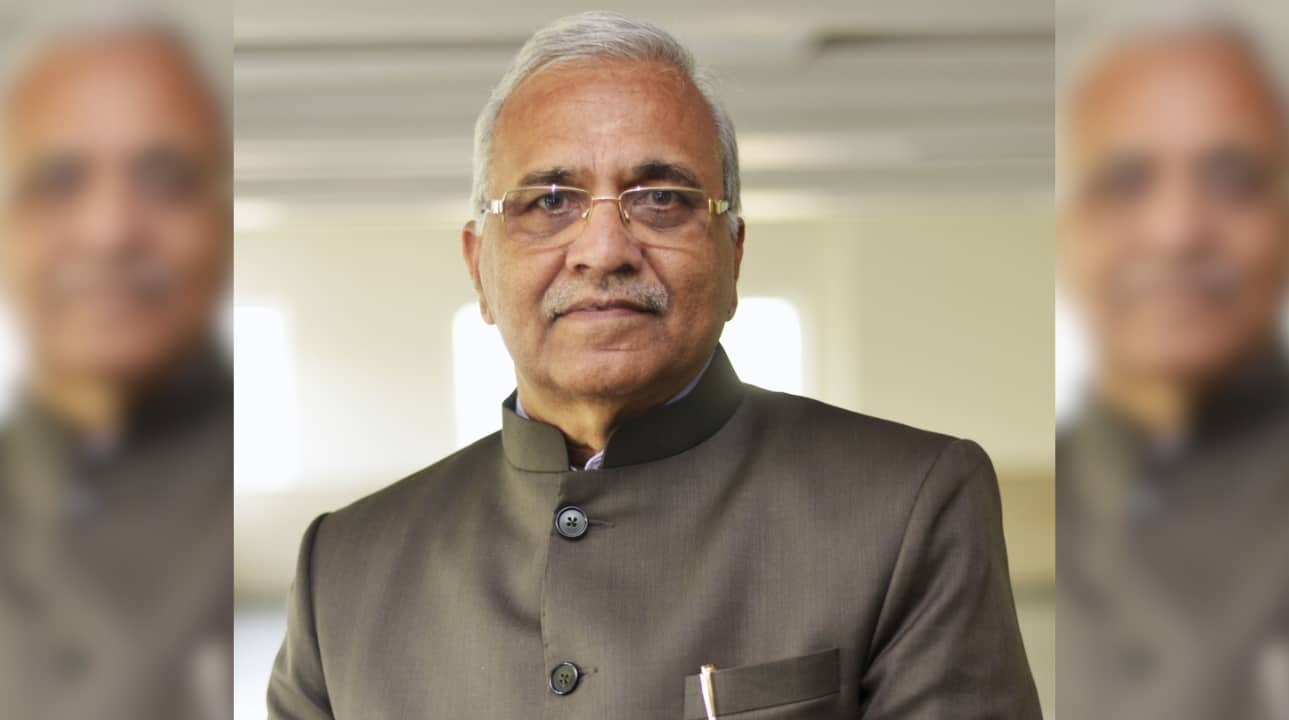

Bima Sugam platform to rank insurance products using AI-driven metrics, will go beyond just pricing

The idea is to help consumers make informed decisions based on the reliability and performance of insurers, not just on affordability, says Deepak Rajoo, CIO, Royal Sundaram Insurance

ECONOMY

RBI to launch certificate of deposits' tokenisation tomorrow, says official

Pati cautioned that such innovations must be approached thoughtfully, with robust legal and regulatory frameworks in place

BUSINESS

Insurance agents & associations likely to take up GST issue with IRDAI, Finance Ministry

While strict cost caps has forced private insurers to pass GST burden to agents, PSUs like LIC, New India Assurance, Oriental and United India have decided to absorb loss

BUSINESS

Acko Life CEO Sandip Goenka steps down

Goenka, who took charge on October 15, 2024, stepped down from the role this month, ending an 11-month tenure at the company

BUSINESS

Battle for India’s largest mid-sized bank intensifies

While the top 3 private lenders HDFC Bank, ICICI Bank, and Axis Bank have stayed steady for over a decade, most of the action in the pecking order has been in the mid-tier where banks have swapped ranks in a tight contest

BUSINESS

GST cut on insurance may trim medical inflation but won’t shift consumer mindset: Debashish Banerjee, Partner, Deloitte

Deloitte’s Debashish Banerjee says the bigger barrier to insurance penetration is trust, not pricing, and GST relief alone won’t change consumer behaviour

WORLD

H1B Visa cost hike could further dampen demand for overseas education loans

Industry experts say the sector has witnessed decline since Trump’s Presidency and demand for US education loans for the Fall 2025 academic year has plunged compared to a year ago

BUSINESS

Leading insurers see ITC impact from GST exemption as manageable, no major disruption

Experts are of the view that smaller, retail-focused insurers may face pressure sooner, while larger diversified players can cushion short-term margin shock

BUSINESS

Micro-covers turning 'push' insurance into 'pull' products, says Universal Sompo CEO

Regulators are also examining structural reforms such as monoline alongside composite licenses, which could reshape the way insurers operate in India, Mathur says

BUSINESS

'Insurers spend large portion of premium towards overheads like commissions leaving little for claims,' says AHPI’s Girdhar Gyani

He flags insurers’ unwillingness to cover advanced treatments, low incurred claim ratios that leave little for actual patient payouts, and delayed bill authorisations that prolong discharges.

COMPANIES

Shriram Wealth bets on 'democratising' wealth, to soon enter Rs 10 lakhs-Rs 2 crore segment

Shriram Wealth builds early traction with 400 families and 150 professionals across 11 cities within three months of launch, says MD and CEO Vikas Satija

BUSINESS

MC Analysis | Why introducing a regulator for healthcare could be difficult

Industry’s demand in favour of introducing a healthcare regulator has been gaining grounds recently but industry complexities could dampen the progress.

BUSINESS

GST rate cut buzz likely to have dampened insurance sales in August

Consumer deferrals on GST expectations, along with crop drag, high year-ago base, and seasonal headwinds, made August a rare weak month for insurers after three months of strong growth

BUSINESS

GST cut likely to boost individual protection, but revival will be gradual, say analysts

The effect on volumes, product mix and profitability will depend on how distribution channels adjust, how insurers reprice to offset the loss of input tax credits, and whether employers push individual policies over group benefits.

BUSINESS

GST on insurance: Policyholders have a lot to know post GST 2.0, here's why

Here’s everything policyholders need to know about the GST cut on future premiums and policy benefits

BUSINESS

Despite life insurers’ premium growth of 6% in August, policy sales drop 9%

Premium income for private insurers climbed 10.84 percent to Rs 65,410.42 crore during the period under review, up from Rs 59,013.14 crore last year. LIC, on the other hand, posted a modest 3.02 percent growth, collecting Rs 98,051.09 crore compared to Rs 95,180.63 crore a year ago

BUSINESS

Insurance forum likely to seek clarity on input tax credit and GST exemption from IRDAI, Centre

Sources say, insurers may be fearing the possibility of customer grievances if refunds are delayed or denied, while actuarial teams face the challenge of recalculating projections for policies spanning across the transition period

COMPANIES

Bima Sugam to launch digital insurance marketplace this year; governance structure still unclear

The initiative is supported by an authorised capital of Rs 500 crore and a paid-up capital of Rs 310 crore, with shareholding spread widely across life, general, and health insurers

BUSINESS

GST 2.0: Insurers approach govt to seek clarity on ITC treatment

Insurers, who had initially lobbied for GST to be charged at a 0% rate instead of an exemption, have sought clarification on whether insurance companies can claim input tax credit at an entity level

BUSINESS

GST cuts to boost demand but won’t trigger credit growth as banks remain cautious over tariffs

Despite the GST relief and the upcoming festive season, lenders are exercising caution, with analysts expecting credit growth to remain largely unchanged amid trade-related uncertainties.

BUSINESS

GST relief on health premiums may nudge insurers, companies to revisit India Inc’s employee benefits

With the GST Council continuing to levy 18 percent tax on group health policies, employers may scale back group coverage and shift toward allowances for individual insurance coverage plans.

BUSINESS

Insurers expect surge in small-ticket policies after GST cut, bet on higher adoption with affordable premiums

Lower entry costs will encourage first-time buyers to consider insurance policies both in life and general plans, and wider adoption and a large customer base is where we see real growth and potential, say industry leaders.

BUSINESS

Bima Sugam likely to go through another phase of adjustments as governance, funding issues linger

The platform, originally planned for launch in early 2024, is now expected to be delayed by 12-18 months from the original timeline, sources said