BUSINESS

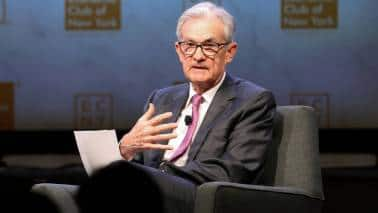

Even Jerome Powell is having trouble reading this economy

It’s relatively clear that there are still a number of paths to potentially higher policy rates in 2024, and it’s hard to make any high-conviction bets in one direction or the other

BUSINESS

Rout in 10-year treasury notes is no wild aberration

History suggests that the surge in yields is probably just a detour. But that doesn’t mean it won’t hurt

BUSINESS

US Economy: Risks Are growing of a double-dip 'vibecession'

The US may be heading back into a “vibecession” — a condition in which consumer confidence and other economic “vibes” decline so much that they threaten to become self-fulfilling prophecies and drag the economy down with them

BUSINESS

Fed’s debate about ‘neutral’ is mostly an exercise

The central bank’s tea leaves suggest that some policymakers think the rate is on the rise. But the most influential voices probably won’t be swayed

BUSINESS

Powell has already hinted at where he stands on ‘neutral’

The Fed chair’s early Jackson Hole speeches indicate a lot about how he thinks about the equilibrium real rate of interest

BUSINESS

Why this hysteria over higher US Treasury bond yields?

Perhaps the jump in longer-term yields is just what the US Federal Reserve needs to complete the proverbial last mile in its inflation fight — a necessary but ultimately temporary part of the disinflation process. And perhaps the question isn’t “why is this happening now?” but “why didn’t it happen before?”

BUSINESS

When the reigning No 1 portfolio strategist confirms there's no crystal ball

Morgan Stanley’s Michael Wilson, the reigning No 1 portfolio strategist in Institutional Investor’s annual survey, who nailed last year’s interest-rate driven selloff in US equities and had held on to his bearish views through 2023, advancing the thesis that the bear market would move into a second phase driven by sharp earnings declines, now admits that he had got it wrong

BUSINESS

Worried about Nvidia, Apple and Meta? Nasdaq has your back

To tackle the “over-concentration” of the Nasdaq 100, the index provider is carrying out a “special rebalance” on July 24 to redistribute weights after the run-up in megacap stocks. Although the out-of-cycle move was rare and blindsided some investors, it is a sign that the system is working as intended

BUSINESS

Stock market bulls are now free to fight the US Federal Reserve

A year ago, core inflation still hadn’t peaked, the drivers of inflation were widely misunderstand, and policymakers were going all out. By now, inflation has clearly peaked and inflation expectations are under control. Fed policymakers will want to maintain some restraint on the economy, but stock market buoyancy certainly hasn’t been an issue for them

BUSINESS

US recession 2023 might be cancelled but economists won't admit it

Despite a streak of positive economic data from the US, the forecasting consensus still sees a 64 percent probability of recession in the next 12 months. Economists are not giving up on the downturn thesis, just pushing it back. This could be because resilient core inflation and a Fed that’s determined — perhaps overly so — to bring it back to its 2 percent target, could end the US economy's good run

BUSINESS

Rate Hikes: US Federal Reserve may be nowhere near done yet

Some policymakers are clearly getting uncomfortable with the way that inflation is reacting — or failing to react — to the 500 basis points of rate increases since March 2022. Inflation isn’t accelerating, but it’s not coming down, either and this suggests a risk of rates having to go to 6 percent or 6.25 percent

BUSINESS

Economic pessimists are running out of worries

The outlook has improved with the lifting of the debt-ceiling cloud and the easing of the bank crisis

BUSINESS

Nvidia stock rides the AI wave with more to come

Nvidia’s latest stock pop came after the company projected $11 billion in sales for the quarter ending in July, beating estimates of about $7.18 billion for the quarter. It has been helped by the coming of generative AI, which is forcing the world’s $1 trillion in installed data center infrastructure into extensive upgrades to accelerate computing power and significantly cut energy and costs

BUSINESS

Greenspan’s success shows Jerome Powell how to skip

Several Federal Reserve officials have mused about putting off an interest-rate increase at the June policy meeting. History shows that’s a smart move in a hazy economy

BUSINESS

Stock bulls won’t find much to celebrate in the US Fed’s pause

The Fed retained its hawkish bias, which should disappoint those who think the Fed should already be weighing rate cuts in the second half of the year

BUSINESS

Fed unity is showing cracks at a critical time

The rate-setting committee has mostly stuck together in the past year. A mild second-half recession would test that solidarity

BUSINESS

Federal reserve pause is still coming, just not yet

The core consumer price index decelerated a bit in March from a month earlier but likely not enough to convince policymakers they have done enough to control inflation

BUSINESS

Stock market Cassandras and Pollyannas are stuck in limbo

Doomsayers get a lot of the attention, and perma-bulls get the rest. But in the past 11 months, they’ve all been wrong

BUSINESS

As Fed nears rate peak, be careful what you wish for

The central bank’s decision day highlighted the breakdown of correlations between stocks and bonds. That puts its dovish turn in a different light

BUSINESS

CPI: If the Fed fails to raise rates, it will be a sign of panic

For all the concern about Silicon Valley Bank, the latest Consumer Price Index shows why the central bank can't suspend the inflation fight prematurely

BUSINESS

Powell’s testimony is a sideshow. Follow the data

The Fed chair’s comments sent financial markets lower, but the narrative could change as soon as Friday with fresh jobs numbers

BUSINESS

US Federal Reserve might need a new excuse to stay hawkish

US Fed zeroed in on a ridiculously specific metric to justify its rate increases. Even that is showing signs of improvement

BUSINESS

US GDP and jobs data show the stock market bears are still early

A lively start to January and the latest spate of economic data show the perils in turning negative on equities too soon

BUSINESS

Jerome Powell delivers masterful performance at a difficult time

The Federal Reserve chair needed to prep markets for a coming slowdown in rate increases without loosening financial conditions. He pulled it off