BUSINESS

MC Exclusive | M&M Finance in the process of restructuring its housing arm

The new leadership at the parent company is clear that the mortgage business has to move out of the affordable homes segment in order to pare its bad loans book.

BUSINESS

Vault matters | Thinning bank credit growth needs RBI’s immediate attention

While it is often perceived that bank credit growth is a derivate of GDP growth, the fact is both are interlinked. If credit growth posted by banks is muted, GDP growth is unlikely to outperform the loan growth data. At 11.5% as per recent RBI data, bank loan growth isn’t very inspiring

BUSINESS

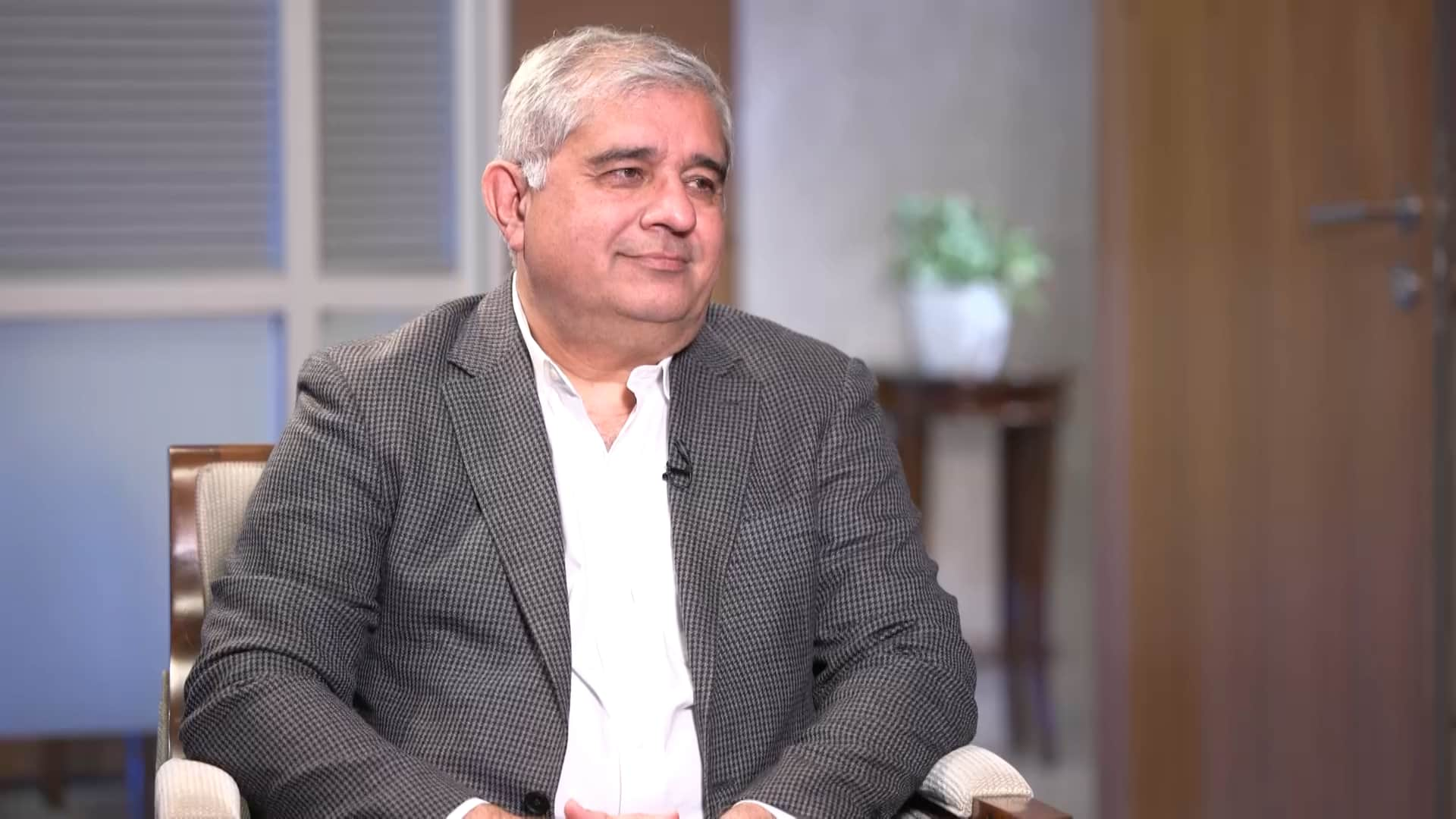

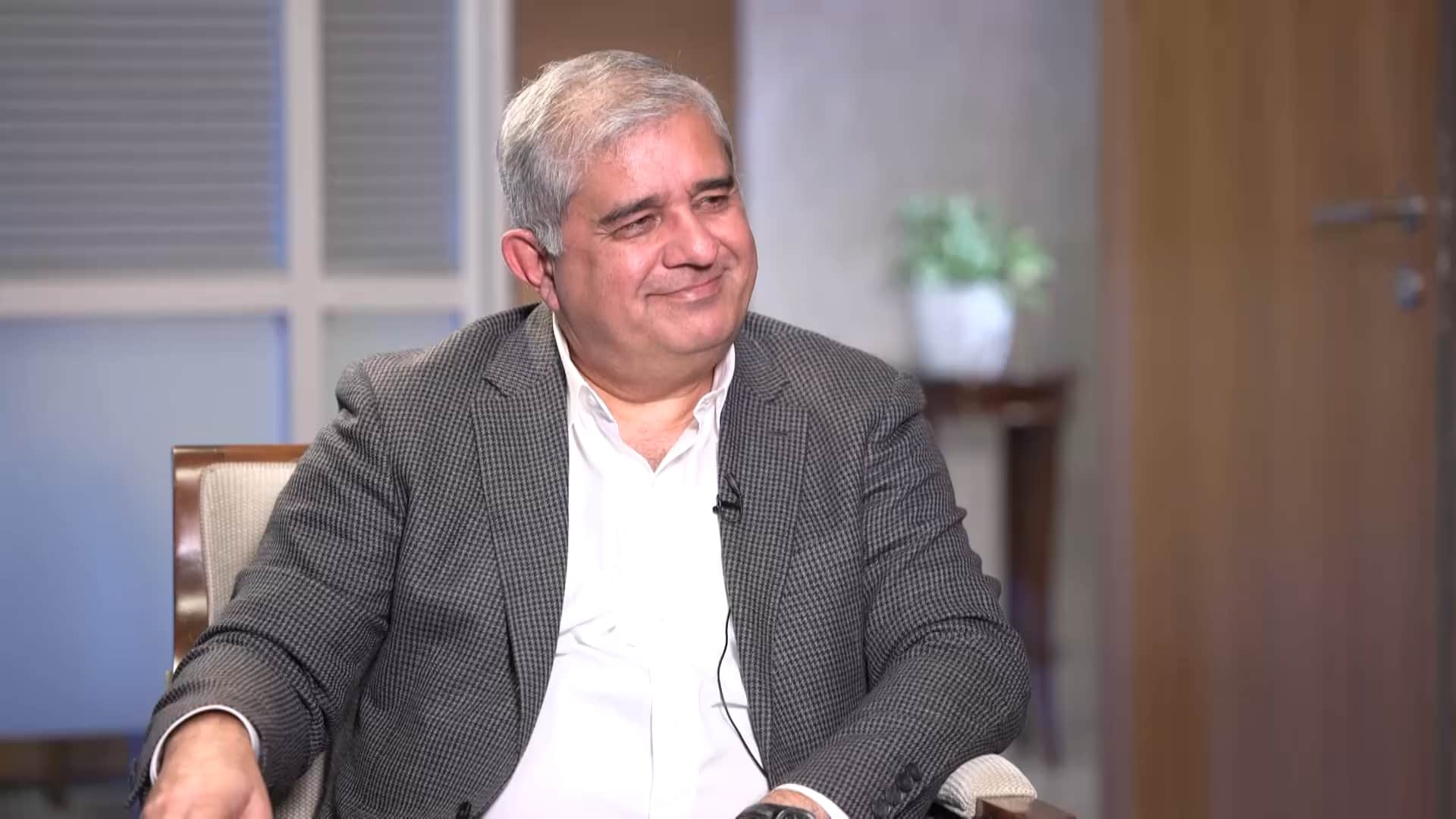

MC Exclusive | Third term as Axis Bank chief will be about continuing our journey: Amitabh Chaudhry

Axis Bank MD and CEO speaks exclusively to Moneycontrol as he takes charge for the third term, shares his insight into the House of GPS and the road ahead

INDIA

Vault Matters | Should the regulator have the final word or the only word?

About nine intermediaries, including Kotak Mahindra Bank, India’s fourth largest private bank, faced the ire of the Reserve Bank of India in 2024. A few that faced bans have resumed business while others are yet to get their names cleared. Yet, it is far from business-as-usual for most of them. Should there be recourse for businesses to get a better grip on the core problem before stringent regulatory action?

BUSINESS

Mizuho makes a binding bid for Avendus Capital

On December 18, Moneycontrol reported that Nomura has placed its final bid for the homegrown investment banking firm. Bid from Carlyle is expected around the first week of January 2025

BUSINESS

MC Exclusive | We're on course to be small finance bank, talks on with RBI: Fino Payments Bank chief Rishi Gupta

Would prefer to convert to a small finance bank, even if permitted to lend as payments bank, says Rishi Gupta, MD and CEO, Fino Payments Bank

BUSINESS

Axis Bank MD & CEO says not looking to acquire Yes Bank or IDBI Bank

While the bank has plans for inorganic growth options, Amitabh Chaudhry ruled out the possibility of making a move for IDBI Bank or Yes Bank.

BUSINESS

Interest rate cut won’t spur capex: Amitabh Chaudhry, MD & CEO, Axis Bank

Chaudhry believes that while there is pressure building to cut interest rates, that itself may not help improve capex.

BUSINESS

MC Exclusive | We aim to maintain our NIM at 3.8% in long run: Axis Bank chief Amitabh Chaudhry

Amitabh Chaudhry, MD & CEO, Axis Bank speaks exclusively to Moneycontrol on what lies ahead for the bank.

BUSINESS

Vault matters | Barely discussed concerns in gold loans

The year 2024 belonged to gold loans clearly. From one of the largest players, IIFL Finance, being banned for a little over six months this year to the regulator waking up the irregularities in the sector, gold loans have become the product everyone wants to focus on. But if unsecured loans are being realigned as secured gold loans product, is that proposition well thought through?

BUSINESS

Final binding bids for Avendus Capital come through

Nomura has bid for complete acquisition of Avendus Capital, while bids from Mizuho and other interested investors expected later this week, sources have told Moneycontrol

BUSINESS

HDFC Bank reopens stake talks with MUFG for HDB Financial

Ahead of possible changes to the holding norms proposed by the central bank, HDFC Bank is keen to onboard a large investor in HDB Financial before it goes public

BUSINESS

Vault matters | Why credit bureaus need to be more borrower friendly

While the central bank has taking a slew of steps to ensure that there is accuracy and faster dissemination of credit history, more can be done to increase the efficiency of credit bureaus. Unlike corporate rating agencies, retail customers barely get a chance to make a case on why the rating score may be wrong. This needs to change for deeper retail penetration

BUSINESS

Vault Matters | How I would remember Shaktikanta Das

If former Prime Minister Narasimha Rao would be remembered for quietly reforming the country in 1991, Das will be remembered as RBI’s very own Narasimha Rao. He brought about certain critical changes in the way banks and NBFCs operated and ensured that everyone towed the line

BUSINESS

How Sachin Bansal's Navi Finserv reversed RBI lending ban in quick time

Navi’s move to reduce the peak interest rates could also mean that it will naturally reduce its exposure to customers with higher risk profiles and is likely to help the company reduce its NPA during FY 25

BUSINESS

MC Analysis | Sanjay Malhotra, who succeeds Shaktikanta Das as new RBI Governor, has a tougher task

Markets usually anticipate the incoming Governor to slash interest rates. This time around, with inflation being where it is, it needs to be seen whether there is adequate headroom to tinker with rates just yet. Malhotra’s decision on certain critical banking-related issues and the divestment of IDBI Bank will be interesting to note.

COMPANIES

Bain’s deal with Manappuram may face delays due to differences over terms

According to sources, promoters of Manappuram Finance and Bain Capital were not in agreement on structure of the deal

BUSINESS

MC Exclusive | Bajaj Finance to halt co-branded credit cards business

According to sources, Bajaj Finance is keen to launch its own credit card business if regulatory approvals come through rather than pursing co-branded cards with banks.

BUSINESS

MFI loan disbursements likely to be muted in November

This would be the third straight month of weak disbursements for the sector. Industry leaders warn that prolonged shrinkage in monthly disbursements could significantly hamper access to bank funding for NBFC-MFIs in the near term.

BUSINESS

Vault matters: Generalist or a specialist - lenders’ dilemma

Until three years ago, being a specialist like a microfinance lender or catering exclusively to affordable housing or consumer loans helped, especially in raking premium valuations. Today, being a jack of all trades is helping lenders position themselves better amidst concerns emerging in various pockets of the financial services sector

BUSINESS

Japanese lenders MUFG, SMBC may have walked off from Yes Bank deal

Unfavourable norms on control-related issues and apprehensions about how Yes Bank would contribute to consolidated financials of the Japanese lenders are said to be among the reasons for the breakdown of deal talks

BANKING

RBI Governor Shaktikanta Das may secure third term

Sources say his tenure may extended by up to two years. The final decision will be made by the Appointments Committee of the Cabinet (ACC), and an official communication from the government is expected soon

BUSINESS

MC Exclusive | Fundamental building blocks won’t change: DCB Bank chief Praveen Kutty

For inorganic options, either the geography, or the segment, or the product has to be different. We ensure that we avoid a situation whereby our partners feel that their toes are getting stepped upon, said the MD and CEO

BUSINESS

Being South-based helped us manage asset quality issues better: Sadaf Sayeed, MD & CEO, Muthoot Microfin

Kerala, Tamil Nadu, Karnataka contribute almost 49 per cent of the loan book. We have just entered Andhra and Telangana, which is also contributing to further growth. In these areas, the collection efficiency is much higher.