BUSINESS

India to have second-largest number of Citi employees: CEO Balasubramanian

India supports about 80 countries globally, with some employees having created their AI patents, the CEO tells Moneycontrol

BUSINESS

Citi India CEO Balasubramanian expects $15-billion IPO rush over next 2 months

The pipeline of companies waiting to hit the market is quite robust and there could be a meaningful spill over to early 2026, Balasubramanian tells Moneycontrol in an interview

BUSINESS

Lenders turn cautious on gold loan borrowing limits

Sources say loan to value by leading NBFCs and a few banks in the gold loan segment has started reducing by 2 – 4 percent, in anticipation of a likely dip in gold prices.

BUSINESS

MC Exclusive | Federal Bank to roll out preferential issue for 9.99% stake

PE major Blackstone said to be the front runner, issue likely to be rolled out at Rs 210 - 215

BUSINESS

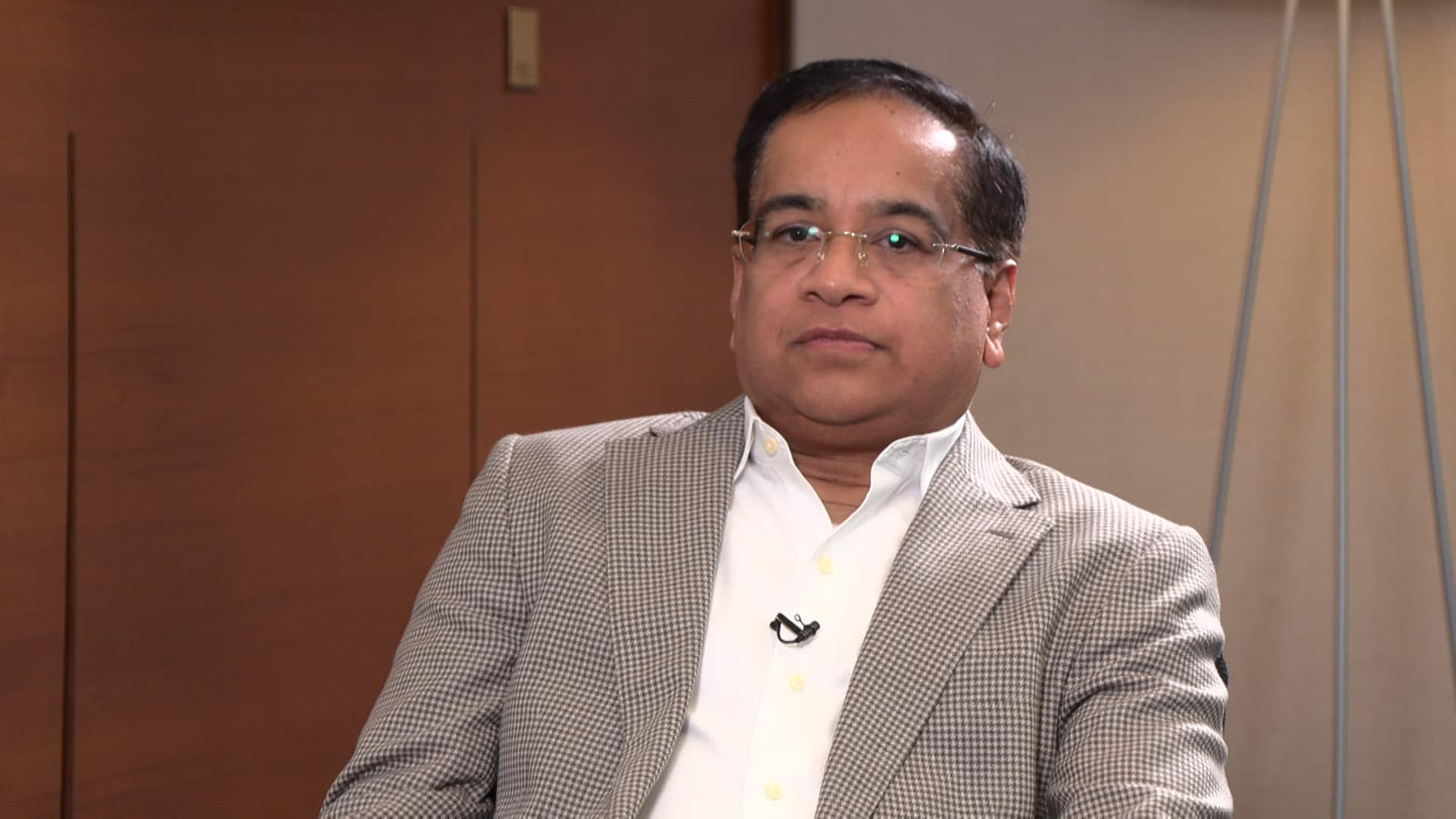

MC Exclusive | Governance, compliance & 82 years of legacy positioned RBL favourably: RS Kumar, MD & CEO, RBL Bank

BUSINESS

IndusInd Bank sees no fresh financial hit as BFIL probe, internal control overhaul progress

The auditor of BFIL had earlier issued a qualified conclusion in its limited review dated October 17, 2025, on the financial results for the September quarter and half year. However, the Bank clarified that these observations were not material to the group’s overall results.

BUSINESS

IndusInd Bank sets up executive group to strengthen financial controls after Rs 1,960 crore accounting discrepancies

According to the bank’s disclosure, the newly formed Project Management Group will oversee corrective measures, ensure process standardisation, and tighten internal checks to prevent such lapses in the future.

BUSINESS

Probe so far not pointing at fund siphoning at IndusInd Bank: EOW Sources

The sources cited add that EOW will question Siddharth Banerjee, head of global market and financial institutions group, in the coming days. A few employees who were part of the former DMD's team may also be called for questioning.

BUSINESS

RBL Bank set to become Emirates NBD's largest subsidiary outside Dubai

Sources indicate that Emirates NBD will infuse fresh capital at Rs 295 a share to take a 51% stake in RBL Bank. Emirates will take five board position in RBL Bank and subsequently through an open offer pick up an additional 25% stake. RBL Bank may be merged with Indian operations of Emirates NBD, though the wholly owned subsidiary mode

BUSINESS

Piramal, KKR seek exit from Shriram General Life Insurance: Sources

Both investors are said to have initiated the exit process and are mulling various options including a listing for the company or a secondary sale.

BUSINESS

Pretty happy with the outcome of market listing: Rajiv Sabharwal, MD & CEO, Tata Capital

We have added over 22 lakh new shareholders to the Tata Capital family, says Rajiv Sabharwal

BUSINESS

Treasury frauds at IndusInd Bank may date back to 2017 or earlier, emails reveal

Emails accessed by Moneycontrol indicate that IndusInd Bank’s former CFO Arun Khurana was aware of fraudulent accounting practices adopted for foreign derivative contracts. Separately, days ahead of the Grant Thornton audit report, CHRO Zubin Mody had calls with select employees where he was quoted as saying, 'say everything you know'

BUSINESS

Truhome Finance awaits rating upgrade after doubling AUM to Rs 20,000 crore

Warburg is expected to provide additional growth capital as Truhome scales up further

BUSINESS

Mizuho–Avendus deal enters final stage of conclusion

Sources say some of the valuation and deal terms related aspects which was holding up the acquisition since June have now been ironed out. The deal closure is likely soon.

BUSINESS

Tata Trusts, Tata Sons in talks to provide part-exit to SP Group

Shapoorji Pallonji Group eyes 4–6% stake sale in Tata Sons to unlock funds, end long-running standoff.

BUSINESS

IndusInd Bank hires former Yes Bank executive Pankaj Sharma as head of business transformation

Pankaj Sharma is seen as taking over from Anil Rao, the current head of operations at IndusInd Bank. Anil Rao is set to superannuate in a few weeks and may not to seek an extended tenure.

BUSINESS

RBI MPC Analysis: It’s a pro-banks, pro-India Inc economic policy

Even if devil lies in details, many demands of the banking sector have been granted in one stroke of the wand. Over the next 3 – 5 years, some of the regulatory decluttering can go a long way in reshaping the business of banking.

BUSINESS

HDFC Bank’s Parag Rao superannuates this week; portfolio to be spilt into smaller functions

The bank has a superannuation policy of 60 years for its employees, though exceptions are said to be have been made on a case-to-case basis

BUSINESS

Cross-border transactions, wealth management will remain focus areas: PD Singh, Standard Chartered's India & South Asia CEO

Stating that the India franchise is adequately capitalised for the next five years, Singh expects the bank’s corporate book to grow 10-12% in FY26, though some large M&A deals could accelerate growth.

BUSINESS

SMBC Global CEO Akihiro Fukutome to visit India soon

The primary agenda of his visit to India, according to sources, is to address employees of Yes Bank and assure them about their roles in the bank.

BUSINESS

India is central to Tide’s global growth story: Oliver Prill, CEO, Tide

India is where some of our most innovative products are being developed and exported elsewhere, said Oliver Prill, CEO, Tide in an interview with Moneycontrol.

BANKING

L&T Finance hopes to succeed in assessing borrower quality through its underwriting engine

According to Sudipta Roy, MD & CEO, L&T Finance V 3.0 of Project Cyclops processes 1,400 transactions per second as against the 100 transactions processed by V 1.0. Bounce rates for two-wheeler loans underwritten through this system have fallen from 20 percent to 7 -8 percent, he says

BANKING

Applicative AI and 'techno-managers' will drive future BFSI winners, says Sudipta Roy of L&T Finance

Payments, affordable housing, consumption finance including checkout financing are the new areas of interest for L&T Finance, as they blend with the company’s strategy on delivering return on assets and the risk profile of customers it targets.

BUSINESS

NaBFID is a success story by combining the right timing, institutional maturity, and strategic clarity, says MD Rajkiran Rai

Our cumulative sanctions to date have crossed Rs 2.5 lakh crore. We’re projecting this to increase to around Rs 3.2 lakh crore by March 2026. These are projects that have already been appraised and committed to, but disbursement happens progressively, especially in infrastructure, Rai said.