BUSINESS

MC Explains: Why the Kerala HC ruling on the Dhanlaxmi Bank Board battle is important

The verdict on the maintainability of writ petitions can set a precedent in similar cases. The HC has ruled that a private bank’s decision to appoint its Board of Directors is a private affair.

BUSINESS

Dhanlaxmi board seat battle simmers with Kerala HC upholding bank’s appeal

Former directors had moved HC seeking board positions and challenging the bank's decision to deny them Board seats

BUSINESS

Banking Central | The RBI’s silence on Dhanlaxmi Bank events is deafening

One of the oldest private banks in the country is yet again facing a crisis at top level management triggered by shareholder action. How long the RBI can remain a mute spectator in this whole drama?

BUSINESS

What next for Kerala-based Dhanlaxmi Bank?

Turmoil in top management, a power struggle on the Board and major capital woes could invite central bank action. The regulator is keeping a close watch on the situation at the Thrissur-based lender.

BUSINESS

Dhanlaxmi shareholders call for EGM on November 12, seek to suspend CEO's powers on capital expenditure

On June 1, Moneycontrol reported that shareholders have raised the alarm on the lender’s financial situation and rising costs even as its board tries to recover from two back-to-back resignations.

BUSINESS

Banking Central | HDFC Bank, Federal Q2 numbers signal good news for industry, yet challenges remain

If HDFC Bank numbers offer any clue, credit growth and asset quality look upbeat for the second quarter. Banks are clearly past the covid woes

BUSINESS

MPC Minutes: It's time to halt policy rate hikes, suggests member Jayanth Varma

Varma's comments assume significance in the context of an ongoing debate on whether raising rates too quickly will hurt growth.

BUSINESS

Explainer| MPC fails in meeting inflation mandate: What happens next? 5 key points

CPI inflation came at 7.41% in September. With this, the MPC has formally failed to meet the inflation mandate, a scenario former RBI Governor D Subbarao had warned early this year.

BUSINESS

Banking Central | SEBI sends a strong message to rating industry with Brickwork ban

Rating agencies are the guardians of trust for many investors in financial markets. The Brickwork episode shows not all is well.

BUSINESS

Of dreams, movies, gold and dust: The rise and fall of 'Atlas' Ramachandran

Ramachandran wasn’t just a businessman but a personality who personified the so-called ‘gulf dream’ of an average Malayali in 70s..

BUSINESS

Banking Central: How predictable is the RBI Monetary policy?

The surprise element that used to accompany monetary policies in the past has clearly gone. It's easier to predict the outcomes now.

BUSINESS

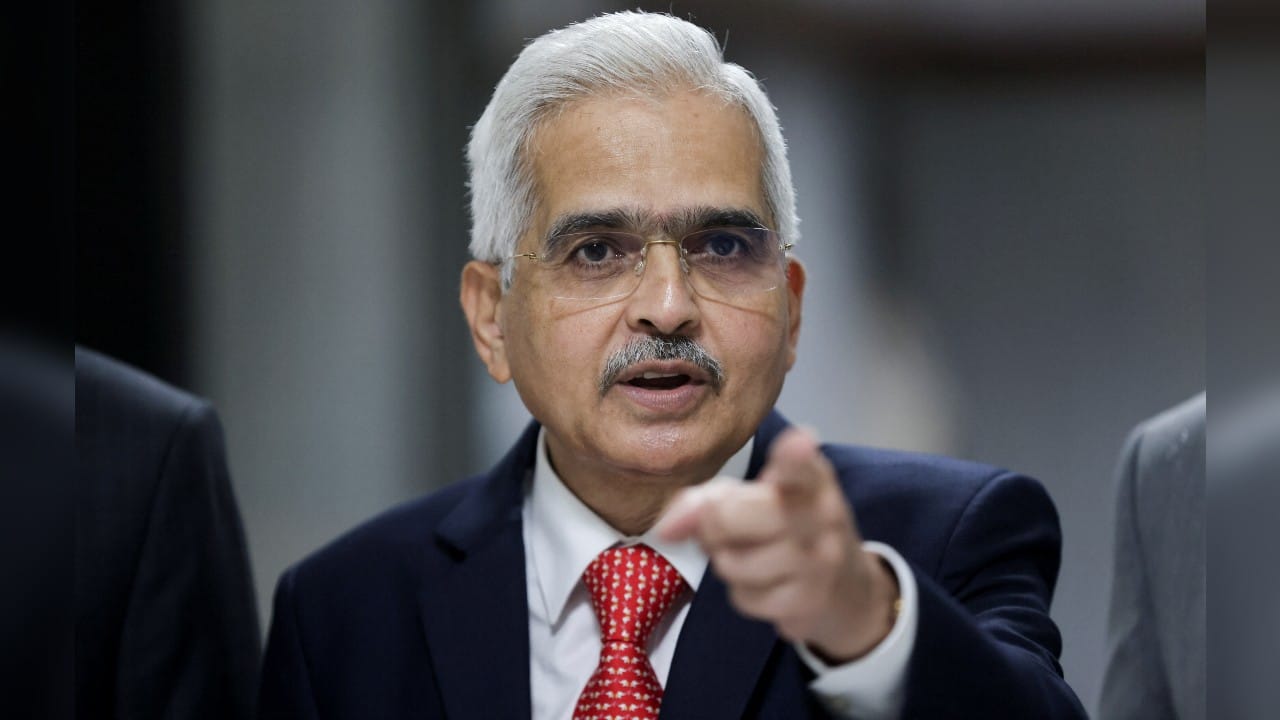

RBI Monetary Policy | What is the message from Shaktikanta Das to markets?

The big theme throughout the policy announcement was threat of high inflation. That worry is likely to remain in the foreseeable future.

BUSINESS

RBI hikes repo rate by 50 bps as battle on inflation continues in full swing

It is pertinent to note that the Governor didn't hint at a 'neutral' stance, instead chose to stick to the 'calibrated withdrawal' to highlight the fact that MPC remains hawkish on the overall policy approach.

BUSINESS

Why Kotak’s promotion of officials fined by Sebi has raised a stink

The action has triggered a debate: should an organisation promote officials penalized by a regulator or wait until a clean chit is given by a higher court?

BUSINESS

Banking Central | What does another rate hike this Friday mean to you?

MPC's focus likely to continue on inflation fight even as growth recovery remains a concern

BUSINESS

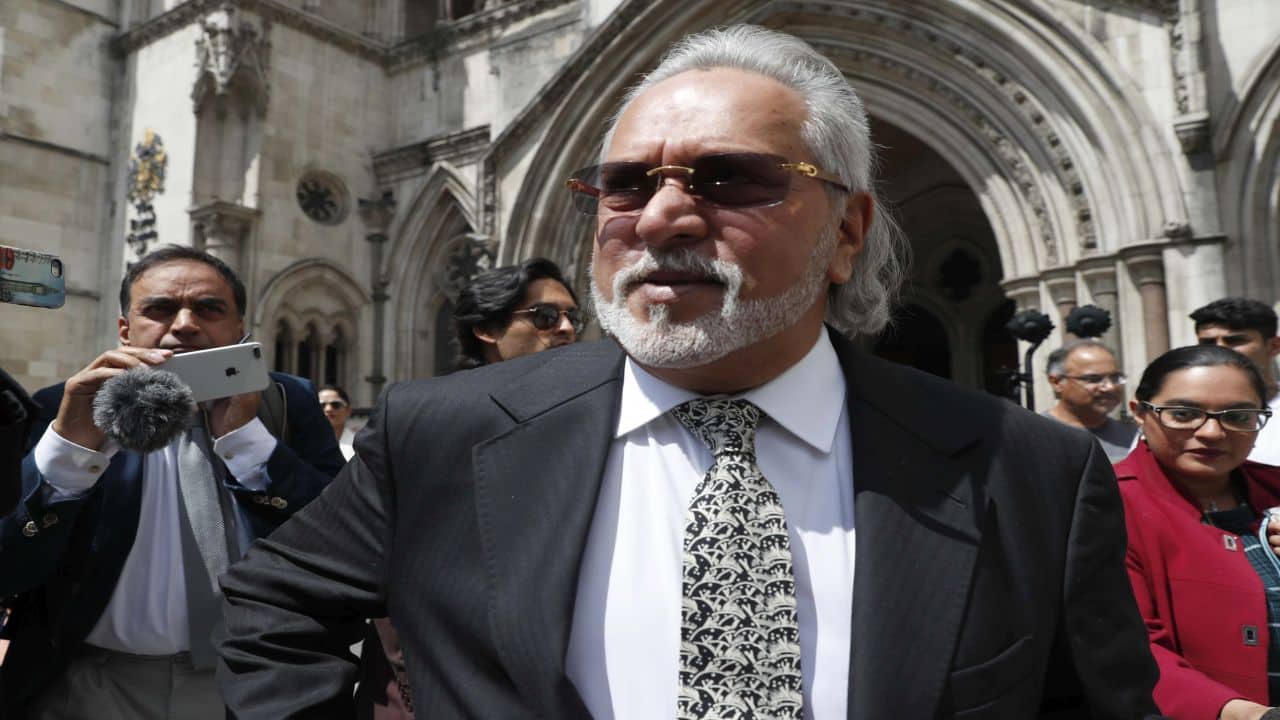

Creditor is proxy for Vijay Mallya, allege minority shareholders in duel for McDowell Holdings

The stage is set for an unusual and bitter legal battle for ownership of McDowell Holdings as minority shareholders challenge NCLT’s decision to award the debt resolution plan in the Supreme Court

BUSINESS

Banking Central | Who will control erring loan recovery agents?

The Hazaribag incident highlights the dark world of recovery agents. Unfair loan recovery practices must stop

BUSINESS

MC Explains | August CPI at 7%; how high inflation impacts common man?

The reversal in August retail inflation number after the easing seen in July reaffirms another rate hike in September

BUSINESS

Banking Central | Sebi penalty on Rana Kapoor strengthens Yes Bank’s AT1 bondholders' case

The AT1 bond case has been going on since the bank announced writedown of these bonds, triggering a major debate in the industry. With the market regulator finding former CEO guilty in the case as well, Yes Bank’s retail investors have an additional reason to cite before the Bombay HC to seek compensation.

BUSINESS

Banking Central | Government must not arm twist PSBs on education loans

Leave it to the judgment of banks; it is equally important to get the money back just as giving it

BUSINESS

Banking Central | New overseas investment rules a winner for banks, jolt to wilful defaulters

The new rule addresses a long standing problem of fund diversion by loan defaulters across the boarder

BUSINESS

Banking Central | What MPC’s inflation failure means to common man

The rate setting panel is set to explain its failure in meeting the inflation target in a written statement to the government

BUSINESS

MPC resolution to remain focused on withdrawal of accommodation confusing: Jayanth Varma

The MPC hiked the repo rate, or key lending rate, by 50 basis points to 5.4 percent thereby effecting a total of 140 bps hike in a span of five months citing high inflation.

BUSINESS

Banking Central | Borrowers deserve freedom from harassment

The latest RBI directions are a step in the right direction but the problem lies with its implementation on the ground