BUSINESS

Lack of revenue model on UPI might push more fintechs towards Rupay credit card

Rupay credit cards can be linked with a UPI account and attract MDR, which generates revenue for ecosystem partners

BUSINESS

Groww reports a 3x growth in profits at Rs 1,819 crore, revenue grows 31% to Rs 4056 crore

The relatively high growth and profitability come as a shot in the arm for the Bengaluru wealthtech platform ahead of its IPO plans

BUSINESS

Travel fintech Scapia launches Rupay credit card to target UPI payments, merges credit line and statement with Visa card

Customers are frustrated with the long bank statements because of the UPI payments, and the company’s dual cards with a single statement offer them a unique solution to merge all their payments into one app

BUSINESS

Fintech Slice set to launch Rupay credit card months after merger with NESFB

At its peak, Slice had more than 2 million pre-paid cards in circulation, challenging several mid-tier private sector banks' credit-card business

BUSINESS

Fintechs hopeful of revival in credit growth after RBI's big rate cut

There are some concerns about the speed of transmission of lower rates to NBFCs and fintechs, with some expecting this to take a quarter but there are others who expect at least six months

BUSINESS

Groww convenes EGM for shareholder approval of GIC, Iconiq investment

Both companies are getting 1.4 percent stake for Rs 867 crore each, in a cumulative fund raise of Rs 1,735 crore (around $200 million).

TECHNOLOGY

PhonePe appoints former Standard Chartered CEO Zarin Daruwala to the board ahead of IPO

Daruwala, a veteran with over three decades of banking experience, retired from Standard Chartered in April after serving as the CEO for nine years. Before that, she was with ICICI Bank for 26 years.

TECHNOLOGY

World-beater in the making: UPI on the cusp of surpassing Visa’s daily transaction volume

The feat is even more remarkable because card networks such as Visa and Mastercard follow a deferred settlement model compared to UPI’s real-time payment settlement model

TECHNOLOGY

NPCI's BHIM doubles transaction volume less than a year after being spun off as separate firm

NPCI spun off BHIM as a separate arm in August 2024 to meet the growing demand for digital transactions and also to end PhonePe and Google Pay's dominance of UPI

TECHNOLOGY

New payment regulatory board is MPC-like independent body and will spur innovation, say fintech executives

There is a growing recognition within the political sphere that payments have, in effect, outpaced traditional banking in both scale and public impact.

BUSINESS

Is Groww worth $7-8 billion? Sebi F&O rules key to determining IPO fate

Broking firms are bracing for higher taxes on trading during the current fiscal, have been earning lower exchange rebates since the middle of the last fiscal, and are facing stricter restrictions on retail F&O trading since late last year

BUSINESS

Iconiq to pump in $150 million in Groww in pre IPO round at $7 billion valuation

The current funding is part of the $300million Series F round where GIC has also put in $150 million

BUSINESS

Zerodha’s AI foray wins early fans, but raises questions over assisted investing

Screenshots shared by users demonstrated how easily complex portfolio insights were generated in conversation-like exchanges with the AI.

BUSINESS

PhonePe designates top officials as key management personnel after turning into public company

The Walmart-owned PhonePe is the country’s largest mobile payment company with close to 50 percent market share

TECHNOLOGY

VCs hail RBI’s proposal to allow banks and NBFCs to invest up to 15% in AIFs

Among the key asks of AIFs has been that banks and NBFCs should not be asked to provision for AIF investments in equity-linked instruments

BUSINESS

IPO-bound Groww to acquire wealth management startup Fisdom for $150 million

The acquisition comes a fortnight before Groww is expected to file for IPO through the confidential route with the markets regulator Sebi

BUSINESS

Groww to file for confidential IPO in two weeks, raises $150 million from GIC

The country's largest stock broking firm by active investor base, has more than doubled its FY24 revenue to Rs 3,145 crore at a consolidated level

TECHNOLOGY

How AI helped Razorpay build conversational payment solutions in 72 hours

An AI agent can integrate multiple APIs without human intervention and a Razorpay customer does not need the engineering expertise to do this

TECHNOLOGY

Top four brokers see third straight month of decline in active investor base

Broking firms are bracing for higher taxes on trading, lower exchange rebates, and stricter restrictions on retail futures and options trading since late last year

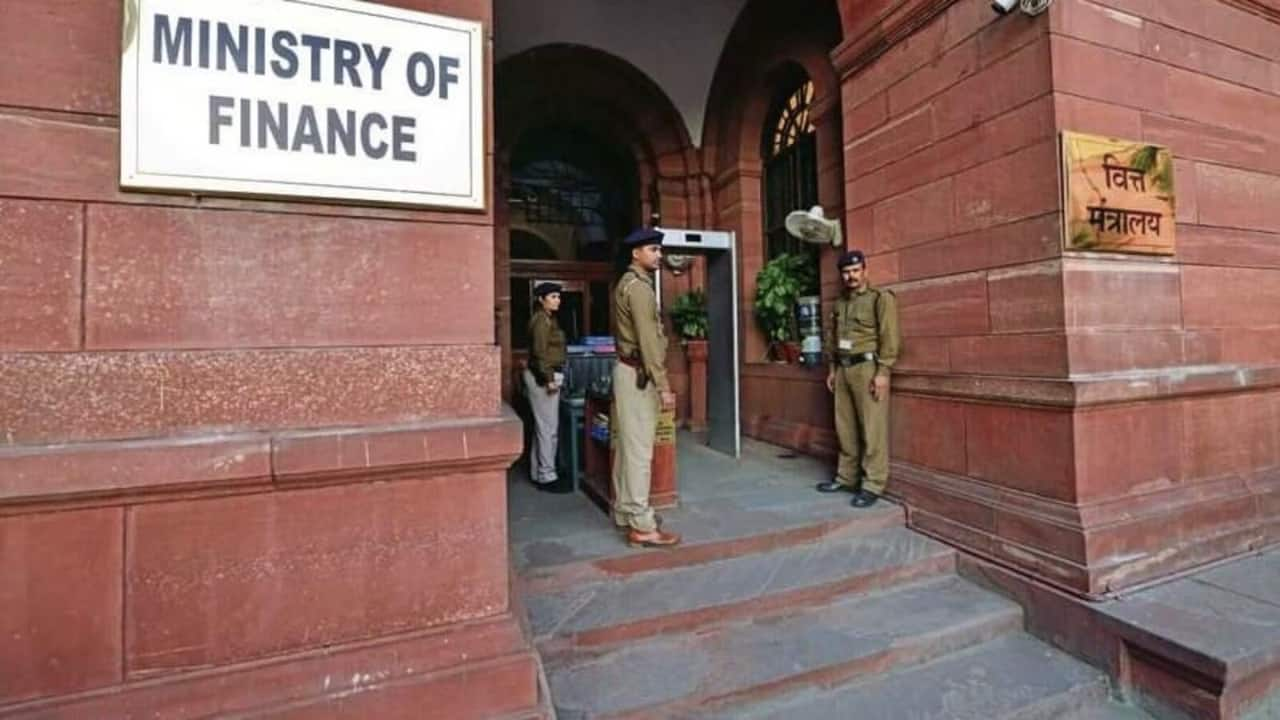

BUSINESS

Govt asks RBI, NPCI, others to amp up cyber security amid widening conflict with Pakistan

The finance ministry's advisory follows similar alerts by CERT-In and RBI to step up security against possible cyberattacks

BUSINESS

UPI merchant transaction growth slows, marginal market share gain in the last year

Merchant payments constituted around 63.4 percent of the overall UPI payments in April 2025. In April 2024, it had reached 62.3 percent, representing a gain of only one percent

BUSINESS

Bengaluru Airport back in the black with net profit of Rs 510 crore

In FY25, revenue of the South India's busiest airport, backed by Canadian billionaire Prem Watsa, grew 43 percent to Rs 3,732 crore

BUSINESS

NPCI seeks third-party audit to limit UPI transaction status checks by banks

NPCI has also mandated that banks can initiate a maximum of three check transaction status APIs, preferably within two hours from the initiation/authentication of the original transaction.

BUSINESS

Account Aggregator ecosystem complex, needs time to mature, Sahamati’s BG Mahesh

It is picking up, as more than 3.5 lakh consents are approved daily. The value of loans disbursed through the ecosystem is more than Rs 10,000 crore a month, says the CEO