BUSINESS

Yes Bank, Axis Bank go live on Paytm's UPI platform

The RBI's deadline for Paytm Payments Bank Limited to stop all banking operations runs out today. PPBL was acting as the backend bank powering Paytm's UPI payments until now

BUSINESS

OneCard's access to customer data likely forced some banks to stop issuing co-branded credit cards

The pause is most likely temporary and once OneCard starts accessing customer data in encrypted form, the banks will start issuing the cards again

BUSINESS

SBI partners with Paytm as the fourth bank for its UPI business

Moneycontrol reported that Paytm had partnered with Axis Bank, Yes Bank and HDFC Bank for TPAP partnerships earlier.

BUSINESS

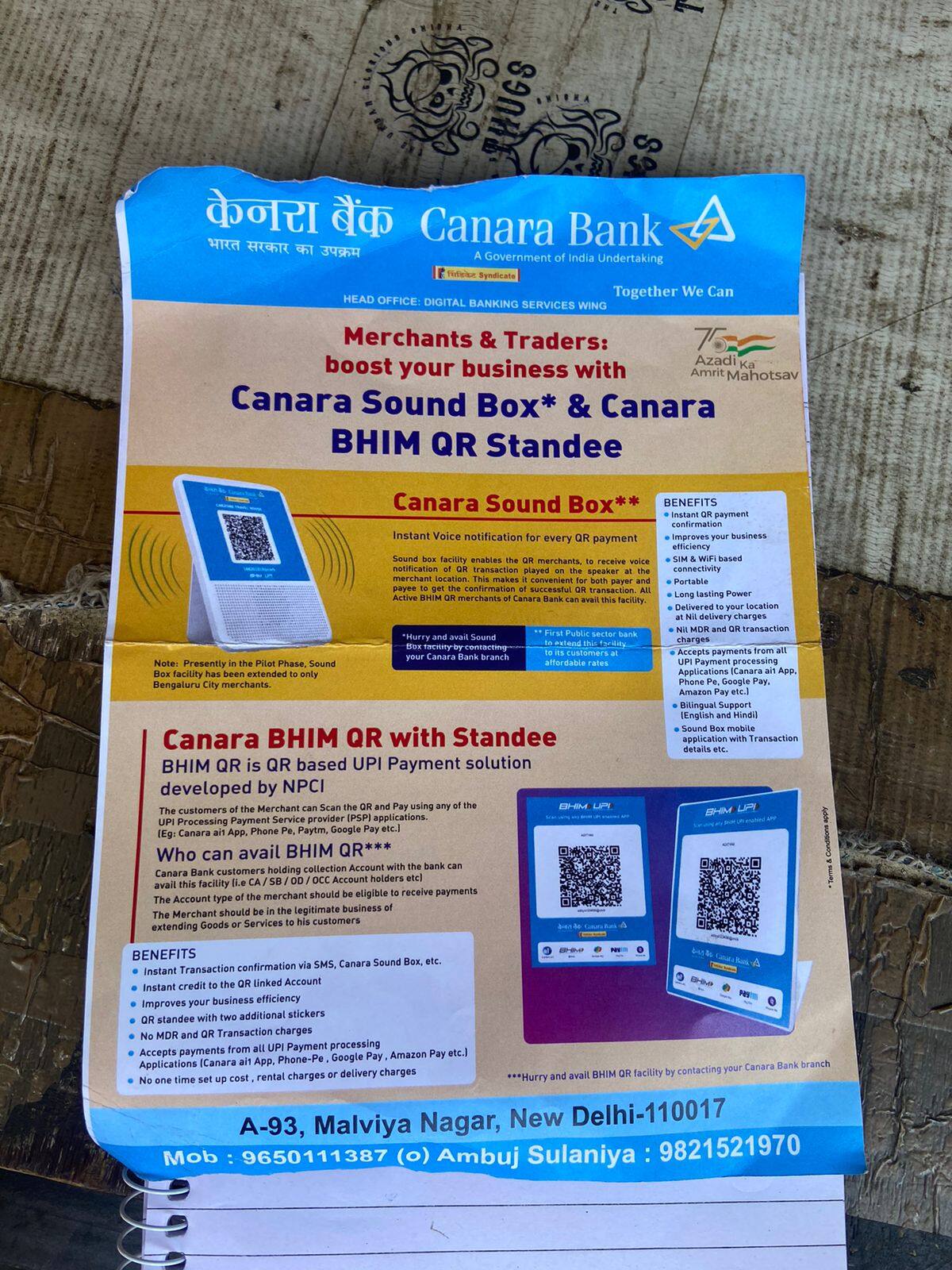

Paytm in talks with Axis, Canara, Yes and Kotak to migrate merchant accounts from payments bank

The discussions have not concluded yet. More than one bank will likely migrate the merchant accounts as the policymakers wish to avoid any concentration risk though commercials will take precedence over everything

BUSINESS

RBI's card network portability circular is open to different interpretations, may require more clarification

The interpretation in itself would make a world of difference in terms of cost, obligations and even customer convenience and continuity. However, this could also mean that the guidelines are not followed in letter and spirit

BUSINESS

Smaller UPI apps seek NPCI support to challenge dominance of PhonePe, Google Pay

NPCI is planning to hold monthly meetings till December and possibly beyond that to address the lopsided UPI market share, where the top three players control around 95 percent of the total transaction volume and value

BUSINESS

Payments bank controversy hits Paytm’s UPI market share, drops to 11% in February

From March 15, Paytm will have to function as a third-party application provider just like rivals PhonePe and Google Pay and not as a payments bank app. The transition will likely see a further drop in market share

BUSINESS

Why Paytm is likely to require Paytm Payments Bank's services even after March 15

Despite the announcement from Paytm on cutting all ties with its associate company PPBL, the fintech firm is still dependent on the payments bank in multiple ways

BUSINESS

Paytm Payments Bank board rejig unlikely to sway RBI, say bankers

Paytm’s efforts to mollify the regulator is being seen as an attempt to buy time beyond the March 15 deadline. Migration of merchants is taking more time than expected, with several banks worried about redoing KYC of crores of subscribers

BUSINESS

Merchant loyalty to Paytm intact despite the payments bank setback, says Datum survey

According to a large survey of 2,000 people done by Datum Intelligence, 80 percent of the merchants said that they are either staying or waiting for more information before shifting. Only 13 percent planned to shift to competitors

BUSINESS

After Axis Bank, HDFC and Yes Bank submit TPAP application for Paytm UPI business

On February 23, RBI said that customers and merchants having ‘@paytm’ handles are to be migrated seamlessly from PPBL to a set of newly identified banks to avoid any disruption

BUSINESS

Despite RBI’s tightening of unsecured loan norms, Navi scaling up well, says Sachin Bansal

Navi Finserv’s third non-convertible debentures opens on February 26 with an issue size of Rs 600 crore. The fintech’s two previous NCDs had raised close to around Rs 1,000 crore

TECHNOLOGY

Paytm, Axis Bank to submit TPAP application for UPI business with NPCI this week

Paytm is also in discussions with several other banks, including Yes Bank, HDFC Bank, ICICI Bank, and Canara Bank; however, none of the discussions have concluded yet.

BUSINESS

What the RBI FAQs mean for Paytm and its users: Said and Unsaid

It is effectively curtains for Paytm Payments Bank per the RBI FAQs but there is some good news for One97 Communications. Read on

BUSINESS

RBI consults NPCI, NETC, BBPS ahead of FAQs on Paytm to minimise consumer disruption

The FAQs on Paytm is not likely to offer any indemnity for banks taking up the PPBL accounts. RBI is also not expected to specify its approval or disapproval of banks making any business decisions to work with PPBL

BUSINESS

Hurts when people don’t understand we turned profitable without cutting expenses: PB Fintech’s Yashish Dahiya

In conversation with moneycontrol, the founder says that only a few investors could see the real strength of the company, which includes his early investors like Info Edge.

BUSINESS

Without RBI migration approval, Paytm's UPI business faces an existential crisis

Paytm has a 13 percent market share in UPI debit transactions and around 20 percent market share in credit transactions

TECHNOLOGY

Tough times ahead for Paytm Payments Bank as RBI refuses to offer any concessions

Paytm’s plan for migrating accounts to other banks may not happen anytime soon with the RBI refusing to intervene in the payment company's business discussions with banks

BUSINESS

VSS, senior Paytm officials meet RBI, regulators not keen on saving wallets business

The RBI is not keen on salvaging the company's wallet business through migration or transfer of assets. The discussions mostly centred on stabilising and transitioning the UPI accounts and handles managed by PPBL

BUSINESS

Banks await RBI green light before partnering with Paytm to take over merchant accounts

Banks are worried about the scale of KYC migration. They will have to do the millions of KYC all over again and the risk-reward ratio does not seem appealing

BUSINESS

Moving Paytm Payments Bank accounts to other banks likely to be a difficult task

Paytm Payments Bank is the largest beneficiary bank in UPI ecosystem. This move will relegate Paytm like any other UPI app without a USP, which helped the company win merchants in the first place, giving PhonePe and Google Pay to increase market share

BUSINESS

RBI deals body blow to Paytm with crippling restrictions on its payments bank

Paytm Payments Bank is one of the key partners that houses many of the key products offered by Paytm including wallets, FASTags, UPI and deposit accounts of millions of merchants.

BUSINESS

Increasing customer frequency to Flipkart app is key, says CEO Kalyan Krishnamurthy

Flipkart has around 500 million users on its platform, while expansion is key the firm has turned its main focus towards increasing the user frequency to the app.

BUSINESS

Flipkart will go slow on hiring, says CEO Kalyan Krishnamurthy

The Walmart-owned e-commerce giant recently let go of 1,000 employees, as part of its annual performance review exercise. The prolonged funding winter saw major Indian startups handing out pink slips to their employees in 2023, as companies attempt to realign cost structures.