Nitin Agrawal

Moneycontrol Research

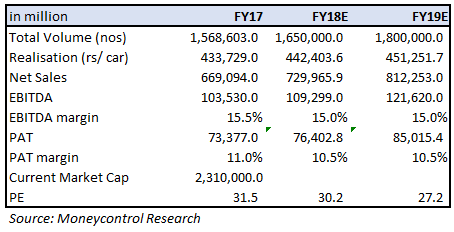

Maruti Suzuki India Limited (MSIL), the country’s top car maker with a market share of close to 51 percent, continues to ride smoothly unfazed by structural changes in the industry. While the topline performance was healthy during the quarter, margin performance was rather muted. We continue to like the unique moats of Maruti although valuation leaves little room for an upside.

Quarter in a nutshell

Strong volume and selling price growth

MSIL posted a strong volume growth of 13.2 percent (YoY) despite the industry headwinds that it faced, starting from demonetization last year to GST in the current quarter. The growth in volumes was led by Brezza, a compact SUV and Baleno, a premium hatchback.

Utility vehicles (UV) witnessed a significant 45 percent growth (YoY), followed by compact's 17.5 percent growth (YoY). UVs now contribute close to 15.5 percent of total domestic sales.

Net sales registered a growth of 16.9 percent on the back of growth in volume and average realization (3.2 percent YoY). The increase in net realisation was attributed to the expanding premium products in the portfolio.

Raw material price dented operating performance

MSIL posted 151 bps (YoY) contraction in EBITDA margin. The contraction is attributed to an increase in the raw material price of close to 270 bps (YoY) and higher marketing expenses. This was partially offset by cost reduction measures taken by the company. Additionally, one-time compensation to dealers towards GST loss led to 50 bps impact on the margins.

Moot question here is whether the company is for the long-haul?

Today, MSIL has a virtual monopoly in passenger vehicle market in India led by strong dealership network and brand loyalty on the back of competitively priced products and resale value.

Adept at recognizing the changing preference

MSIL has been able to identify customer preference patterns and has worked accordingly. This is evident from the fact that MSIL’s domestic volume grew by 8.6 percent compounded over FY07-17 and the revenue registered 14.6 percent growth over the same period, indicating the customers’ readiness to pay for premium products. The company was able to move up the curve at the right time.

MSIL has moved its product portfolio dominated by small cars to a broader base, which caters to almost all segments of the passenger vehicle market. This is evident from the share of small cars in its portfolio that has fallen from 75 percent in FY12 to close to close to 58 percent in FY17. This is expected to fall further on the back of new launches.

Strong Distribution Network

MSIL’s leadership is indicated by its strong distribution network. This distribution network is its unique competitive advantage in an otherwise highly competitive industry. MSIL had close to 2,300 dealers at the end of FY17 and the number of dealerships grew 2.9 times over FY10. No one else in the industry even comes close to this (Hyundai – 470, Honda – 335, Toyota – 213).

In an endeavor to cater to the premium segment, the company is expanding its Nexa network. It currently has around 250 Nexa outlets and plans to expand to 400 by 2020. Recently, it has launched Nexa service, especially designed workshop to serve premium customers. It plans to expand Nexa service centers to 60-70 by the end of this fiscal year and 300 workshops by 2020.

On the back of the right product portfolio and strong distribution network, MSIL has been able to grow its market share despite the entry of multiple global players.

Strong Product Pipeline

MSIL has a slew of launches lined up for the next three years. The company has a track record of more success than failures over last three years. Except for S-Cross, all other launches from FY12 till FY17 witnessed strong customer demand. This gives us the requisite confidence about the new product pipeline of the Company.

Capacity Expansion

MSIL has an order backlog of 130,000 units indicating strong demand from customers and need for capacity expansion. The company has clearly chalked out a capacity expansion plan. Gujarat plant has already started production and is expected to produce 150,000 units in FY18 and the management expects to expand the capacity of this plant to 1.5 million.

However, while MSIL has all the right ingredients of success, capacity constraint might put a ceiling on earnings. MSIL currently trades at 31.1 times trailing earnings and 30.2 times FY18 and 27.2 times FY19 projected earnings. Despite our high comfort in the business, the valuation leaves little room for comfort unless there is greater visibility on capacity. We would, therefore, advise investors capitalise on dips to build position in the stock. With a slew of new launches including refreshers, strong order pipeline, product rejig toward premium products, and leadership position in Indian market make this company worthy of investors’ attention.

With a slew of new launches including refreshers, strong order pipeline, product rejig toward premium products, and leadership position in Indian market make this company worthy of investors’ attention.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!