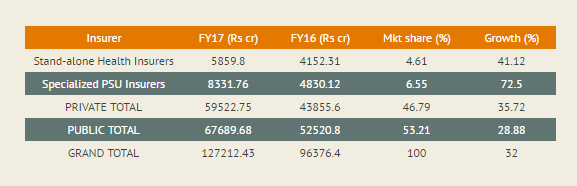

General insurance companies have collected Rs 1.27 lakh crore premium in FY17, showing a growth of 32 percent over the previous financial year. Crop insurance contributed the largest to the growth with Agriculture Insurance Company of India showing a 101.3 percent growth.

Among the insurers, private sector insurers beat public sector insurers in premium collection. Public general insurers collected Rs 67,689.68 crore in FY17, showing a 29 percent growth. Private non-life insurers, on the other hand, collected Rs 59522.75 crore of premium showing a 36 percent growth over last fiscal.

Standalone private health insurers collected Rs 5859.80 crore, showing a 41 percent growth over previous fiscal. All the insurers in this space posted double-digit growth compared to the previous year. In FY17, this segment got the sixth insurer: Aditya Birla Health Insurance.

Among the public sector insurers, Oriental Insurance posted the highest growth of 30 percent in FY17, on a year-on-year basis. United India posted 26.5 percent growth in premiums while New India posted 26 percent growth. However, in terms of the premium collected, New India came on top of the public sector insurers.

Gross Premium Collection by Non-life insurers

Source: IRDAI

Data infographics by Ritesh Presswala

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.