Flipkart has offered a term sheet to Snapdeal for an all stock acquisition for a valuation of USD 550 million almost half of the much talked about valuation of USD 1 billion after multiple weeks of due diligence, according to people privy to the development.

The term sheet has been received in the last 3-4 days.

While Snapdeal is not keen to go ahead with the deal and is mulling a Plan B, the decision will be taken by lead investor Japan-based SoftBank.

"Besides a low valuation, the term sheet has a lot of hold backs and conditions. It is a very complicated term sheet," said one of the person quoted above. "SoftBank will be negotiating the valuation further," he added.

If the sale doesn't go through, Snapdeal may witness another round of layoffs which may impact 600 to 1,000 odd employees as part of the Plan B.

Moneycontrol had reported in May that the Snapdeal had signed a non-binding letter of intent with Flipkart.

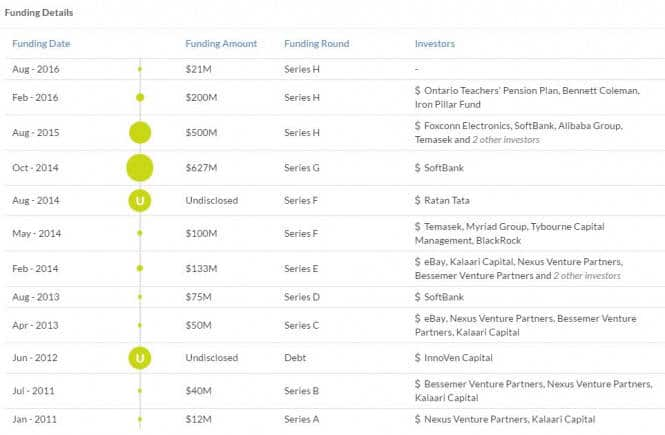

Here's a look at Snapdeal's funding over the past few years.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!