The Reserve Bank of India’s decision to cut its policy repo rate by 25 basis points to 6 per cent is likely to lead to a further cut in the lending rates, especially home and car loans by banks.

Financial sector experts believe that consumers are in for a good time with EMIs likely to come down and lenders likely to come up with festive season offers on loan rates in the ensuing months.

“Home loan rates could come down to around 8.2% per annum on an average. So, the new borrowers can expect EMIs to come down and which would also cut down the interest outgo over the loan tenure. Banks may come also up with promotional offers till festival season to attract more customers,” Rishi Mehra, CEO of Wishfin.com said.

RBI Credit Policy: How Interest Rates WorkMehra said old borrowers under the MCLR regime would have to wait until the next reset period to get the rate reset. “Normally MCLR-based home loans are reset once a year. However, if the loan rate charged to them is higher at the existing lender, they can think of switching the loan portfolio to another lender that would take over the outstanding balance at a lower rate of interest. If the gap of interest rates between the existing and new lender remains more than 1% or so, it would make sense to switch the loan,” he said.

On the other hand, base rate customers can switch to the MCLR regime to take advantage of the lower rates. “It may incur a switchover fee of around Rs 5,000-20,000. But the overall interest would reduce substantially with the said option,” Mehra said.

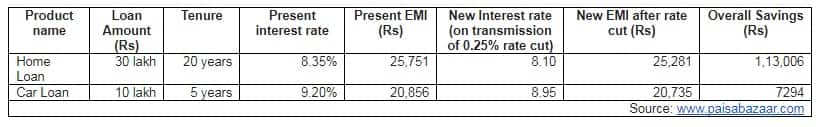

According to Paisabazaar.com, this is how the EMI's are likely to come down on home loan and Auto loan:

“With the rate cut, the ball now lies in the banks’ court, to transmit the reduced rate to consumers in the form of cheaper loans. I expect the banks to pass on the rate cut to borrowers, but over a period of time," Naveen Kukreja, CEO & co-founder, Paisabazaar.com said.

Adhil Shetty, CEO & Co-founder BankBazaar.com also said home and car loan rates would come down. “The rate cuts at this time mean that the cost of credit required to make big-ticket purchases such as a home or a vehicle comes down even further. This is a very good signal to the market and has the potential to push growth in several sectors.” Shetty said.

He said that the forthcoming festive season will spur credit offtake. “This is the beginning of the festival season across the country with Eid, Ganesh Chaturthi, and Dussera lined up over the next two months. Sectors such as realty, automobile, and consumer durables are expected to see much traction in the next couple of months,” Shetty said.

In his post-monetary policy, press conference, RBI Governor, Urjit Patel said that the transmission of previous rate cuts has been strong in the home loan and personal loans segment. Patel said that this was because these lending areas saw much larger competition among lenders, with NBFCs too in the fray.

The RBI governor hoped that similar transmission of lending rate cuts are made effective in other loans too, especially in view of the easing liquidity situation.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.