Highlights: - Direct income incentives – Marginal boost @Rs 6,000/- - Fisheries and husbandry – Not enough this time after a strong jump last year - A steady focus on food processing industries - HUL, Dabur, ITC among companies to benefit from an incremental fix for rural

Finance Minister Piyush Goyal provided a combo of direct income support and allocation across agri and allied industries in Budget 2019. While direct income benefits are supportive for margin of staple consumption, steady push for the food processing industries is positive.

Direct income incentives – marginal uptick but across the regionA set of policy initiatives was targeted toward lower to the middle-income class population.

The urban lower middle class got a complete tax rebate for taxable income up to Rs 5 lakh which leads to Rs 18,500 crore stimulus for three crore middle-class taxpayers.

Measures were focused to target alleviation of rural distress. Assured income support for marginal farmers (Pradhan Mantri Kisan Samman Nidhi (PM-KISAN) amounting to direct income support of Rs 6,000 per year (Rs 75,000 crore scheme) is one such step. This targets 12 crore small and marginal farmer families with land under two hectares.

While the math seems simple with Rs 6,000/- per head annual transfer, it is supportive for staple consumption but doesn’t amount to a quantum leap.

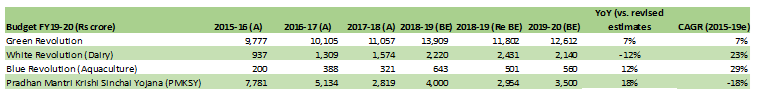

Non-farm productivity – not much to move the needleThere have been a few allocation changes for the agriculture allied sector. Budget allocation for aquaculture is higher than revised budget estimates of FY18 but lower than the FY18 budget proposal. Not surprisingly, fisheries stocks (Avanti feeds, Waterbase, Apex frozen foods) after having a positive move during budget speech slumped thereafter.

Dairy companies such as Parag Milk Foods, Prabhat Dairy, Hatsun Agro had a mixed reaction. Though five-year CAGR growth in allocation suggests continuing emphasis, the current allocation which is marginally lower than FY18 estimates is disappointing. There is special support of Rs 100 crore for state cooperative dairy federations but a closer look indicates this is diverted from the National Daily Plan subhead.

One-time separate enhancement of Rs 750 crore (from Rs 301 crore) allocation for Rashtriya Gokul Mission in the current year itself intended to upscale sustainable genetic up-gradation of cow resources. This could be positive towards for dairy companies focusing on owning dairy farms and focus on premium milk.

In the last Budget, the government announced the facility of extension of the Kisan Credit Card scheme (KCC) to Animal Husbandry and Fisheries farmers. This facility has been extended to fisheries and animal husbandry farmers in terms of Interest rate subvention of up to 5 percent. This seems to be a relief for the farmers involved in such activities, who were discouraged from these activities due to the debt burden.

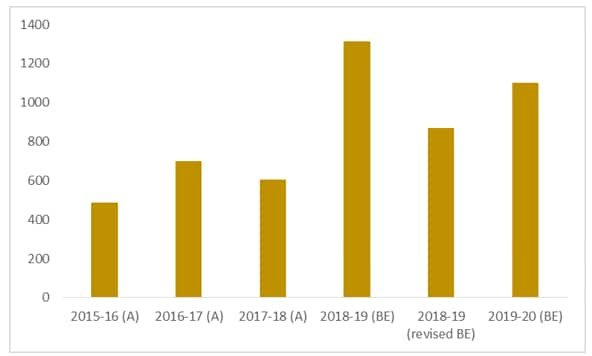

Last year, budget allocation for the food and distribution department had a 75 percent increase in compared to FY18 actuals. Revised estimates are in fact higher than that of budget estimates which means intended expenditure has been on track. This year, this is a step higher by 7 percent YoY to Rs 190,821 crore with a focus to set up cold storage chains. Further, budget allocation for food processing has been increased by 26 percent from the revised estimates.

Companies gaining attention in this space are HUL, ITC, Prataap Snacks, Venkys ltd, Jain Irrigation etc. One of the key FMCG company to look at in this space is ITC, which is among the better-positioned company in the food processing value chain.

Chart: Budget allocation for food processing schemes (Rs. Crore)

Another additional focus which will boost the prospects for rural infrastructure is the focus on digital villages. Government targets 100,000 digital villages that would be connected through Wi-Fi. It will assist residents in entrepreneurship opportunities such as setting up cottage industries.

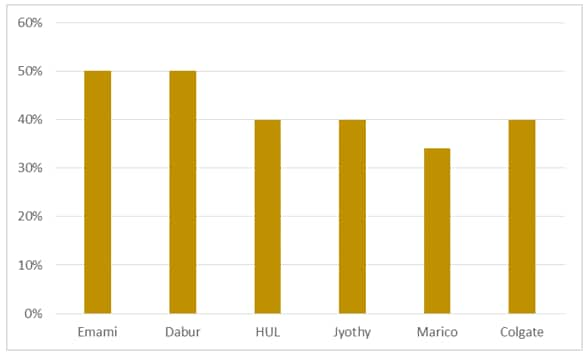

Companies like Dabur, Emami, HUL, Jyothy labs have 40-50 percent sales from the rural economy and so can benefit from the rural infrastructure focus and improvement in disposable income. Among this, we remain constructive on Dabur and HUL. Across the board, there has been a positive commentary from the FMCG companies in the current quarterly result implying steady staple demand from the rural sector in spite of otherwise rural distress. In the case of HUL, for instance, growth continues to be led by demand in rural areas which is 1.3 times of urban.

Chart: Share of FMCG sector sales from rural areas

Source: Company, Moneycontrol research

Follow @anubhavsays(Moneycontrol Research analysts do not hold positions in the companies discussed here.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.