The market is quick in spotting hidden gems and according to analysts, this gets reflected in stocks which are trading significantly above their book value.

Book value is an accounting measure which is calculated as total assets minus intangible assets such as patents, goodwill and liabilities.

If any stock is trading above its respective book value could be considered risk, but analysts say that market is attributing higher valuation to the future growth rate of the company.

“When stocks are trading premium to their book value means that market is ascribing significant value to its future growth. When market ascribes a higher value to future growth it encapsulates higher risks as this growth can potentially not get delivered due to a plethora of reasons,” Saravana Kumar, CIO, LIC MF told moneycontrol.

“Though high price to book theoretically indicates higher risks, but in reality, with a cyclical upturn in macroeconomics, these companies may deliver on the growth expectations and such higher multiples may be justified in the longer term,” he said.

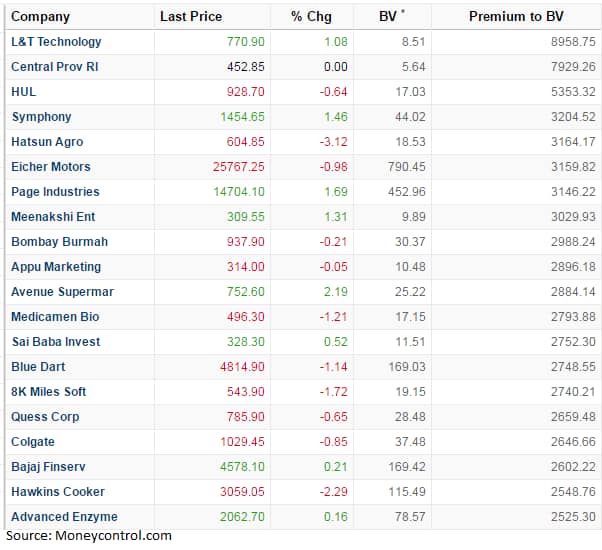

Top 30 stocks which continue to trade with massive premium to its book value include names like L&T Technology, HUL, Symphony, Hatsun Agro, Eicher Motors, Bombay Burmah, Blue Dart, Quess Corp, Avenue Supermart, 8K Miles, Colgate etc. among others.

Even if we look back at the performance of most of the companies falling in the list of top companies compiled by moneycontrol shows massive outperformance with respect to benchmark indices.

Bombay Burmah has more than doubled investors’ wealth in the last one year, while Symphony rose over 20 percent in the same period, and Hatsun Agro rallied nearly 90 percent.

However, specific investment call on buying more/holding/booking profit needs to be taken in the context of overall SWOT analysis and competitive advantages of any company in question, suggest experts. Investors should, however, be aware of changes in the risk profile of their investments all the time.

In which case book value should be ignored?Book value may not be ignored in general, but certain sectors differ in the capital requirements such as banking which are more linked to book value for its future prospects, while FMCG has lower connect with book value due to its capital-light approach, say experts.

“In the case of a company with leveraged balance sheet, typically the price/book would appear to be inordinately high, in spite of which depending on the attractiveness of the other valuation parameters it can still be a good buy,” Alok Ranjan, Head of Research, Way2Wealth Brokers Pvt told moneycontrol.

“In the case of real estate companies also assessment on book value basis could be misleading as most of the assets would be reflecting acquisition price of those assets and may not reflect the current market value of the assets,” he said.

Other parameters to considerInvestors should not take a buy or a sell decision based on premium or discount to book value. It is a handy tool but should be considered along with other valuation parameters such as P/E, EV/EBITDA, Market cap/Sales etc. among others.

As higher price to book indicates higher reliance on future growth, investors need to work on their assumptions of future growth. “Future growth is mainly a function of growth of the industry, shift in market share dynamics in the sector given competitive intensity and adjacent opportunities which can be captured by a specific company,” said Kumar of L&T MF.

“Investors be warned – this high price to book value stocks usually also tend to test softer issues of investors like patience, confidence and holding power. These softer issues though may not be reflected easily in numbers, go a long way to achieving real returns,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!