The government on Friday announced a new exchange-traded fund (ETF), Bharat-22, which consist of 22 bluechip stocks spread across 6 sectors.

The analyst community has already given a thumbs up to the Bharat-22 exchange traded fund (ETF) as it reflects the confidence of the government in its state-run public sector companies which offers value for money to investors.

The move will help the government to sell its equity stakes in state run firms and also achieve its objective to raise Rs 72,500 crore through disinvestment in FY18.

The pro-growth polices initiated by the Modi-led government changed the inherent profile of PSUs which are now on track to get re-rated. The product is good for investors who have a long term horizon while investing.

“For us, the most important factor was the governments’ confidence and challenge to outlay the performance of Governments policies & reforms led by listed government entities,” Vinod Nair, Head of Research Geojit Financial Services told Moneycontrol.

“The current Government is more focused on appraisal targets like reforms, governance, and divestment. As a result, we are seeing re-rating in PSU's which will make government more achievable to the goals like privatisation & divestment,” he said.

The government did not formally announce the date of the launch of ETF. ICICI Prudential AMC will be the ETF Manager and Asia Index Private Ltd (JV BSE and S& P Global) will be the Index Provider.

Bharat22 is fairly diversified products which will represent the performance of India & Government's agenda over the long-term. “We feel the performance and attractiveness of Bharat-22 is better than other ETFs which are linked to index, sector or less diversified. Given better diversity, reform and improved government governance,” said Nair of Geojit Financial Services.

Let’s first understand what is an ETF? ETFs or exchange traded funds are similar to mutual funds wherein investors can purchase units, the value of which will depend on the rise and fall in line with the performance of 22 stocks.

In the Exchange Traded Fund (ETF), 22 companies will have a diversified portfolio consisting of Central Public Sector Enterprise (CPSE), Public Sector Banks (PSBs) and will also have some strategic holding in the Specified Undertaking of the Unit Trust of India (SUUTI), Finance Minister Arun Jaitley said told reporters here.

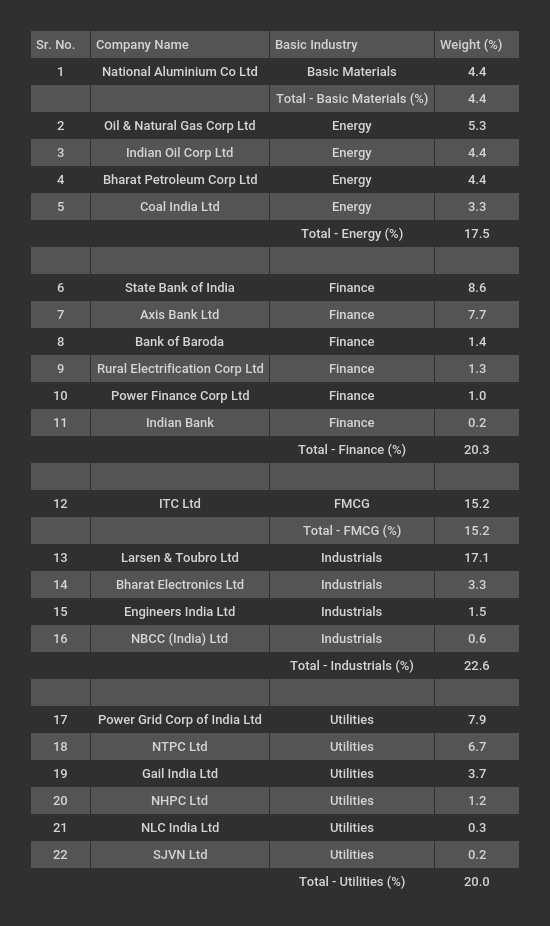

The ETF will be a portfolio of six sectors--basic materials, energy, finance, FMCG, as well as industrial and utilities, Jaitley said. There will be a sectoral capping of 20 percent and a single company stock cap of 15 percent.

“Bharat 22 has been formed keeping in mind the divestment strategy of the Government of India. It is a canny way of disinvestment by offering a basket of shares instead of individual shares,” Jimeet Modi, CEO, SAMCO Securities told Moneycontrol.

“It is more of a defensive play. This ETF is well suited for long term risk averse investors and will not be suitable for aggressive investors seeking higher returns,” he said.

Top PSUs stocks which are part of the Bharat 22 index include names like National Aluminium Company, ONGC, IOC, BPCL, Coal India, SBI, Axis Bank, Bank of Baroda, REC, Power Finance Corp., Indian Bank, ITC, L&T, Bharat Electricals, EIL, NBCC, Power Grid, NTPC, Gail India, NHPC, NLC India, and SJVN.

“The companies which have been taken in the index are fundamentally sound and may perform well with the improvement in the economy,” Sanjeev Jain, AVP - Equity Research at Ashika Stock Broking Ltd told Moneycontrol.

If investors remember the first government ETF (CPSE ETF) was launched in March 2014. The fund has outperformed the index by a wide margin. It is up over 22 percent in the past one year, more than the near-18 percent rise in the Nifty50 index, and 17% which is the average of top 3 ETF linked to the index.

“Bharat-22 is adverse to political risk, changes in government policy and governance of PSU which was less active historically. Whereas the main reason for the attractiveness of PSU in the recent years are change in Governments working & policies towards the fiscal & monetary performance of the country,” said Nair.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!