The S&P BSE Sensex rallied over 13 percent so far in 2017 while there are close to 400 stocks across categories which have given negative returns in the same period.

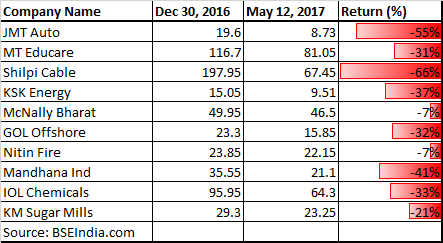

For simplification, we have collated a list of top ten stocks which include names like JMT Auto, MT Educare, Shilpi Cable, McNally Bharat, Nitin Fire, GOL Offshore, Mandhana Industries, KMSugar Mills, KSK Energy, and IOL Chemicals.

Indian markets experience huge liquidity gush which has taken many stocks higher despite muted fundamentals but these stocks have a different story to tell.

The Nifty, which rallied nearly 15 percent so far in 2017 hit a fresh record high of 9,450.65 this week. At a time when there is bullish sentiment, underperformance by stocks could be taken as a sign of caution.

“Most of the stocks which have underperformed so far in the year 2017 are sketchy in terms of volumes and in many cases the average daily turnover is below Rs 1 crore, giving rise to negligible transactions,” Pushkaraj Sham Kanitkar, AVP - Technical Research at GEPL Capital told Moneycontrol. Secondly, the prices have remained in an extended downtrend even lasting over 2 odd years.

Liquidity is an important aspect of trading. Time and again analysts have raised caution towards illiquid stocks which may be easy to get into but difficult to get out of.

Illiquid stocks pose a higher risk to investors as they cannot be sold easily because they see limited trading. It is difficult to find buyers for them as compared to frequently traded shares.

According to the BSE, a stock is termed illiquid when average daily turnover is less than Rs 2 lakh calculated for previous two-quarters, and the security is classified as illiquid at all exchanges where it is traded.

We spoke to few analysts on what should investors do if they are holding these stocks:

Analyst: Gaurav Ratnaparkhi, Senior Technical Analyst, SharekhanGOL OffshoreThe stock is trading in a multiyear downward sloping channel & is heading towards the lower channel line, which is near Rs12. This means that the stock has around 25 percent downside even from the current level. Hence, the recommendation is to exit at current level

Nitin FireThe stock is forming a complex correction from the high of July 2014. The structure is yet to resolve completely on the way down. Thus the stock can come down to 20-18 before it forms a base for itself.

Mandhana IndustriesThe chart isn’t attractive from an investment point of view. The Recent structure shows that there is scope for a short-term bounce till Rs25-26 as long as the swing low of Rs20.20 holds. However, the bounce should be used to exit from the counter.

IOL ChemicalsThe stock had formed a Double Top pattern during July to September last year. The pattern broke out on the downside in November. Since then the stock has tumbled down significantly and has a long way to go on the downside with the target placed at 45. The recommendation is to exit at current level

KM Sugar MillsThe stock has completed a rally on the quarterly time frame & has entered multi-month correction phase. There could be some more pain from short to medium term perspective. The stock can come down to Rs20-19.50 where it can form a base before starting a fresh rally.

Analyst: BirendraKumar Singh, AVP –Technical Research, Systematix SharesJMT Auto, KSK Energy, Shilpi Cable, McNally Bharat have turned illiquid counter and it is not possible to give a technical view.

MT Educare: The stock is placed at its long-term support, and can be accumulated between Rs80-73 with a stop loss of Rs62. A decisive move above Rs88 it will be positive up to Rs 96.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!