MAS Financial Services' initial share sale offer is set to open for subscription on October 6, with a price band of Rs 456-459 per share.

Equity shares are proposed to be listed on National Stock Exchange and BSE Limited.

The non-banking finance company is expected to debut on bourses on Wednesday, October 18. The issue will close on October 10.

Motilal Oswal Investment Advisors is the sole book running lead manager to the offer while Link Intime India is the registrar.

Here are 10 things you should know before investing in IPO:-Company ProfileMAS Financial Services is a Gujarat-headquartered non-banking finance company (NBFC) with more than two decades of business operations.

As of June 30, 2017, MAS operates across six states and the national capital territory (NCT) of Delhi.

Its business and financing products are primarily focused on middle and low income customer segments.

Financing products include five principal categories - micro-enterprise loans; SME loans; two-wheeler loans; commercial vehicle loans (which include new and used commercial vehicle loans, used car loans and tractor loans); and housing loans.

As of June 2017, it had more than 5 lakh active loan accounts, across more than 3,165 customer locations in six states and the NCT of Delhi, served through 121 branches.

Swalamb Mass Financial Services Limited is its group company.

Public Issue DetailsMAS is expected to raise Rs 460 crore through public issue that consists of fresh issue of up to Rs 233 crore and offer for sale of up to Rs 227.04 crore by selling shareholders.

The offer for sale comprises of an offer aggregating up to Rs 112.66 crore by DEG-Deutsche Investitions-und Entwicklungsgesellschaft MBH, up to Rs 79.34 crore by NederlandseFinancierings – MaatschappijvoorOntwikkelingslanden N.V. (FMO) and up to Rs 35.04 crore by Sarva Capital LLC.

The offer includes a reservation of up to Rs 7 crore worth shares for eligible employees.

The bids can be made for minimum 32 equity shares and in multiples of 32 shares thereafter.

The 50 percent of the total offer is reserved for qualified institutional buyers (QIBs); of which the company may allocate up to 60 percent of the QIB portion to anchor investors. Out of 60 percent to anchor investors, at least one-third is reserved for domestic mutual funds.

Further, 15 percent of the net offer is reserved for non-institutional bidders and 35 percent for retail individual bidders.

Pre-IPO PlacementMAS has already raised Rs 135 crore through the pre-IPO placement issue.

"The company has undertaken a private placement of 39,90,422 equity shares for cash consideration aggregating to Rs 135 crore," it said in its release.

Hence, the size of the fresh issue has been reduced accordingly.

Objects of IssueThe funds raised through fresh issue will be utilised towards augmenting its capital base to meet future capital requirements.

The issue proceeds are expected to be deployed in fiscal years 2018 and 2019.

The company will not receive any proceeds from the offer for sale.

FinancialsMAS' asset under management (AUM) increased at a CAGR of 33.37 percent from Rs 10,53.19 crore as of March 31, 2013 to Rs 3,332.56 crore as of

March 31, 2017.

Its capital to risky asset ratio (CRAR) stood at 23.80 percent as of June 30, 2017, improved from 22.96 percent in March 2017, 18.27 percent in March 2016 and 18.14 percent in March 2015.

AUM in micro-enterprise, SME, two-wheeler, Commercial Vehicle and housing loan segments increased at a CAGR of 32.14 percent, 137.64 percent, 5.86 percent, 2.62 percent and 44.09 percent during FY13 to FY17.

In FY17 and June quarter 2017, the company obtained Rs 1,512.51 crore and Rs 308.19 crore, respectively, through assignment and/or securitisation of loans.

> The company has a track record of consistent growth with quality loan portfolio.

> Diversified product portfolio and customer base aligned with increasing market demand is a key component of growth and success. Its target customer segments present significant growth opportunities for business.

> Quality loan portfolio and stable credit history has enabled the company to obtain capital for business operations without overleveraging or significant equity dilution.

> The company has developed an extensive operational network in Gujarat and Maharashtra. "We leverage our in-depth market knowledge to identify and develop close working relationships with MFIs, HFCs and other NBFCs focused on markets similar to ours. As of June 30, 2017, we had 98 such institutional borrowers," the company said.

> It has robust credit assessment and risk management framework.

> It has experienced management team with reputed investors.

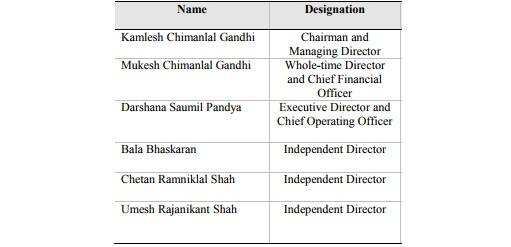

PromotersKamlesh Chimanlal Gandhi, Mukesh Chimanlal Gandhi, Shweta Kamlesh Gandhi and Prarthna Marketing Private Limited.

Promoters, Kamlesh Chimanlal Gandhi (Chairman and Managing Director) and Mukesh Chimanlal Gandhi (Chief Financial Officer and Director – Finance), each have over 21 years of experience in the financial services sector.

Mukesh Chimanlal Gandhi is also the chairman of the Gujarat Finance Companies Association and a director of the Finance Industry Development Council.

Its investors include development finance institutions such as FMO and DEG, and private equity investors such as Sarva Capital and India Business Excellence Fund - III.

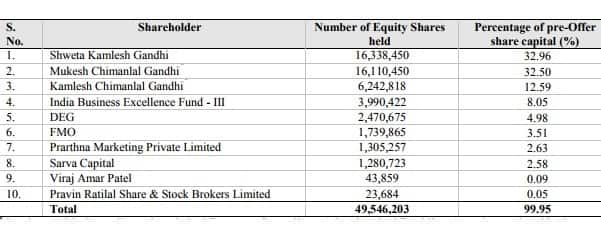

ShareholdingTop 10 shareholders of the company as of September 25, 2017:-

> The company caters to the high risk segment in terms of business operations which are economically more volatile in nature and any adverse impact can cause higher risk of loan defaults.

> Interest rate remains a high risk as company relies on external sources of borrowing mainly from banks and bond market, any sharp increase in interest rate can spike borrowing cost putting pressure on spreads.

> The company carries a lower provision coverage ratio on NPAs and on non-recovery of NPAs can cause high credit losses to the company affecting profitability and networth of the company.

> AUM size still remain small compared to peers and hence challenge will remain to improve processes on underwriting and increased volumes on continuous basis which can add to operational expenses & credit cost.

> Micro-enterprise loans are largely unsecured lending

> Currently, bulk of business is concentrated in Gujarat & Maharashtra.

> Growth prospects linked to other player prospects. As of June 30, 2017, the company had given loans to 98 institutional borrowers (MFIs, HFCs and other NBFCs) aggregating Rs 1,820 crore, representing 52.6 percent of AUM. Therefore, to a significant extent, the future asset growth for MAS would depend on the continuity of relationship with these financial institutions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.