One of the tenets of sound investing often stressed by legendary investors like Warren Buffett is investing in business, which requires very little cash for growth. Business which do not require cash needs no dilution in equity and stays away from debt.

Promoted by Future Group’s Kishore Biyani, Future Supply Chain (FSC), which has come out with an offer for sale, operates on similar philosophy. No wonder the entire proceeds from IPO (size of Rs 646-650 crore) will go to promoters and private equity investors rather than investing back in the business. The company does not need capital; in fact, it is sitting on cash of Rs 65 crore with negligible debt.

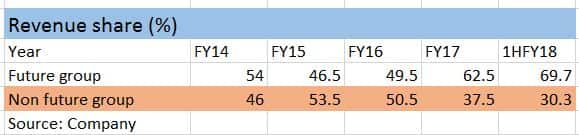

An attractive modelFuture Supply Chain is into contract logistics or third-party logistics and is an end-to-end solution provider. Third-party logistics typically require low capex as most of the assets such as vehicles, warehouses are owned by others. While solving some of its parent’s (Future group’s) in-house logistic requirements, it has gained and developed expertise in the retail sector, which is considered to be the most complex. Today, it is able to leverage this solution-based know how and provide services to other clients. Of the total revenue of Rs 561 crore earned in FY17, the group contributed 62.5 percent while the rest was accounted by external clients comprising marquee names like ITC, Amazon, Hindware, P&G, Honda, Philips, Cipla, Tupperware, Hitachi, Amway and many others.

While it is growing its external clients, what is worth noting is that the group spends close to Rs 1300 crore annually on logistics, of which about Rs 350 crore comes to FSC.

While the entire group spend may not come to FSC, what is changing is that it is gradually working on other segments like cold chain and others to get part of the group’s basket which is largely tilted towards FMCG and food categories.

Currently, fashion and apparels, engineering and automotive are the biggest segment of its client basket. The company follows a gradual approach; experimenting and building solutions around one particular segment largely with the help of the group companies and then take it to the market for the non-group companies. This essentially means that there is more potential for growth within the group and non-group companies as it develops new services and captures market share.

Nevertheless, the company recently spent close to Rs 80 crore and expanded its apparel warehousing facility in Nagpur from 10 crore garments capacity by over three times to 35 crore garment capacity at a single location. This will help drive both revenues and profitability over the next two to three years.

On top of that there will be a natural demand push from the group and non-group companies in terms of volumes as the economy picks up.

Post GST, the importance of third party logistics will gain momentum as companies will look for more efficiencies and national solution providers.

Technology will enable better inventory management and tracking thus allowing the users to rely on third-party logistics in future. In multi-location based logistic solutions like departmental stores the company has been able to strengthen its position delivering solutions to manage inventory efficiently.

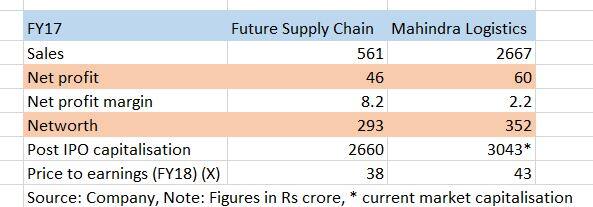

The recently listed Mahindra Group Company, Mahindra Logistics, in the similar space is trading below or at par its issue price. Moneycontrol Research had raised valuation concerns in our IPO note of Mahindra Logistics, which priced its issue at 43 times its annualised earnings of FY18.

Unlike Mahindra, Future Supply Chain has priced its issue at reasonable 38 times its FY18 earnings. Moreover, valuations should also be assessed from the perspective of return ratios and growth.

In case of Future Supply Chain the margins are far better and return ratios are similar. In terms of growth the recently expanded capacity will add to both sales and net profit apart from its efforts to grow non group clients. It is also experimenting in other segments like Cold Chain and others which could turn out to be growth drivers in the future.

Follow @jitendra1929For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!