It may be too early to turn bullish on emerging markets -- but a raft of bailouts pledged by the IMF and China has some investors deciding it’s too risky to stay bearish.

Over the past two weeks, the International Monetary Fund has been sewing up or inching toward loan agreements with some of the most vulnerable nations -- namely Pakistan, Sri Lanka, Zambia, Egypt and Chile -- after months of negotiations. Meanwhile, China is overcoming its own reticence to offer debt relief, saying it will forgive the liabilities of 17 African nations and redirect its own IMF reserves to the continent’s aid.

While some countries are still waiting, with Ukraine’s premier on Saturday criticizing slow progress from the IMF in agreeing a new assistance package for the war-torn nation, the support the IMF has provided has dramatically changed the odds for poorer nations where -- even a few weeks ago -- a wave of debt defaults looked inevitable. Now, their distress sagas are being recast as turnaround stories, enabling investors to dip a cautious toe back into their assets. Indicators of bearishness such as capital outflows and risk premiums are easing.

“We’ve seen a rebound in emerging-market dollar bonds as the IMF appears to be turning increasingly responsive to the difficulties faced by frontier emerging markets,” said Aninda Mitra, head of Asia macro and investment strategy at BNY Mellon Investment Management in Singapore. “This is helping some investors turn more neutral on emerging markets from a very bearish view.”

This year’s selloff in emerging-market dollar debt has been so sharp that it even dwarfs losses during the 2008 financial crisis. The Bloomberg gauge for the bonds has plunged more than 16%, heading for its worst year on record. Its 10 biggest losers are all countries that have defaulted or are struggling to repay debt -- Sri Lanka, Pakistan, Lebanon, Ghana and Belarus among them.

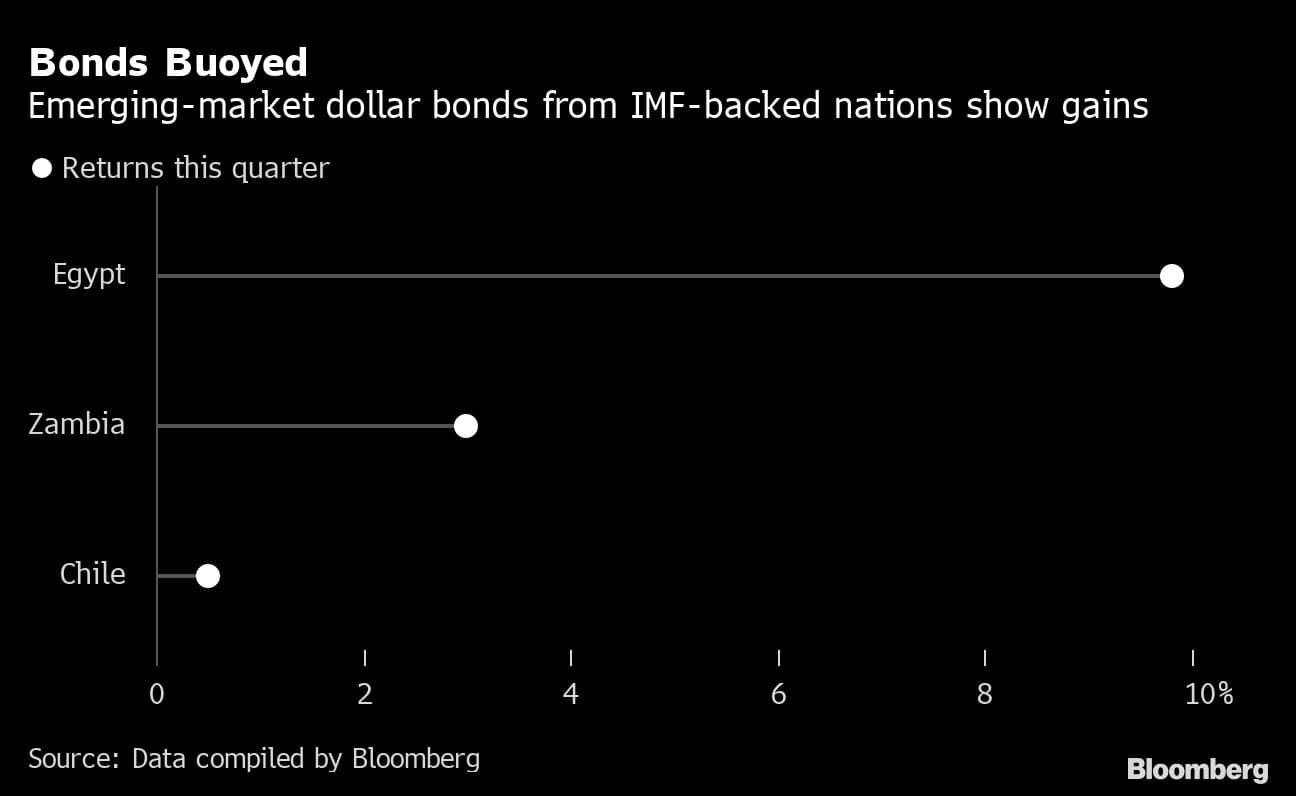

But since mid-July, bears are easing their grip on the securities, allowing a rebound. The benchmark index is up 2.9%, while JPMorgan Chase & Co. data show the extra yield on sovereign debt over Treasuries has fallen 102 basis points from a two-year high of 593. An index that tracks capital flows into emerging markets has risen more than 4%.

Bilateral support is also helping to ease fears of defaults. India has given billions in emergency aid to Sri Lanka, while Pakistan has won $9 billion of investment and loans from the Middle East. Egypt is also getting more than $22 billion from its Persian Gulf allies.

Meanwhile, China said it will forgive a total of 23 interest-free loans to African nations and redirect $10 billion of IMF reserves -- a big relief for the continent. Beijing accounts for almost 40% of the bilateral and private-creditor debt that the world’s poorest countries need to service this year, according to the World Bank.

While betting on the possibility of defaults is becoming increasingly unviable, assets of distressed nations are benefiting.

Zambia’s kwacha is the world’s second best-performing currency against the dollar with an 8.5% surge this quarter after the nation won approval for a $1.3 billion bailout. Not far behind kwacha in gains is Chile’s peso, with a 3.7% rally. Also, Pakistan’s rupee jumped 8.2% in August, the best performance in the world, even as the currency of Ghana, a distressed nation which hasn’t bagged an IMF deal yet, was the worst decliner. Sri Lanka’s bonds have recovered from the depths of a selloff as bondholders strategize to get the best deal possible in a restructuring exercise.

Still, as long as the dollar doesn’t begin a consistent slide and Federal Reserve rate-hike expectations stay firm, global investors won’t fully return to the asset class.

But with the IMF acting to counter some of the pain hanging over emerging markets, others are starting to give these nations another look.

“We have seen some inflows in recent weeks with tactical additions from global investors in certain pockets,” said Neeraj Seth, the head of Asian credit at BlackRock Inc., which he says is neutral on emerging-market assets and expects to see attractive opportunities in the coming quarters. “As we see further stabilization of US rates volatility and stabilization of the dollar, we will potentially see global investors revisiting emerging-market allocations.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.