US Debt Ceiling: All you need to know about it

What is debt ceiling? What happens if the US Congress doesn’t raise it on time? Answers to this and more

1/12

The US Treasury has warned the government that it could run short of cash to pay its bills unless Congress works fast to raise or suspend the debt ceiling. (Image: News18 Creative)

2/12

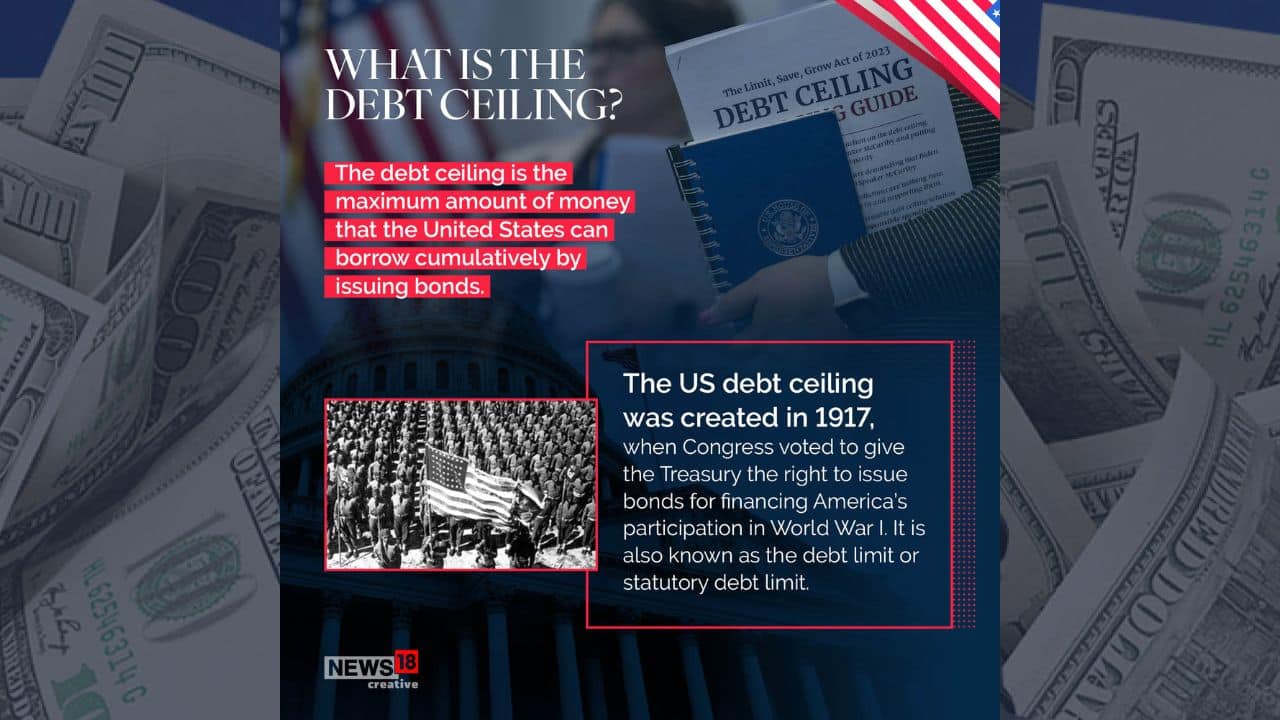

The debt ceiling is the maximum amount of money that the United States can borrow cumulatively by issuing bonds. (Image: News18 Creative)

3/12

Since 2001, the US government has run a deficit of nearly $1 trillion every year. It means it spends $1 trillion more than it receives in taxes and other revenue. (Image: News18 Creative)

4/12

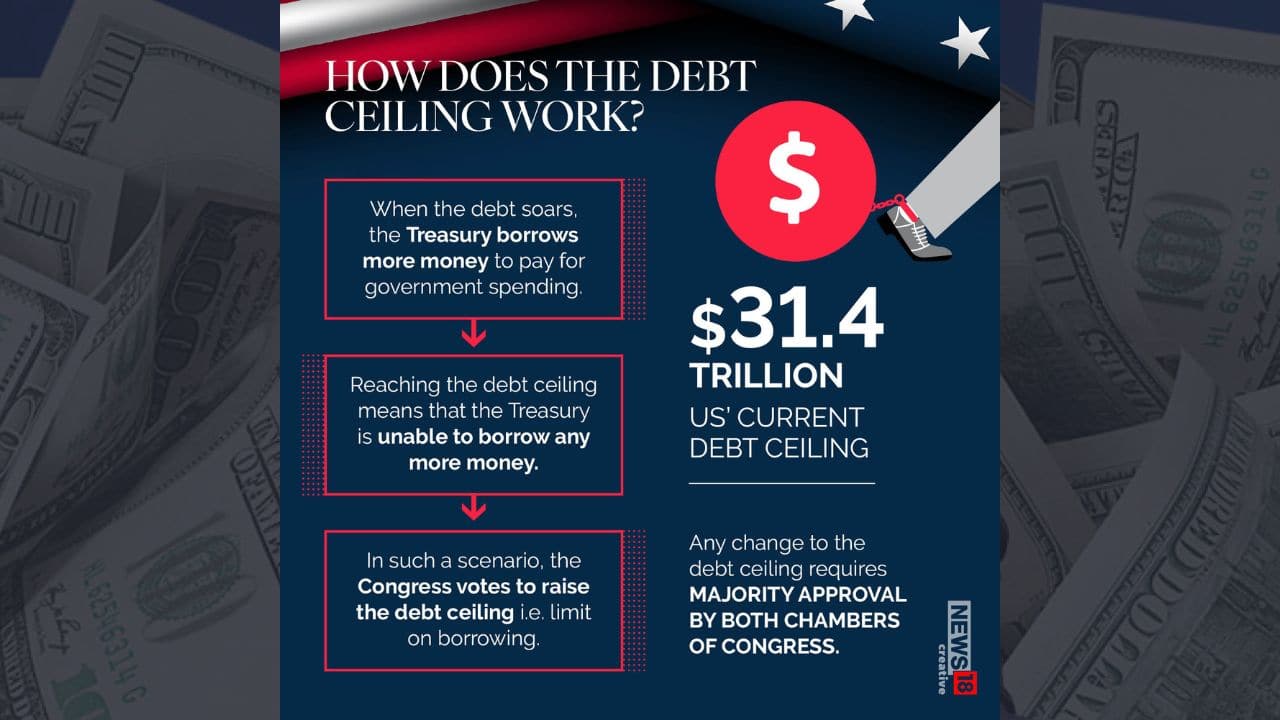

When the debt soars, the Treasury borrows more money to pay for government spending. Reaching the debt ceiling means that the Treasury is unable to borrow any more money. (Image: News18 Creative)

5/12

Since 1960, the US debt ceiling has been raised, extended or revised 78 times. (Image: News18 Creative)

6/12

A big debt is a reflection of the fact that the US has consistently spent more than it raised. (Image: News18 Creative)

7/12

The US Treasury has said that if the debt ceiling isn’t increased, it could run out of money as soon as June. US President Joe Biden has called for a meeting with leaders on May 9. (Image: News18 Creative)

8/12

The default could upend global financial markets and shatter trust in the US as a global business partner. (Image: News18 Creative)

9/12

According to news reports, even something as simple as weather forecasts could ultimately be impacted, as the National Weather Service is federally funded. (Image: News18 Creative)

10/12

With Republicans taking control of the House of Representatives, the US is seeing fresh political tensions. (Image: News18 Creative)

11/12

In exchange for votes to raise the debt ceiling, the Republicans are calling for drastic spending cuts with an intention to dilute the Democrats’ agenda. (Image: News18 Creative)

12/12

Biden has steadfastly said he will not negotiate over the debt ceiling increase, but will discuss budget cuts after a new limit is passed. (Image: News18 Creative)

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!