“The running joke in my group of founders is that it is easier to get a date on Tinder than it is to make it to a quick commerce app.”

There’s almost a palpable sense of desperation in his voice as a Delhi-based entrepreneur talks about his failure to get his snacks brand listed on Zomato’s Blinkit, Swiggy’s Instamart and Zepto. No amount of coaxing and cajoling over a period of more than a year has helped.

For every small consumer product brand with an urban audience, there’s perhaps no priority bigger than being on these apps.

And, why not? Although it was mocked for its utility until a couple of years back, quick commerce is already a $5 billion annual sales channel, according to Goldman Sachs.

While the model has not succeeded in several large Western markets, analysts at HSBC said Indians will eventually graduate from kirana stores (unorganised retail) to quick-commerce.

That’s an alarm bell for consumer brands who never went through the rigmaroles of fighting for shelf space in a DMart or a Big Bazaar.

Just around the same time as most Indians skipped the landline phone and dial-up internet phase to start with affordable gigabytes of mobile data, the e-commerce juggernaut of Flipkart and Amazon ensured that many brands didn’t have to battle it out for real estate in supermarket stores.

If you are surprised about a real estate constraint in the digital world, perhaps you haven’t yet heard of dark stores. These 2,500-3,500 square feet warehouses in and around residential areas are the nerve centres of quick commerce. That’s where your packet of chips and cold drinks comes from during an IPL match.

And, they can accommodate only a certain number of stock-keeping units (SKUs). That’s an important factor in making the quick commerce model scalable and, perhaps, potentially profitable in the long term.

As Moneycontrol spoke with a dozen entrepreneurs and e-commerce executives of small brands, it appeared that the quick commerce channel has become a holy grail of sorts.

They know that the odds are not in their favour. Their products neither have the ‘pull’ factor of the big brands like ITC or Unilever. They lack the network of big VCs who can call up friends placed in the appropriate places for help. And, they don’t have a war chest of marketing dollars.

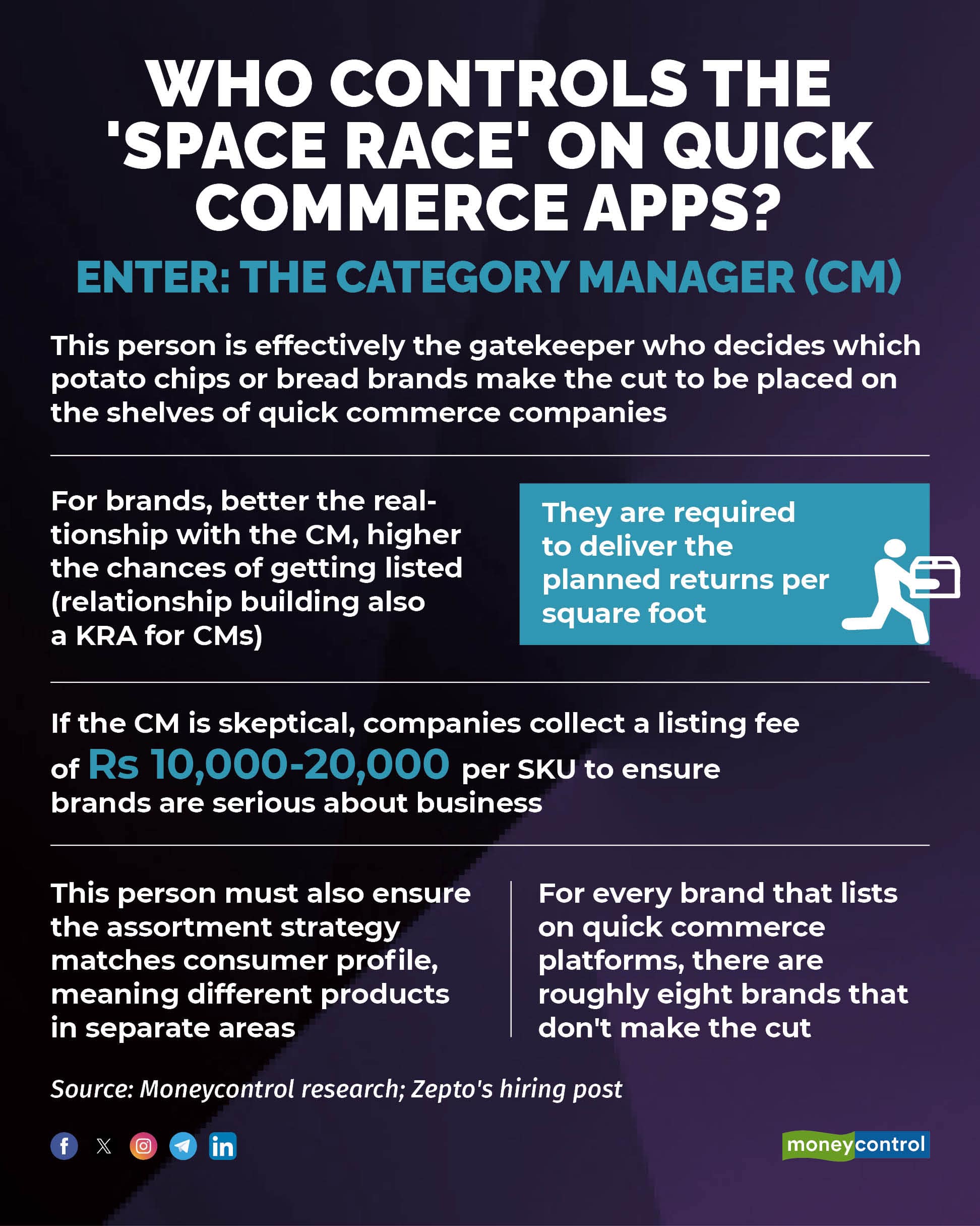

For every brand that manages to list on these apps, there are roughly eight brands that lose out, say industry insiders. Yet, everyone trudges on.

Masters of the world

For brands, the most important cog in the quick commerce wheel is the category manager. This person is effectively the gatekeeper who decides which potato chips or bread brands make the cut to be placed on the quick commerce company’s shelves.

For brands, the most important cog in the quick commerce wheel is the category manager.

For brands, the most important cog in the quick commerce wheel is the category manager.

A few points from the job description of a category manager published by Zepto on a hiring platform will give you an idea of the role’s centrality:

-Plan products/assortment size as per the footage requirement of the stores that make up a fair representation of the optimal merchandise category assortment and its segmentation from the consumer's perspective while delivering the planned returns per square foot.

-Lead the prioritisation and development of the category, and to maximise overall profitability. by applying understanding of retailer economics, product lifecycle management and inventory control to drive profitable volume.

-To apply consumer and marketplace insights to maximise return from consumer and product segments.

-Maintaining an assortment strategy that matches consumer profile, market requirements and the direction of the business.

-Responsible for pricing strategy and promotions and plans to drive work processes and relationship improvements with supply partners.

It’s not hard to fathom that category managers will be aggressively courted by any consumer brand looking to enter a platform.

A founder who has been waiting to list his brand on one of the apps for at least six months now says he has not heard back from the category manager yet.

“Mostly they politely say, ‘Sir, nahin ho payega.’ (It won’t happen.) But, sometimes the conversation may also get heated up…You can’t fault us for trying our best. We will keep sending updates of how our sales have grown on the large marketplaces like Flipkart and Amazon, or how we have become category leaders. There’s no other way,” says another founder of a home essentials brand based in Mumbai.

A lot rides on brands’ relationship with category managers. If the person in-charge knows the brand well and has a good rapport with the company, the chances of getting listed are higher. But, it becomes more challenging when the category manager changes frequently.

“For Swiggy Instamart, within the category that we operate, our category manager has changed thrice in the past year. It has been tough to operate,” the founder of a beverage startup said.

Prove your sincerity

Swiggy Instamart – which has a market share of 32 percent and is the second largest in the space behind Blinkit as per HSBC – says it has to pick only a few companies from the several inbounds it gets because there is limited space in dark stores.

“On average, we receive inquiries from over 500 D2C brands every month, with 60 brands and 800 new products being listed on Swiggy Instamart monthly, expanding choices for consumers,” a Swiggy Instamart spokesperson said.

To ensure brands are taking business seriously, companies like Swiggy Instamart also collect a listing fee that is in the range of Rs 10,000-20,000 per SKU (stock keeping unit). SKU is the term retailers use to identify and track their inventory.

The listing fee however is not a uniform levy on all brands and there is no standardisation. The fee is collected on a case by case basis. “The listing policies keep changing given the dynamic nature of the quick commerce space,” said the Swiggy spokesperson when asked about the differential treatment.

While one founder said he paid a listing fee on Swiggy Instamart, three others said they had not incurred such an expense.

The founder of a snacks company, whose products are live on all quick-commerce companies, said that there needs to be continuous traction for all SKUs. “When companies see a lull in demand, they delist the product and relisting that particular SKU is extremely difficult. The tolerance is low,” the founder said.

Buy your place

A top executive at one of the large quick-commerce companies said marketing spends are “very vital” for D2C companies who want to list and scale on quick-commerce companies. “Marketing, promotion and ad spends make all the difference. Around 90 percent of the brand’s spends should go towards marketing in quick-commerce,” the executive said.

He added that companies should spend on quick-commerce apps as well as outside them so customer awareness and recall is high. That ensures customers keep coming back to transact which creates brand stickiness.

“Companies that have thrived on brick and mortar stores (standalone, general trade and modern trade) so far think they don’t need to spend on marketing, that is the wrong approach to have when they come to quick-commerce,” the executive quoted above said.

“They should understand that setting up physical stores involves a lot of costs: rent, setting up the supply chain, and several other components but all of that is not there in quick-commerce. So, that budget should be replaced with marketing budgets instead,” he concluded.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.