One quick thing: Byju Raveendran and family finally have something to cheer about. The founder of India’s most-valued startup has just become the second-richest entrepreneur in the education sector in the world, according to Hurun Global rich list.

- Raveendran and his family are ranked 994th on the global list of Indian billionaires, having risen 1,005 positions in the past three years and amassing a fortune of $3.3 billion, according to the report.

Byju's valuation has more than tripled in the last three years, from around $8 billion in February 2022 to $22 billion as of October last year, making the startup the world's most-valued privately held edtech company.

In today’s newsletter:

- Why investors don't want startups to move money to GIFT City

- Embrace failure: IIT Madras star mentor to entrepreneurs

- How Zomato edged out Swiggy

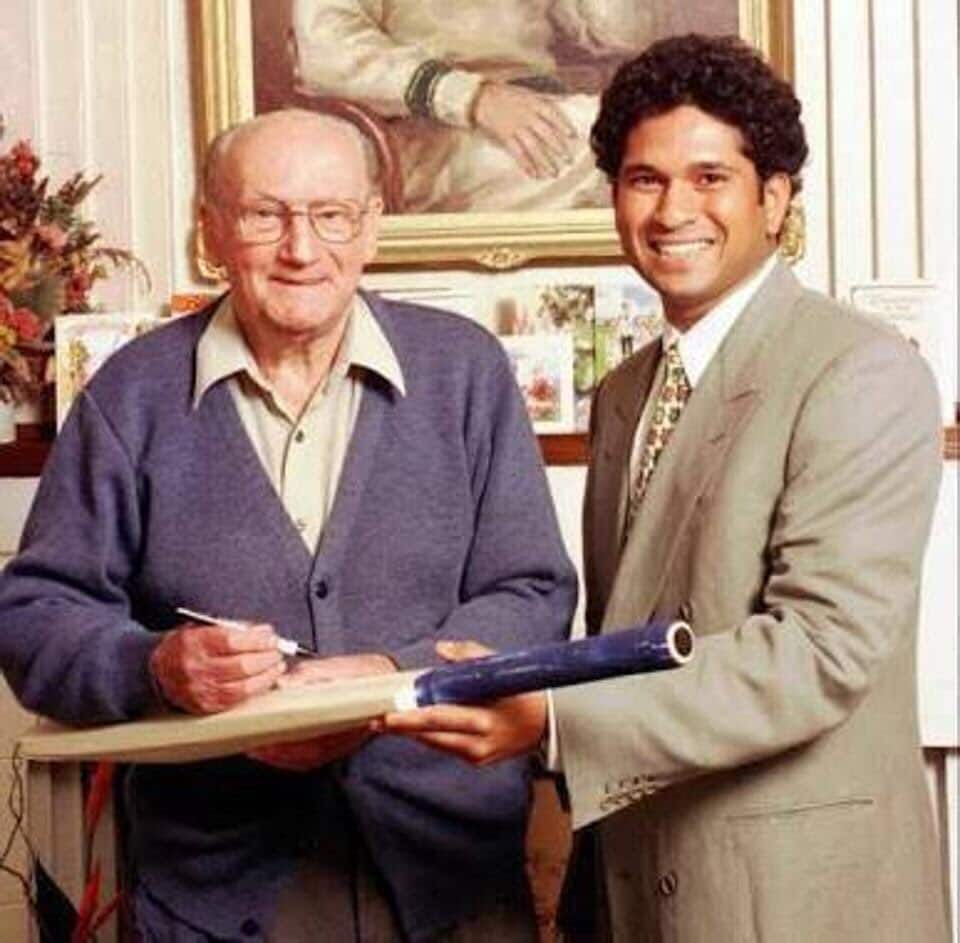

P.S: We have a special treat for cricket enthusiasts today, featuring 'The Don' and the 'Little Master'. Scroll below for more deets!

Was this newsletter forwarded to you? You can sign up for Tech3 here

Top 3 stories

Top 3 stories

Why investors don't want startups to move money to GIFT City

The Indian government has been pitching GIFT City banks as an alternative to US-based banks after the Silicon Valley Bank debacle. But venture capital firms are not yet taking the bait.

What’s the matter?

Money matters

VC firms such as Blume Ventures, 3One4 Capital, Fundamentum, and others have advised their portfolio companies to avoid investing in securities or money market funds.

A top US-based VC fund has also instructed its portfolio companies in India to cash out any long-term deposits and be liquid

“For any portfolio company with US presence, we have strictly mandated that all the deposits should be in ‘too big to fail’ banks that are certain to be bailed out in case something bad happens,” said the partner of a VC firm.

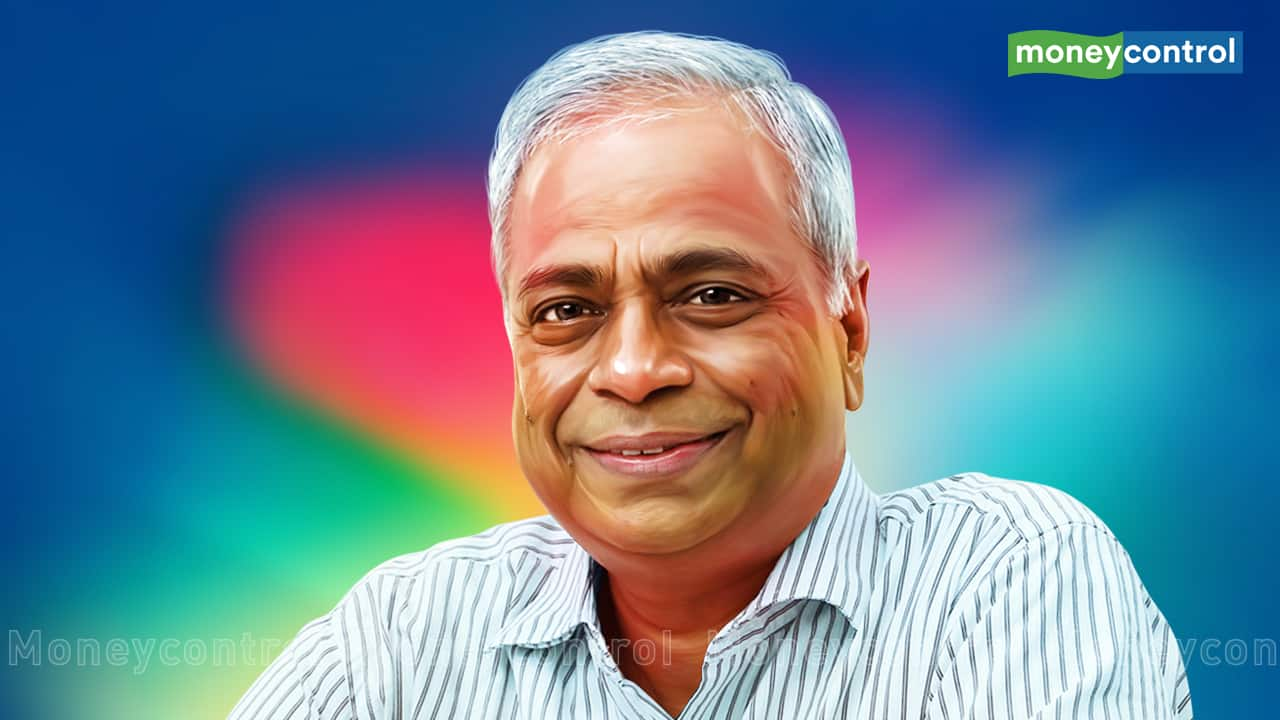

Embrace failure: IIT Madras star mentor to entrepreneurs

People pay attention when 70-year-old Ashok Jhunjhunwala speaks. Why? Because, over a four-decade career, he has impacted thousands of lives through his contributions in academics, technology, entrepreneurship, and innovation.

Tough advice

Jhunjhunwala, president of the IIT Madras Research Park, which has incubated over 200 deep tech startups in its 15 years of operation, has some tough advice for aspiring entrepreneurs.

Jhunjhunwala advised aspiring entrepreneurs to not jump into the field if their family members are dependent on them.

"If you need money immediately, then do not get into entrepreneurship. If you don’t have any financial obligations, get into this area, fail, get up and start again," he said.

Tell me more

He also urged budding entrepreneurs to develop multiple skills and not just concentrate on developing products.

- Entrepreneurs should learn the business aspects of innovation, such as sales, marketing, personnel management, etc, he emphasised.

Jhunjhunwala's advice struck a chord with Guvi, an edtech startup that spent time at the incubation cell of IIT Madras in 2014. Guvi recalled how the ace mentor, through the incubation cell, taught them bookkeeping, accounting, and other crucial but "monotonous" tasks.

This is the sixth and the latest in our Inside IIT Madras series, where we have been looking at the role the institution has been playing in innovation and entrepreneurship. Go deeper!

How Zomato edged out Swiggy

Zomato is eating into Swiggy’s pie of the food delivery market where the two have been neck-to-neck competitors.

- A new version of its Gold loyalty programme has helped widen its market leadership over Swiggy, according to a report by HSBC

- The brokerage note estimated that Zomato’s market share will inch up to 57% in the next fiscal, while Swiggy's will fall to 43%

Unit economics in focus

The Gold programme will have a negative impact on Zomato's unit economics in the range of Rs 10-12 per order beginning in the March quarter, which may concern investors, the report said.

- The report highlighted that Zomato has been able to show a consistent improvement in its unit economics

- Zomato logged a contribution profit of Rs 21.5 per order in the previous quarter

“We believe Zomato will be able to offset this impact (of Gold) from its continued push for higher take-rates and lower costs. In the coming quarters, as the company absorbs the impact of Zomato Gold, EBITDA margins should continue to improve,” the note said.

MC Interview: Binance CTO sceptical about global crypto framework

“Having one unified law across the entire world for a tech guy would be super straightforward and easy to implement. But practically speaking, that might be very tough for the governments to agree on,” Binance Chief Technology Officer Rohit Wad told us in an interview.

Wad’s comments come at a time when the Indian government is increasingly pushing for a common global regulatory framework for crypto through its G20 presidency.

Recent events, such as the fall of banking institutions in the US and Europe, have resulted in Binance emerging as one of the biggest gainers in the crypto sector. This presented an excellent opportunity to catch up with Binance's CTO as he discusses the following topics:

- Crypto and Web3

- Innovations the exchange is working on

- GPT-4 taking on the crypto world

- The WazirX issue

Read the full interview

Today in tech history: Intel begins shipping Pentium chips

The first Intel Pentium processor was shipped on March 22, 1993, marking the beginning of what would become the company's primary product line.

Quick trivia: The name Pentium is derived from the Greek word pente, which means "five" and refers to Intel's fifth-generation microarchitecture, the P5.