One quick thing: EU eyes cooperation with India on DPDP Act implementation

In today’s newsletter:

- US-China tariff war to boost made-in-India iPhones

- Budget 2025 wins startup leaders’ approval

- Sharan Hegde's 1% Club gets RIA nod amid finfluencer crackdown

Was this newsletter forwarded to you? You can sign up for Tech3 here

Top 3 stories

Top 3 stories

US-China tariff war to boost made-in-India iPhones

Surge in electronics exports

The US tariffs are expected to work in India’s favour, with companies like Apple, Motorola, and other tech giants already ramping up their production in the country.

- In 2024, India hit a new record with $20.4 billion in mobile phone exports, largely driven by Apple’s growth

Focusing on exports, Apple aims to produce a quarter of its iPhones in India over the next two to three years as it works to establish a local vendor network and reduce its dependence on Chinese suppliers.

"Apple has shared a plan with the government they want to move more. How much they will accelerate will depend on the ongoing tariff-related developments and geopolitical factors. It looks positive, but the local industry needs to step up to support their expansion," a senior government source told us.

India is also seeing growth in the IT hardware segment, including laptops, tablets, and servers.

- Taiwanese companies are looking to India as a global manufacturing hub, increasing local component production

Policy action

Industry leaders, such as Sunil Vachani of Dixon Technologies, stress the importance of quick policy decisions to capitalise on this opportunity.

“Although the tariffs seem to be a short-term solution, what’s really needed is a more long-term strategy such as a broader trade agreement between India and the US,” Vachani said.

Budgeting for change

The recent Budget 2025 introduced changes that directly benefit mobile phone manufacturers. With the removal of import duties on key components for phone production, India’s manufacturing capabilities become even more competitive.

- The move removes ambiguity, increases manufacturing competitiveness, encourages companies to manufacture components locally and drives up value addition

Dig deeper

Budget 2025 wins startup leaders’ approval

India's top startup leaders have given a big thumbs up to various initiatives announced in Union Budget 2025.

- They believe these moves will accelerate entrepreneurship, spur innovation across sectors, and give a much-needed boost to consumption in both urban and rural India

Nurturing deeptech startups

Prashanth Prakash, founding partner at Accel, said the government's plan to set up a dedicated Fund of Funds fits well with its ambitious AI mission.

- He hopes the government allocates at least Rs 10,000 crore to it, similar to the Sidbi Fund of Funds for Startups

Kunal Bahl, co-founder of Titan Capital and Snapdeal, mentioned that India's proposal to expand Sidbi Fund of Funds to Rs 20,000 crore will be a "big shot in the arm for the ecosystem."

In addition, Indian Alternative Investment Funds (AIFs) getting parity with foreign investors in terms of income classification will give a massive boost to capital formation in India through SEBI-regulated and IFSC-regulated AIFs, said Siddarth Pai, founding partner at 3one4 capital.

Consumption spike

The Union Budget's tax relief measures, which put more money in the hands of the Indian middle class, will give a "definite kick for consumption", especially among younger consumers early in their careers, said Rohit Kapoor, CEO-food marketplace, Swiggy.

- Bahl said people will not only be able to spend more on necessary healthcare and education but also on discretionary spending to upgrade their lifestyle

Yes, but...

One big miss in Budget 2025 was lack of reforms around employee stock option plan (ESOP) taxation, Bahl and Kapoor said.

- Kapoor called ESOP taxation in India as "highly egregious", saying it is not “fairly placed at present”

Go deeper (Prefer video? Watch the panel discussion)

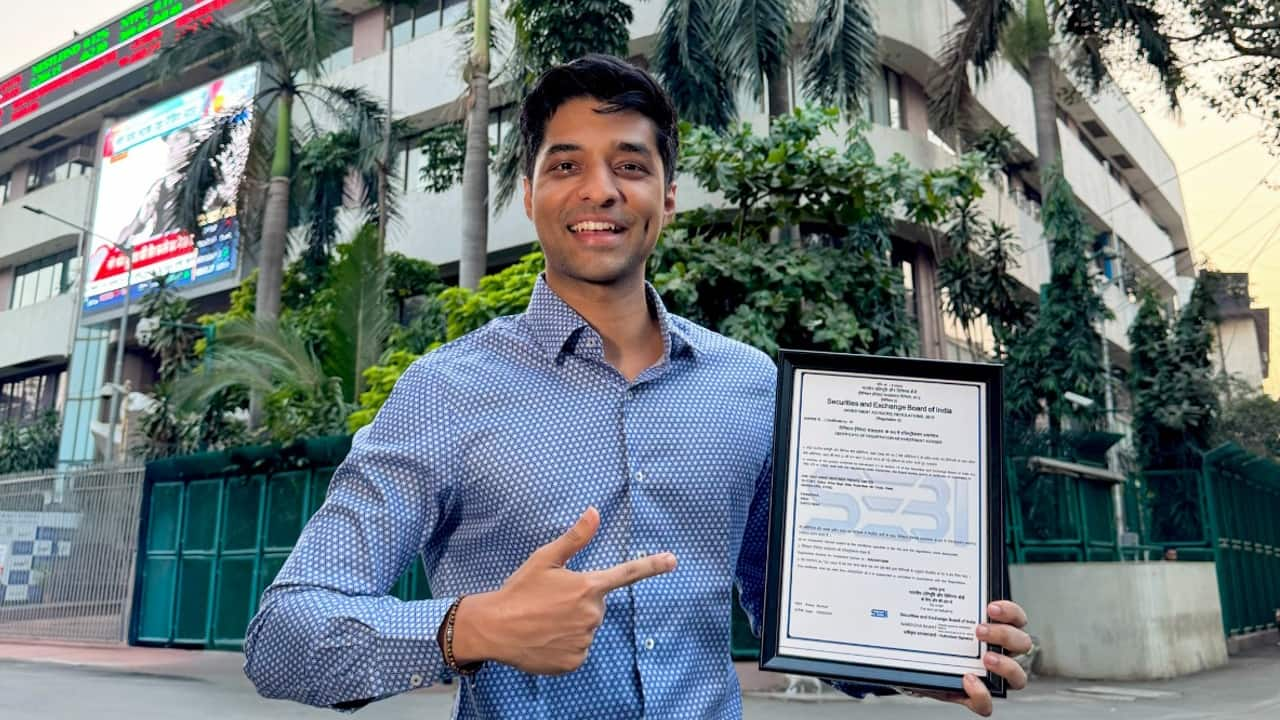

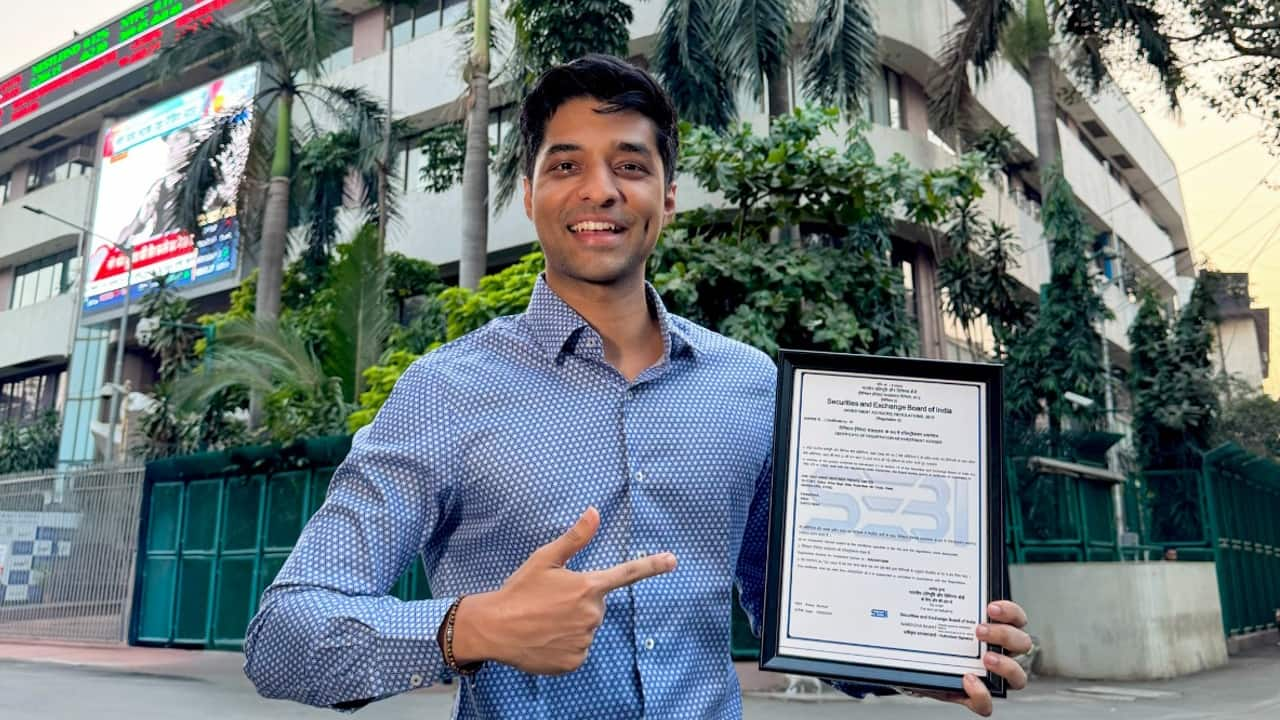

Sharan Hegde's 1% Club gets RIA nod amid finfluencer crackdown

At a time when the Securities Exchange Board of India (SEBI) is tightening its noose around financial influencers, popular finance content creator Sharan Hege’s startup The 1% Club has got the registered investment advisor (RIA) licence from the regulator.

- It has become the first financial influencer-led company to get SEBI-registered

Getting the licence wasn't an easy process and took us 6-8 months, Hegde told us.

Driving the news

A SEBI-registered investment advisor himself, Hegde said that a corporate RIA was needed to fill the talent gap of financial planners in India.

- The 1% Club’s subsidiary, Personal CFO, can now offer personalised 1-on-1 financial planning services.

India currently has only about 1,300 certified planners while the need is of a million financial advisors, Hegde said.

- Hegde wants to capture 5-10% of the financial planner market by training more people

Raghav Gupta, the co-founder of the 1% Club is adopting the IT (Information Technology) hiring model that is hire, train, deploy.

Setting an example

Hegde hopes that more companies like theirs emerge to fill the gap in supply.

“The market demand is so big that there are 10,000 1% Club companies needed in order to even fulfill that demand,” Hegde said.

SEBI crackdown

The regulations are getting stricter to get more people SEBI-registered, Hegde said.

Dig deeper

MC Special: Fintechs see Rupay UPI credit card as growth engine

Customers like the wide acceptance, cashbacks and convenience of UPI, while also loving the credit card rewards.

- RuPay credit cards linked to UPI offer the best of both worlds, fueling the rapid growth of fintech companies enabling this integration

For these fintechs, the credit card platform brings in daily engagement with customers and opens a window of opportunity for selling other financial products such as credit, fixed deposits, insurance and investment among others.

- The popularity has helped Rupay cards to become popular among a large section helping it more than double the credit card market share to 14% in a year