One quick thing: Byju's seeks arbitration in dispute with investors

In today’s newsletter:

- Taiwan quake may not impact India electronic prices

- Sachin Bansal eyes war chest for Navi

- Sameer Nigam sounds alarm on digital competition bill

Was this newsletter forwarded to you? You can sign up for Tech3 here

Top 3 stories

Top 3 stories

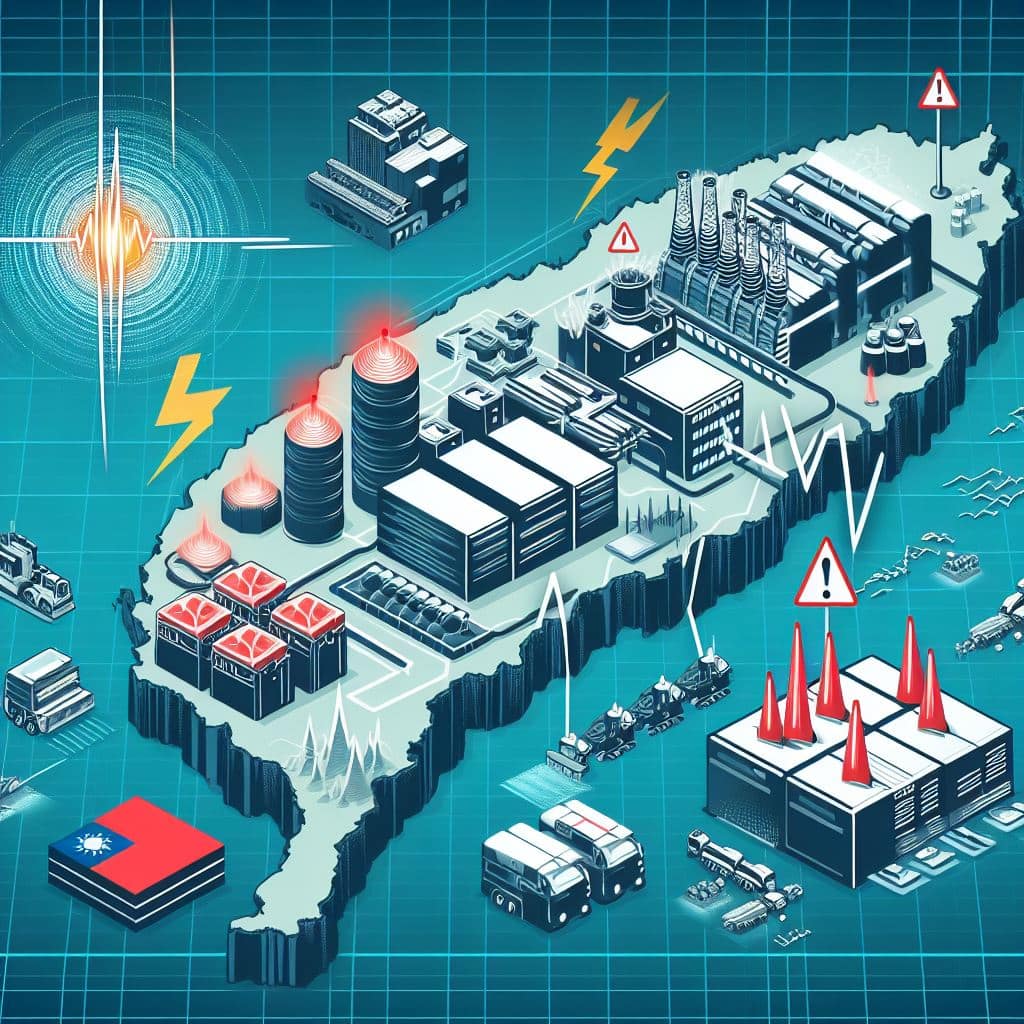

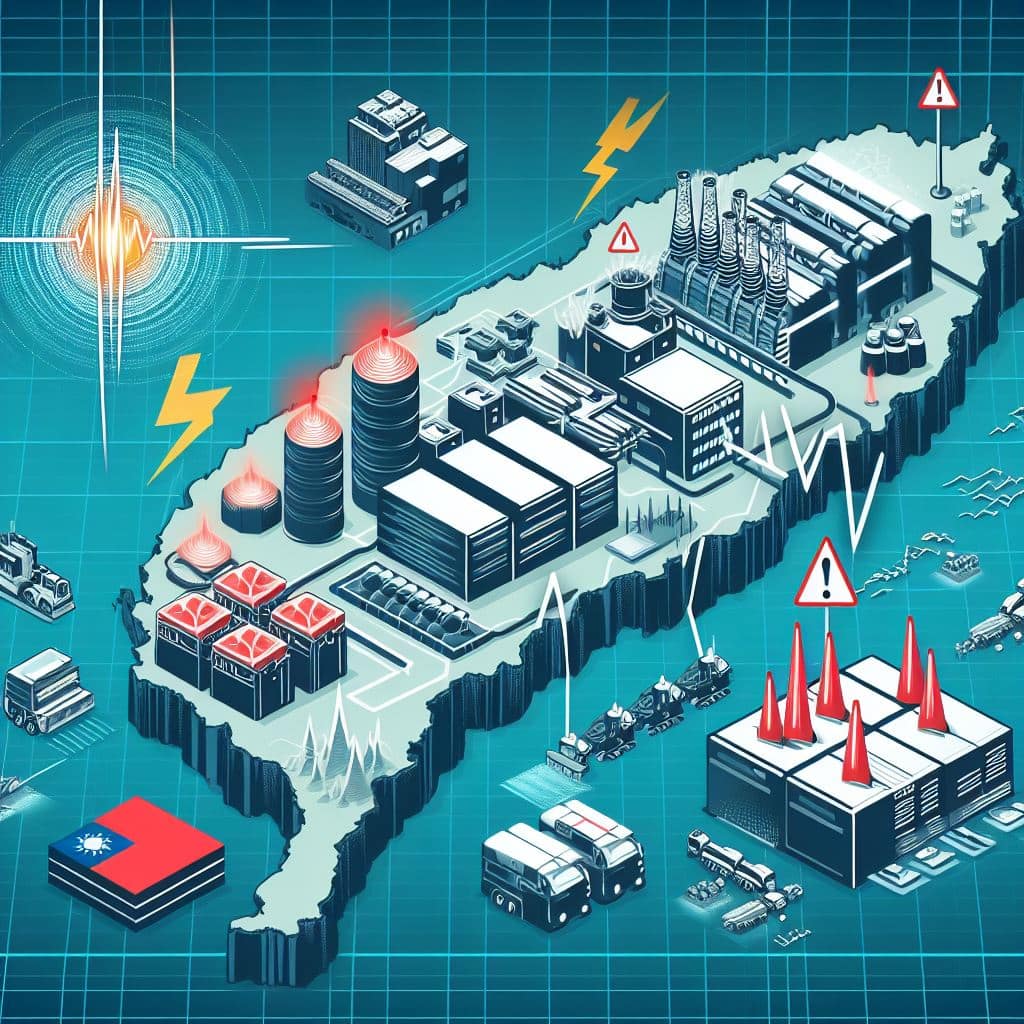

Taiwan quake may not impact India electronic prices

When Taiwan sneezes, the world catches a cold.

If you find something is amiss in the above line, it might mean you aren’t aware that the Southeast Asian island nation serves over 60% of the global chip demand.

- Nearly 90% of high-end AI chips that make ChatGPT possible are produced here

Driving the news

Although chip factories in Taiwan were disrupted by an earthquake yesterday, the Indian industry said it won’t impact prices of cars, phones and other electronics in the country.

- This is because chip procurement contracts are locked with suppliers at least 3-6 months before they are required by the downstream electronics industry.

- Further, most fabs in Taiwan have become operational after a pause of 6-10 hours, according to analysts

Sensing opportunity in crisis

Fears about the concentration of chip supply in Taiwan could help countries like India, Vietnam, Japan, Germany, and the US, which are trying to attract chipmakers with large subsidies.

“It's time to share the load of Taiwan semiconductor industry. We need more hubs around the world for semiconductor manufacturing,” said an India Semiconductor Mission official.

Mitigation strategy

According to experts, Taiwanese factories were made earthquake resistant for up to a magnitude of 8 on the Richter scale, while the latest tremors measured 7.2.

- Taiwan and its surrounding waters have registered about 2,000 earthquakes with a magnitude of 4.0 or greater since 1980

Go deeper

Picture credit: Microsoft Copilot

Sachin Bansal eyes war chest for Navi

Building a successful startup requires many things, but according to Flipkart co-founder Sachin Bansal, there's one crucial element: a well-funded war chest.

And Bansal is applying this lesson to his new venture, Navi

“We keep talking (to investors) regularly. We need investors who are aligned with our vision,” he told us in an exclusive interview.

Capital as a lifeline

Bansal believes a healthy reserve of capital acts as a financial shock absorber.

This "warchest" will allow Navi to weather unforeseen storms and seize potential acquisition opportunities in the heavily regulated fintech industry.

- Navi's first IPO attempt hit a snag due to the market volatility caused by the Russia-Ukraine war

But Bansal isn't deterred. He's keeping his options open and preparing for a second attempt within the next two years.

Funding options abound

Bansal enjoys a significant 97% ownership within Navi, allowing him to raise capital without diluting much of his stake and control over the company.

- So far, Navi relied on non-convertible debentures (NCDs) to meet their financial needs

Dig deeper

Sameer Nigam sounds alarm on digital competition bill

India's startup ecosystem is abuzz with a fiery debate – the draft Digital Competition Bill.

- While some see it as a necessary rein on Big Tech giants, others fear it might inadvertently clip the wings of startups

Driving the news

PhonePe CEO Sameer Nigam isn't a fan of the bill's vague language.

He argues that broad definitions like "online intermediation service" give the Competition Commission of India (CCI) too much leeway in deciding which companies fall under the ambit of the regulation.

- This ambiguity, according to Nigam, creates a "chilling effect" on startups

Tell me more

Nigam further highlights the bill's financial and commercial thresholds for classifying companies as "significant," raising concerns that many startups might inadvertently fall under its purview.

- This could subject them to stricter regulations originally intended for Big Tech

Nigam, along with academics, lawyers, and consultants, urged the government to extend the consultation period beyond the current April 15 deadline.

Find out more