One quick thing: MeitY orders Google to take down Chinese chat app over map dispute

In today’s newsletter:

- Fat cheques return for fit startups

- Indian IT gets a wake-up call

- Indian founders lack global ambition, says Zepto CEO

P.S.: Introducing the Tech3 Podcast, your daily dose of tech and startup insights. Monday to Friday! Check it out on Spotify or Apple Podcasts

Was this newsletter forwarded to you? You can sign up for Tech3 here

Top 3 stories

Top 3 stories

Fat cheques return for fit startups

Late-stage funding is back, but the cheques now come with conditions – ‘fiscal’ fitness and IPO readiness.

Cheques with checks

This time, capital’s only chasing those who’ve earned it, with investors backing a focused cohort of startups with strong fundamentals.

- Startups like Zepto, Groww, Jumbotail, Cred, and Dhan, among others, are raising – or prepping to raise – $100 million+ growth rounds

With ample dry powder, funds are deploying into mature, well-run companies—no FOMO-fuelled frenzies here.

Priced to reflect, not impress

The heady 2021 valuations are out, replaced by good old-fashioned financial discipline.

- Mega rounds of $300 million+ are rare; most cheques now fall roughly between $70 million to $250 million, with tighter valuation discipline, says Avendus Capital’s Karan Sharma

Founders and investors are aligning on realistic pricing, with metrics like EBITDA now driving conversations.

- Market-listed startups like Paytm, Ola Electric, FirstCry, and Nykaa trading below issue price have been a cautionary tale for all

IPO later, exit now

With public markets wobbly, startups are choosing patience, and letting early investors cash out via secondaries.

Companies like Rebel Foods and Zepto are leaning into secondary-heavy rounds to bring new investors in.

Dig deeper

Indian IT gets a wake-up call

It’s a full cycle: Indian IT wrote the code, then came AI, and now AI is rewriting the playbook for the industry.

Driving the news

India’s top IT services companies have wrapped up FY25 with single-digit growth, for the second year in a row.

- TCS, Infosys, and Wipro clocked muted numbers, with Wipro slipping into negative territory for the second consecutive fiscal

The sobering stats are fuelling a larger debate: is this just a temporary slump, or a deeper, structural shift?

Tell me more

The alarm bells are everywhere. HCLTech’s CEO, C Vijayakumar, called the old linear model of IT services already out of time, while Infosys’ chief, Salil Parekh, echoed the need to “find new ways.”

- Even Saas firm Zoho’s founder, Sridhar Vembu, has said the industry is at an “inflection point”

Add to that declining headcounts, shrinking discretionary spends, and warnings from analysts about FY26 being a “complete washout,” the malaise looks more structural than cyclical.

What’s the big deal?

The $280-billion IT industry, once the poster child of India’s export story, is now at a crossroads.

- With AI transforming delivery models, Trump tariff wars threatening US demand, and Global 2000 clients reaching saturation, the old playbook may no longer work

- Adding to the challenge, Global Capability Centres are stealing IT’s thunder—both in terms of revenue and headcount

According to Gartner, future growth will depend on innovation, embedded AI, and new pricing models. But for now, the industry may have to do more with less—and do it fast.

Dig deeper

Indian founders lack global ambition, says Zepto CEO

Zepto CEO Aadit Palicha has a simple message for Indian founders: Stop playing it safe.

Post-crash hangover

In a conversation with Y Combinator CEO Garry Tan, Palicha called out Indian founders for lacking the all-in ambition seen in startup ecosystems like the US and China.

“As an ecosystem, we are very much post-2001 right now, where people were less ambitious – because we had a big reality check in 2022-23. And there is still a lot of fear and lack of ambition in general (in India),” Palicha said.

The 22-year-old CEO critiqued the tendency of Indian entrepreneurs to celebrate early traction rather than pushing for category-defining outcomes.

Mission mode: Always on

According to Palicha, Zepto’s execution-focused culture, which is designed for “the super ambitious, the super capable”, has the potential to drive immense value for the country in the long-term.

“If you look at places like China, the dynamism came from internet companies, and that spread everywhere. So, maybe we can be a small part of that,” he said.

Palicha’s mission is to build a generational internet company that sparks India’s own digital revolution, unlocking 10x more value for India in the future.

Dig deeper

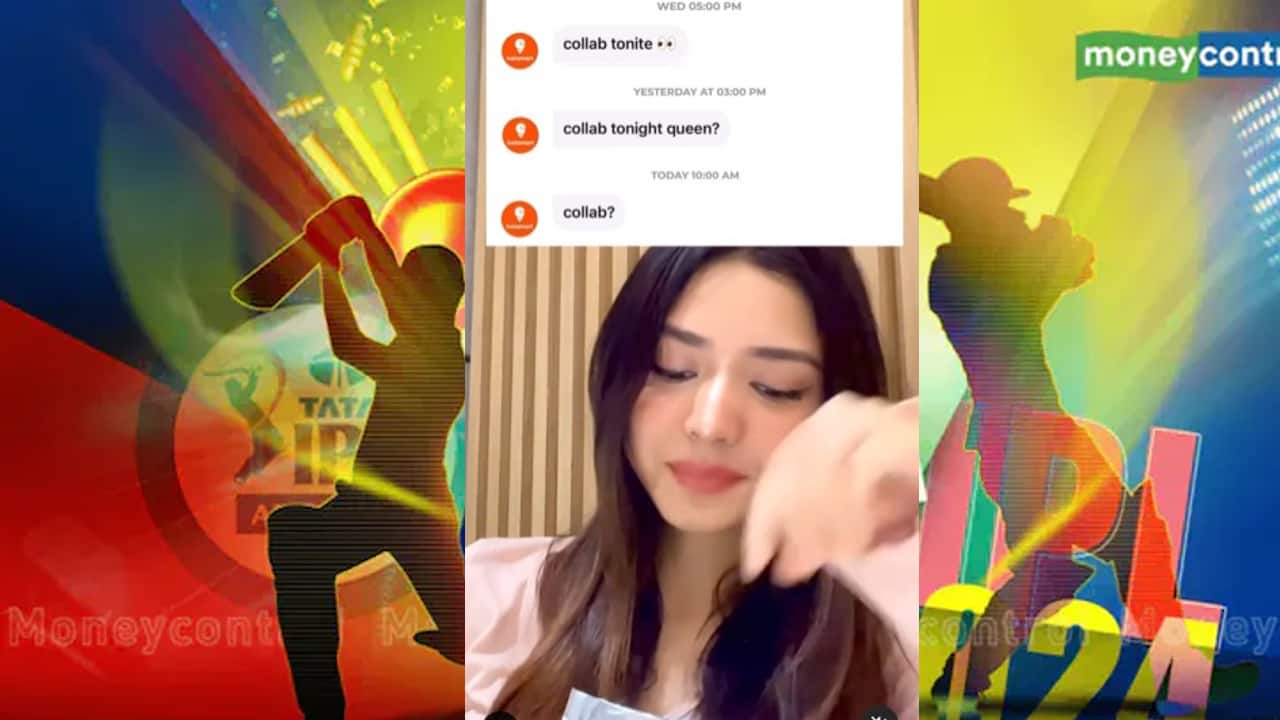

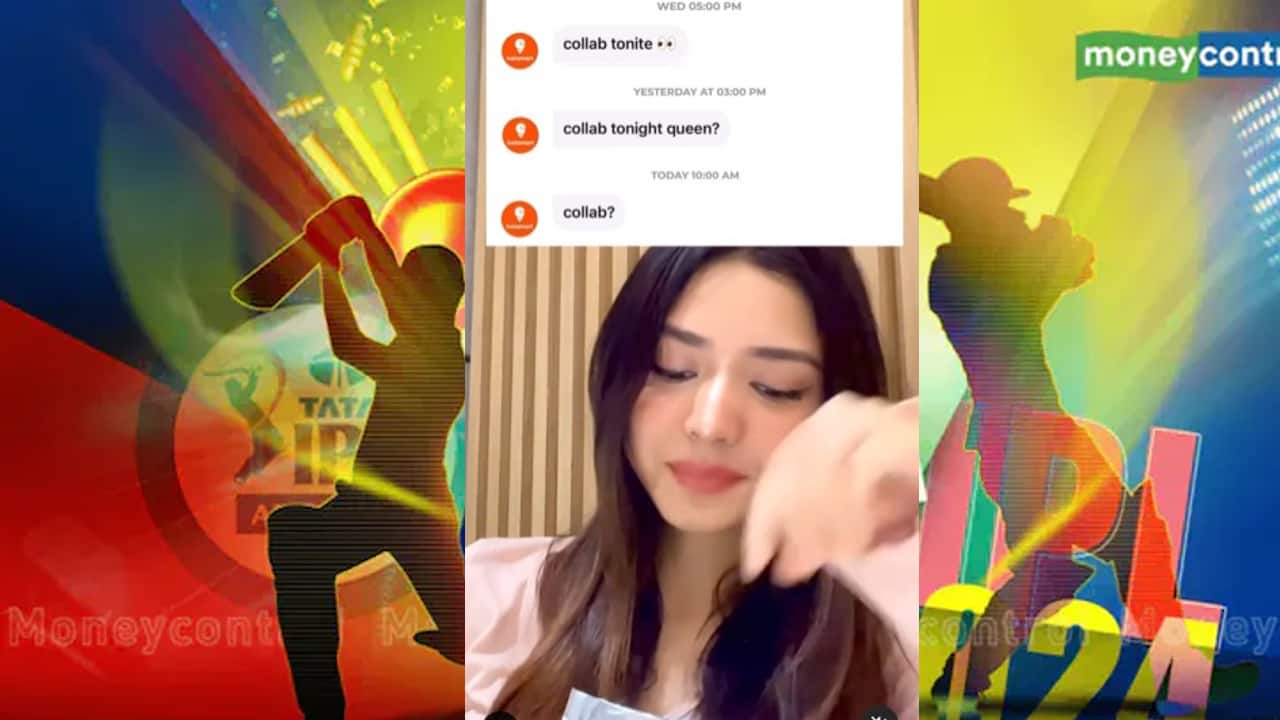

MC Special: Influencers make bank this IPL

While the IPL has always been a spectacle of thrilling cricket and star-studded ads, this season it's the influencers who are stealing the spotlight.

- With Rs 1,000 crore in influencer marketing spends this season, brands are betting big on influencers

Take Aaryapriya Bhuyan, a CSK fan with just 15 Instagram posts — her viral match-day reaction skyrocketed her to over 300,000 followers and landed her deals with Swiggy Instamart and Yes Madam.

- From Rs 5,000 to Rs 50 lakh per campaign, influencers are raking it in!

Find out more