Trending Topics:

- Sensex Live

- Union Budget 2026

- IPO This Week

- Kuku IPO

- Gold Rate Today

Gainers & Losers: 10 stocks that moved the most on November 18

The Sensex closed 87.12 points lower at 61,663 and the Nifty ended 0.20 percent lower at 18,307

1/11

The Indian equity benchmarks ended lower for the second consecutive day on November 18 amid selling across the sectors barring PSU banks. At close, the Sensex was down 87.12 points at 61,663, while the Nifty was down 36.20 points at 18,307.

2/11

PB Fintech | CMP: Rs 401.80 | Foreign brokerages expect a 50 percent upside in the stock. Morgan Stanley has an Overweight rating with a target price of Rs 620 per share. The management has reiterated its profit guidance of Rs 1,000 crore for FY27, and that is what makes Morgan Stanley bullish. “Management has also highlighted its cash losses are near zero,” noted the brokerage. The stock gained over 8 percent on November 18.

3/11

Redington | CMP: Rs 170.20 | Redington on November 18 announced a partnership with Enertech, a solar inverter manufacturing company, to fulfill the rising demand for solar hybrid inverters in India. This partnership will leverage Enertech’s expertise in solar solutions manufacturing and Redington’s dense distribution network across the country. The stock ended 3.5 percent higher.

4/11

Strides Pharma | CMP: Rs 338 | The stock gained 2.62 percent. The company's step-down wholly owned subsidiary Strides Pharma Global Pte. Limited received approval for Potassium Chloride Oral Solution USP, 40 mEq/15mL from the United States Food & Drug Administration (USFDA). The entire Potassium Chloride range of products for the company has a cumulative market opportunity of $330 million as per IQVIA.

5/11

Alstone Textiles | CMP: Rs 300.45 | The company has fixed December 14 as the record date for the proposed 10-for-1 stock split and 9:1 bonus share issue. The stock gained 5 percent and was locked in the upper circuit.

6/11

NMDC | CMP: Rs 111.10 | The stock gained 5.16 percent. Kotak Institutional Equities has upgraded the stock to a "buy" with a target price of Rs 130 apiece. The company announced a 9 percent price cut to revive volumes in H2FY23. The brokerage sees strong re-rating potential after the steel plant demerger, higher FCF & likely higher dividend payout.

7/11

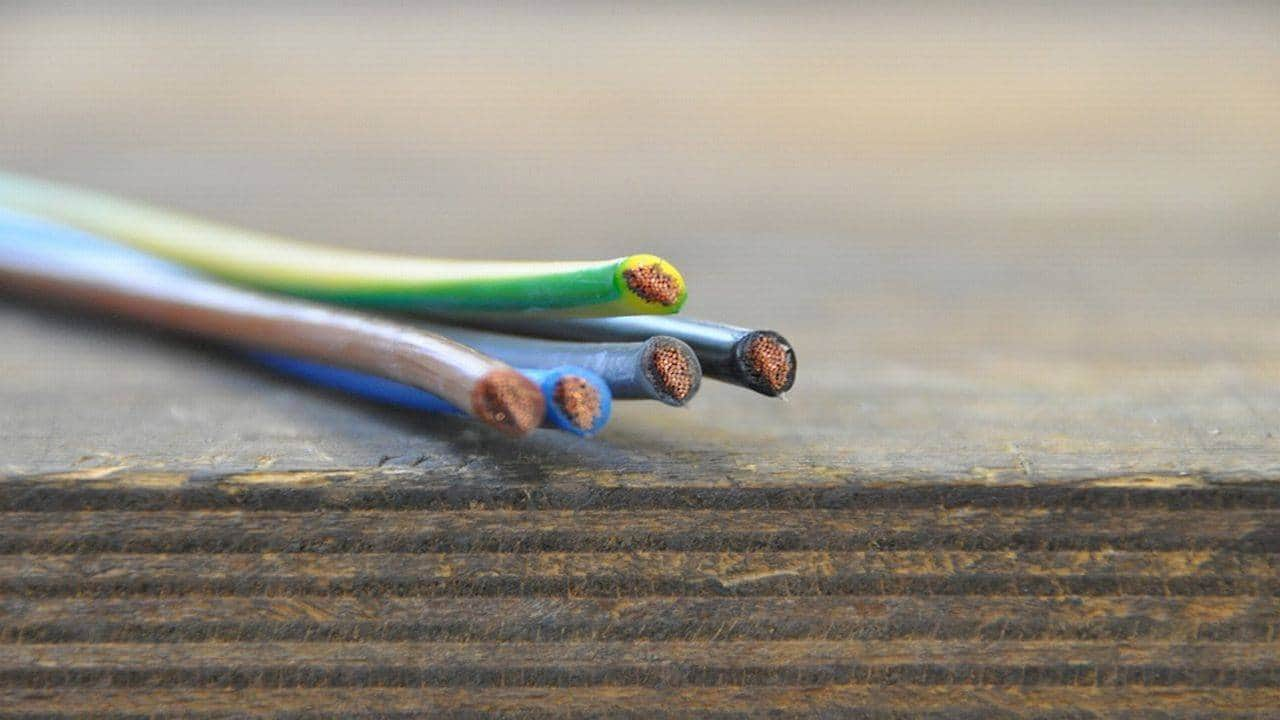

Polycab | CMP: Rs 2,530 | The stock fell 1.6 percent after 16.13 lakh shares, which is 1.1 percent stake in the company, worth Rs 406.6 crore changed hands at an average price of Rs 2,520 a share.

8/11

Nykaa | CMP: Rs 192 | FSN E-Commerce Ventures, which operates Nykaa, recorded two block trades on November 18 in which around 54.2 million shares, or 1.9 percent stake in the company, changed hands, according to Bloomberg. The stock gained 3.6 percent after the deals. Citigroup had a day earlier launched a block to sell shares in the cosmetics-to-fashion retailer worth Rs 1,000 crore on behalf of TPG Capital.

9/11

Paytm | CMP: Rs 546.40 | The stock gained 1.22 percent after foreign portfolio investors BofA Securities Europe, Morgan Stanley, and Societe Generale picked a 2.79 percent stake in the company a day earlier.

10/11

Interglobe Aviation | CMP: Rs 1,779.05 | The stock gained 2 percent. Morgan Stanley has an "overweight" call on the stock, with the target at Rs 2,749 a share. “The company’s management highlighted that yields in Q3FY23-to-date are well above Q1 levels. Domestic traffic is back to pre-Covid levels. And, international travel will be next leg of growth for the airline,” the brokerage said.

11/11

Bajaj Healthcare | CMP: Rs 399.10 | The stock gained 1.24 percent. The US FDA conducted a pre-approval inspection of the company’s API facility located at Vadodara, Gujarat from November 14 to November 17. The inspection was completed successfully with zero observations, the company said.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!