Diwali 2022: Havells, Axis Bank, Laurus Labs, Coforge among top Muhurat Picks

Muhurat picks: ICICIdirect recommends Axis Bank, City Union Bank, Apollo Tyres, Eicher Motors, Coforge, Lemon Tree Hotels, Healthcare Global Enterprises, Laurus Labs, Container Corp and Havells India. Check out the buying range and target price

1/11

Year 2022 has been marked by volatility on account of a wide variety of global news flow ranging from geopolitical issues, higher inflation (mainly food and energy) and hawkish action of central banks. Amid all this negativity, India has relatively outperformed global peers in terms of all economic parameters, said ICICIdirect. "We believe Corporate India will likely deliver earnings growth in excess of 15% over the next two years given the current economic milieu and provide a plethora of investing opportunities in Indian markets. Our one year forward, Nifty target is at 19,425 (21x FY24 EPS) with a sectoral bias towards banks, capital goods/infrastructure and autos, avoiding sectors having more global exposure like IT, oil & gas and metals," broking house added. Here are the 10 muhurat picks that can bear results in the year ahead:

2/11

Axis Bank | Buying Range: Rs 780-815 | Target: Rs 970 | Potential Upside: 22 percent

3/11

City Union Bank | Buying Range: Rs 170-185 | Target: Rs 215 | Potential Upside: 17 percent

4/11

Apollo Tyres | Buying Range: Rs 260-275 | Target: Rs 335 | Potential Upside: 25 percent

5/11

Eicher Motors | Buying Range: Rs 3,300-3,480 | Target: Rs 4,170 | Potential Upside: 23 percent

6/11

Coforge | Buying Range: Rs 3,520-3,680 | Target: Rs 4,375 | Potential Upside: 22 percent

7/11

Lemon Tree Hotels | Buying Range: Rs 78-88 | Target: Rs 110 | Potential Upside: 29 percent

8/11

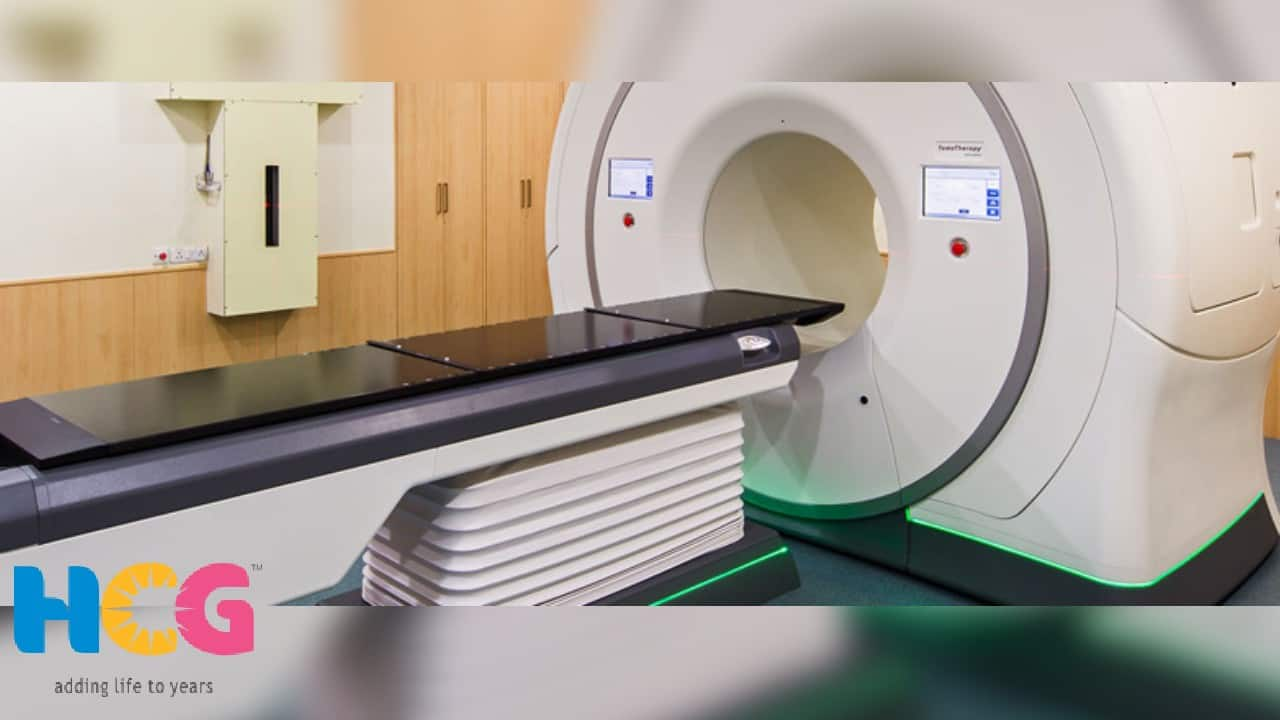

Healthcare Global Enterprises | Buying Range: Rs 285-305 | Target: Rs 345 | Potential Upside: 17 percent

9/11

Laurus Labs | Buying Range: Rs 485-510 | Target: Rs 675 | Potential Upside: 34 percent

10/11

Container Corporation | Buying Range: Rs 685-715 | Target: Rs 890 | Potential Upside: 28 percent

11/11

Havells India | Buying Range: Rs 1,220-1,320 | Target: Rs 1,650 | Potential Upside: 29 percent

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!