Not just saving tax, these top ELSS schemes are also generating wealth

The 3-year lock-in helps fund managers to have a slightly larger portion of small and mid-cap stocks as it prevents a gush of outflows that can be seen in other diversified equity funds.

1/11

Should you withdraw from your tax-saving funds (ELSS or Equity-Linked Savings Schemes) after the mandatory 3-year lock-in period? Investments in ELSS up to Rs 1.5 lakh gets you income-tax deduction benefits. But fund managers and financial advisors have often nudged investors to use ELSS for wealth creation as well, and not just for tax-savings. Data shows that ELSS have proved to be just as beneficial as any diversified equity fund over the long run, say for 7-10 years. Performance as measured by 10-year rolling returns that calculated from the last twelve years’ NAV history shows that the ELSS category delivered a compounded annualised return of 12.8% while the Nifty 500 – TRI clocked 11.9%. Two of these schemes are in MC30; a curated basket of 30 best mutual fund (MF) schemes. Below are the top ELSS schemes that outperformed the barometer indices in most of the period over the last ten years while taking minimal risk.

2/11

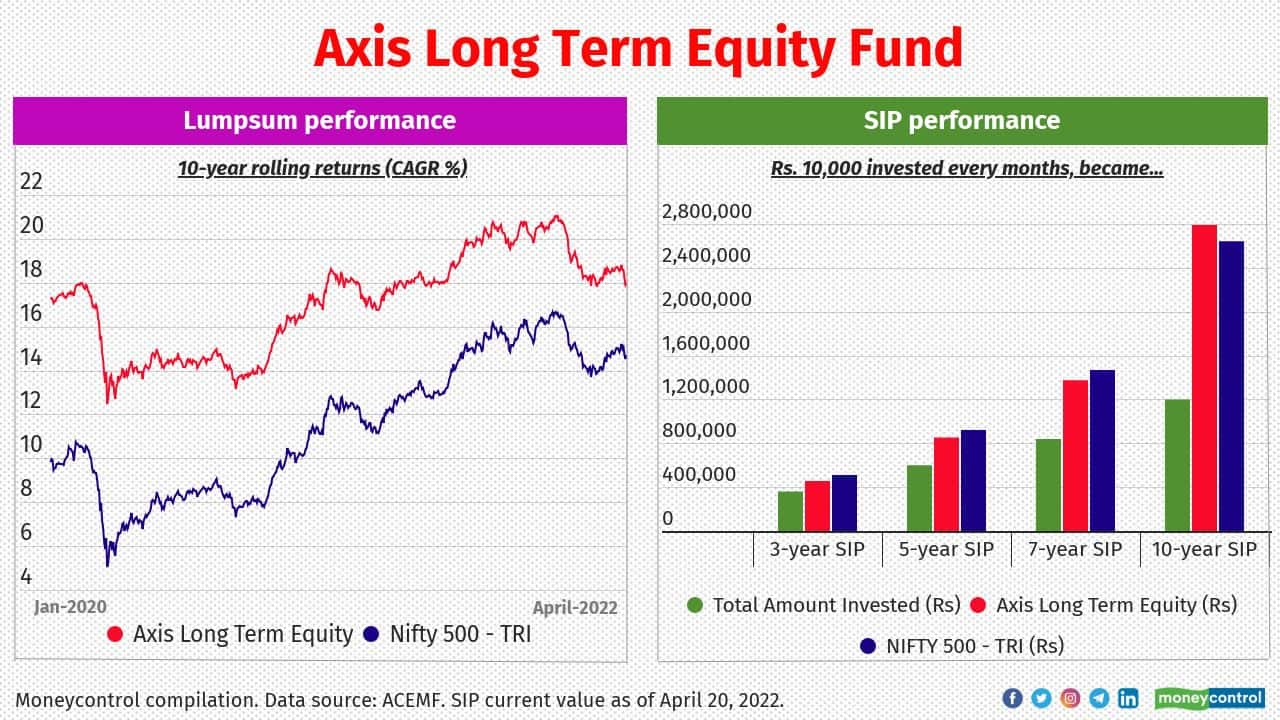

The biggest fund in the ELSS category, with over ₹32,052 crore in assets (as of March 2022), Axis Long-Term Equity has continued with its steady outperformance over its peers and benchmark since its launch. Its performance, as measured by 10-year rolling returns calculated from the past twelve years’ NAV history, shows that the scheme has delivered a compounded annualised growth rate (CAGR) of 17 percent. The fund has a reasonably concentrated portfolio across sectors.

3/11

DSP Tax Saver has been one of the few funds that retained their position in the first and second quartiles in most of the time frames. The performance of the fund has been notable, especially in the market downturns. Performance as measured by 10-year rolling returns calculated from the past twelve years’ NAV history shows that the scheme has delivered 14.6 percent CAGR. It has been maintaining a fairly diversified portfolio.

4/11

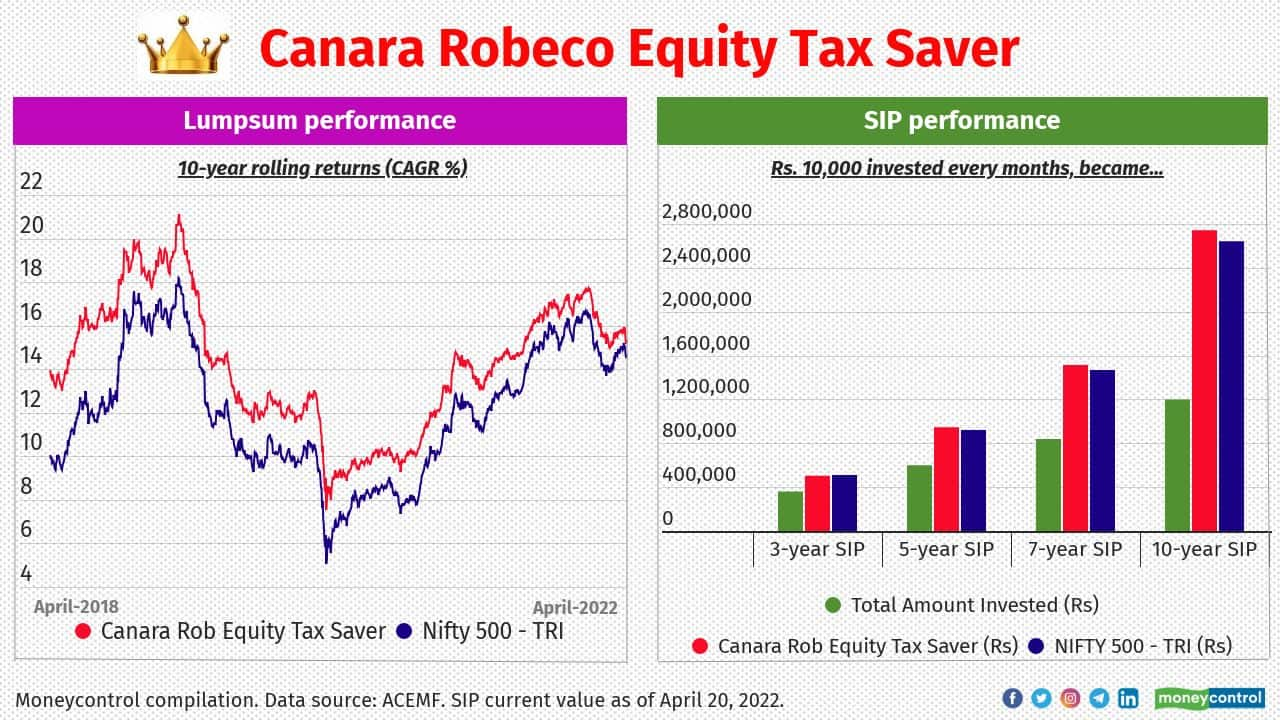

Canara Rob Equity Tax Saver has been part of MC30 basket thanks to its consistency on generating better return while taking relatively lower risk. Its 10-year average rolling return calculated from the past twelve years’ NAV history was 13.5 percent. Unlike the peers, it has a high churning history that helped adopt the prevailing trends in the market to maximize the return.

5/11

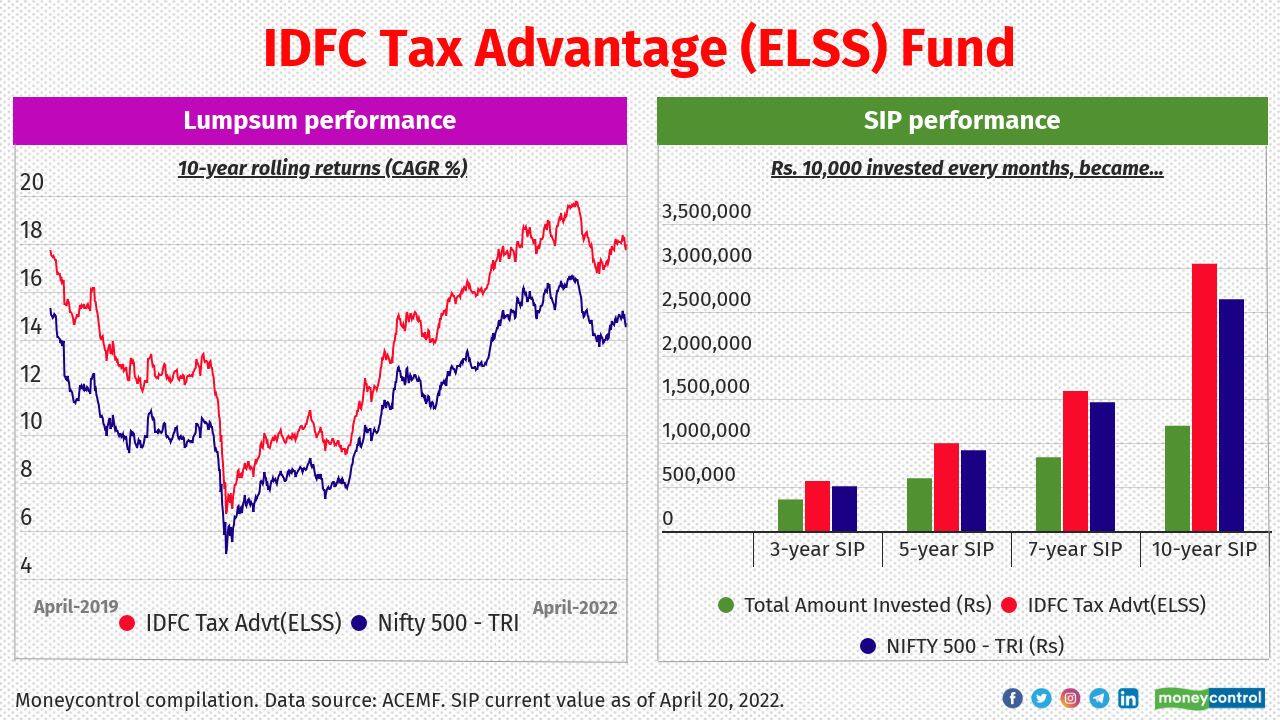

IDFC Tax Advt(ELSS) Fund has been the one allocating higher to the mid and smallcap stocks. It helped spice-up returns in rallies. The 10-year rolling returns calculated from the past twelve years’ NAV history shows that it has delivered 14.3 percent CAGR.

6/11

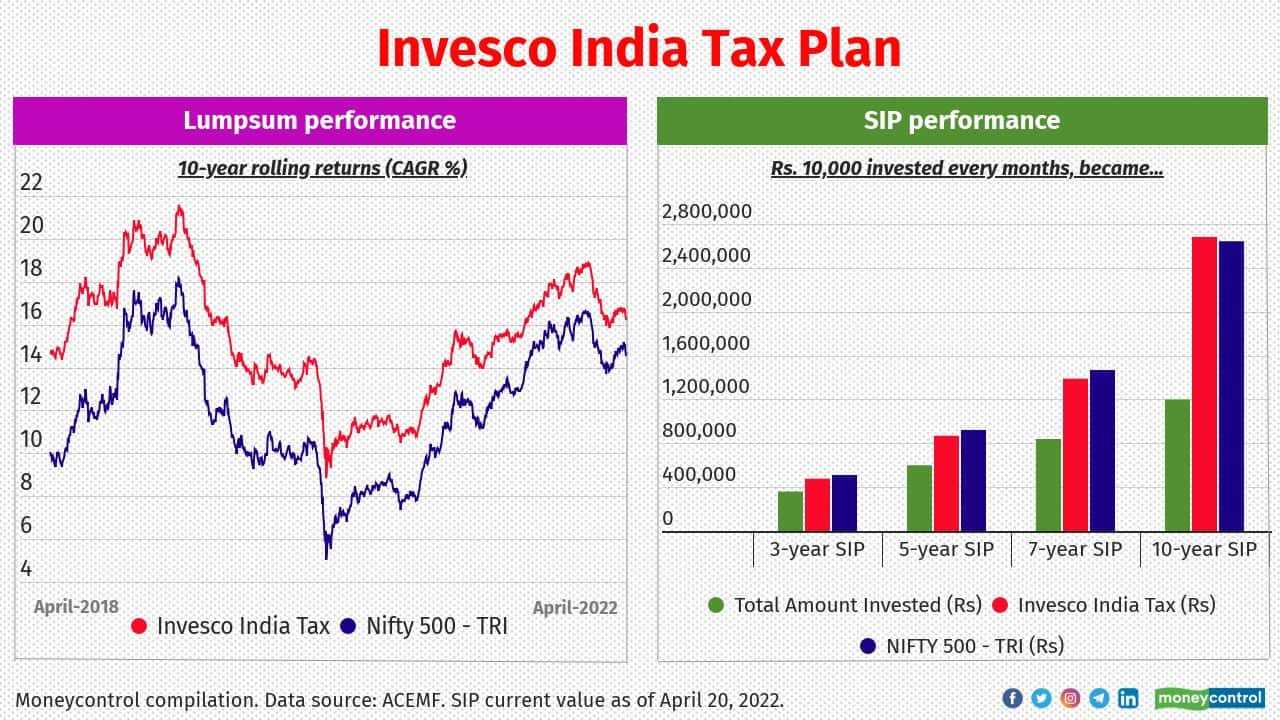

Though Invesco India Tax follows flexicap approach, it tilts towards largecap stocks. At least two-third of the portfolio has been invested in the high quality bluechip stocks. This helped to deliver a balanced return over periods. The 10-year rolling returns calculated from the past twelve years’ NAV history shows that it has delivered a CAGR of 14.5 percent.

7/11

A true flexicap fund that juggles among large, mid and smallcap stocks actively, Tata India Tax Savings has been one of the consistent performers among the ELSS. Its 10-year average rolling return calculated from the past twelve years’ NAV history was 13.7 percent.

8/11

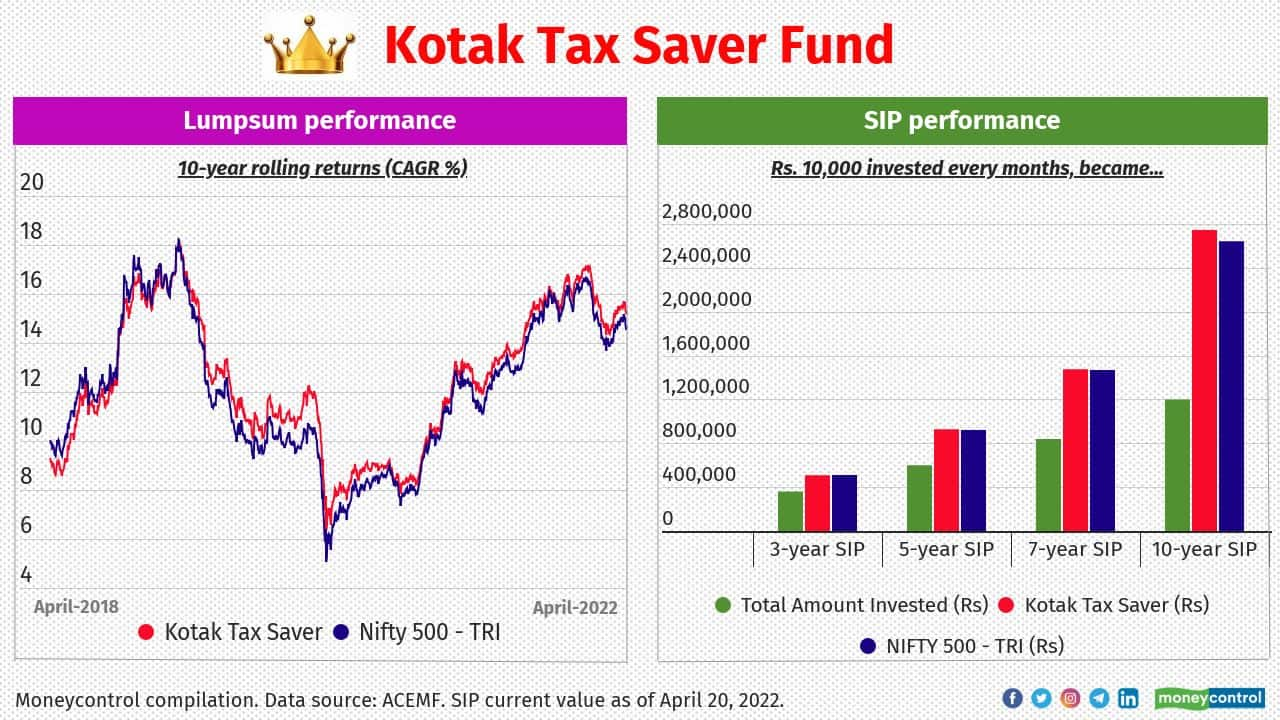

Part of MC30, Kotak Tax Saver has been the decent performer across market cycles and paces. Prudent stock selection has helped the scheme to deliver better return over long run. Its 10-year average rolling return calculated from the past twelve years’ NAV history was 12.7 percent.

9/11

Relatively higher allocation to largecap stocks over the last four years resulted in delivering slightly lower return among peers. However, it has been a decent performer over the long run. Its 10-year average rolling return calculated from the past twelve years’ NAV history was 13 percent.

10/11

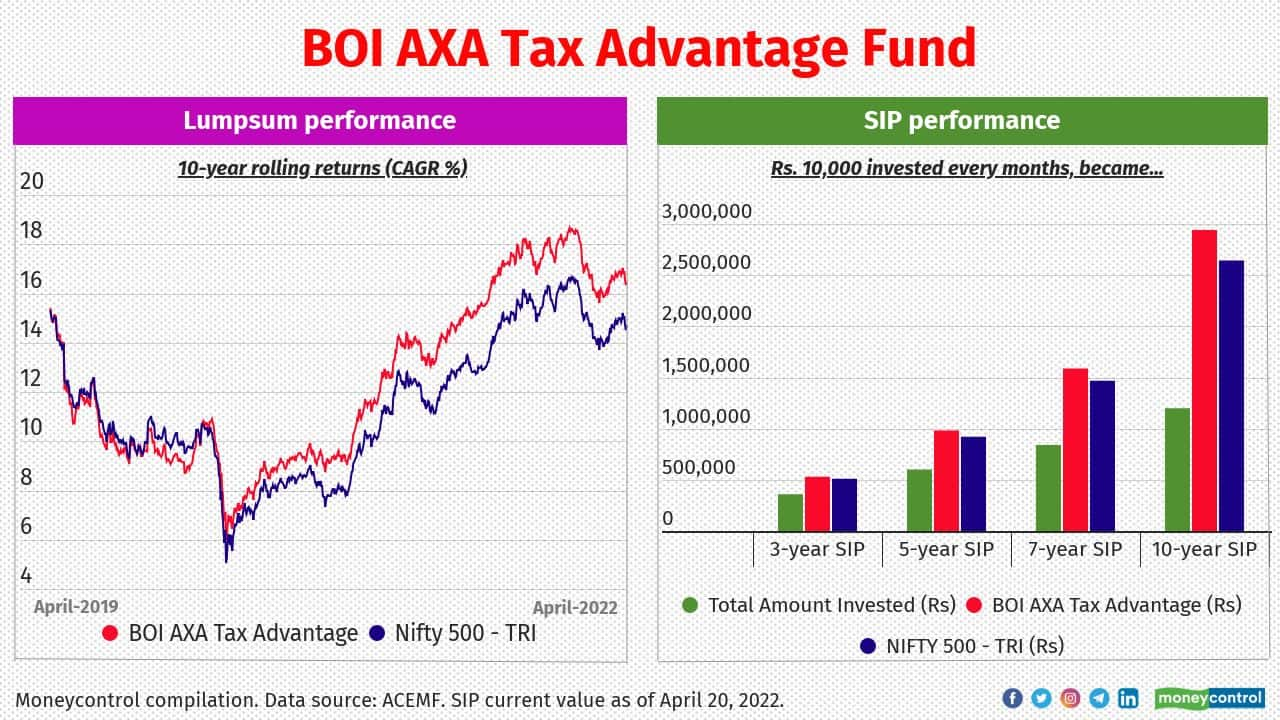

BOI AXA Tax Advantage has been one of the schemes with higher allocation to mid and smallcap stocks over the last five years. It helped to add extra return to the investors. Its 10-year average rolling return calculated from the past twelve years’ NAV history was 13.5 percent.

11/11

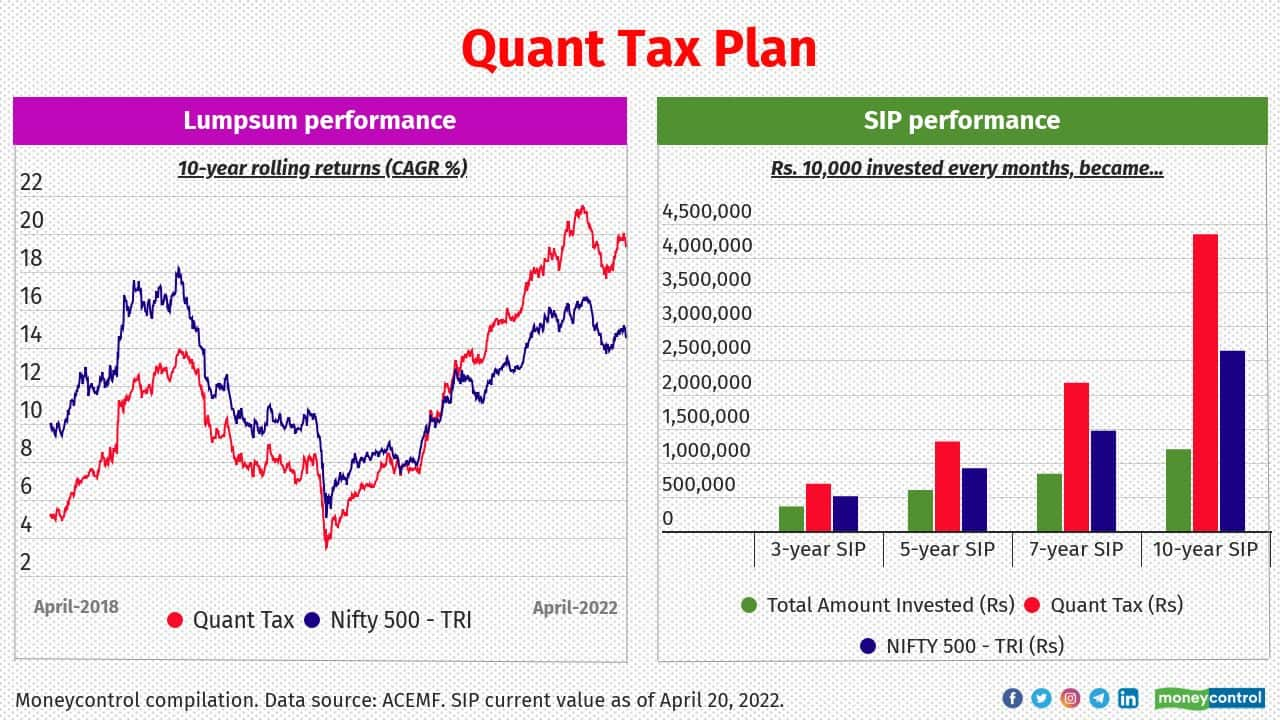

With highest churning ratio (an average of 428% over the last three years), Quant Tax Plan has bucked the market trends efficiently and paid off its investors well. However, its performance in the earlier years was not upto the mark. Its 10-year average rolling return calculated from the past twelve years’ NAV history was 13.5 percent.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!