Best stock picks for NPS-II when low volatility and flexibility matter the most

NPS- II is among the best kept secrets in the National Pension Scheme architecture. Only those investors with a NPS-1 account can open a NPS-2 account. Ten NPS managers offer Tier – II equity funds investing predominantly in the large-cap stocks. Expect a high degree of safety from NPS stock picking

1/11

National Pension System (NPS) is more popularly known as a retirement-focused investment that aims to give you a lump sum when you retire, and some pension. But if that sounds too long a wait, NPS has an answer; the NPS-2 scheme. This is a more flexible investment variant of NPS 1. It provides flexibility to add and withdraw money at any time. Like Tier – I account, the Tier – II account also provides the fund options to the subscribers such as equity (E), Government Bond (G) and Corporate Debt (C). A new fund option called ‘scheme tax saver’ was recently introduced under Tier – II account for central government employees. These funds score over mutual funds on cost. For instance, the maximum fund management fee for NPS equity schemes is 0.09 percent per annum, which is lower than that of the direct equity mutual funds that levy between 0.3 to 1 percent. Sumit Shukla - MD & CEO - Axis pension fund, says, “NPS Tier – II is the best and the cheapest equity investment option available as the total charges taken is less then 20 basis points with a choice to have 100% invested in equity”.

2/11

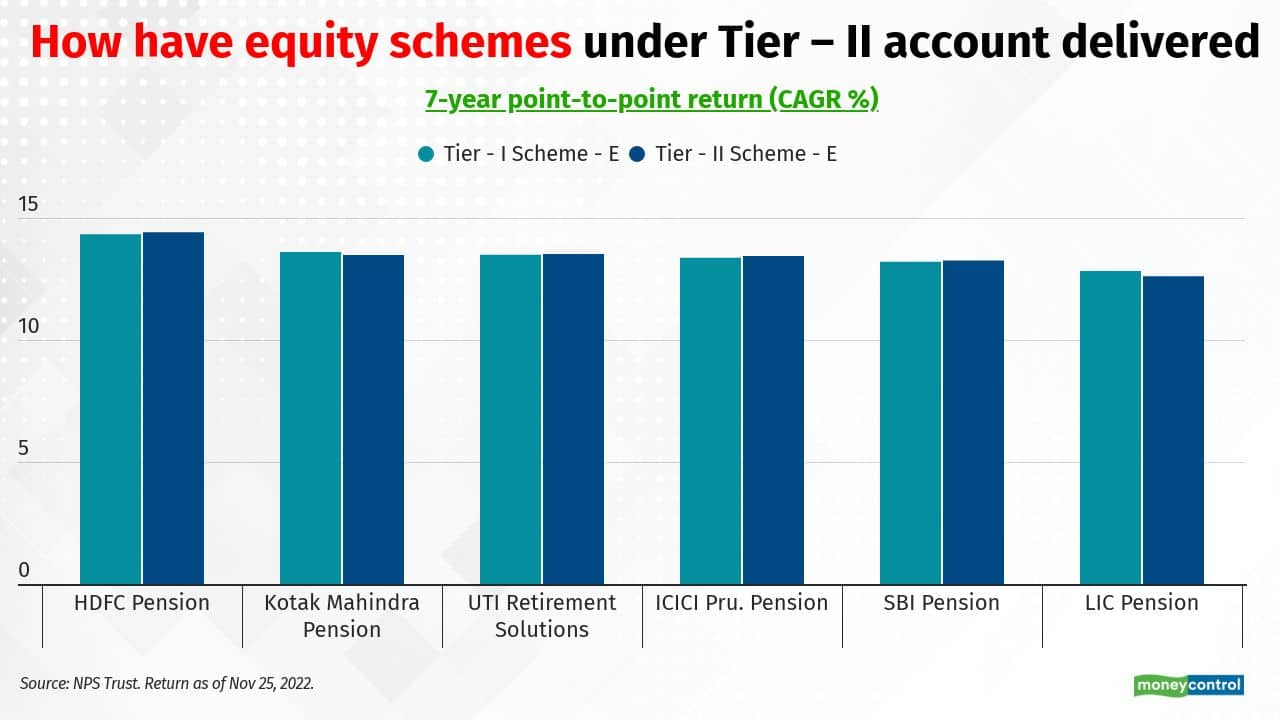

Fund options provided under Tier – I and Tier – II are managed with different portfolio. The total Assets Under management (AUM) of the equity schemes provided under Tier – I as of October 2022 was Rs 39,337 crore while for equity schemes under Tier – II equity schemes it was only Rs 1,678 crore. The equity schemes under the Tier – II account follow a similar investment approach that of the Tier – I account and investing mainly in the top 200 listed companies. The portfolio holdings are almost similar between the equity schemes of Tier – I and Tier – II of the respective NPS managers because both portfolios largely focus on the 200 largest stocks by market capitalisation. However, the weightage of individual stocks within their portfolios are different. Hence, the returns between a Tier 1 and Tier 2 variant of any pension fund house is largely similar. Due to the similar holdings, the returns from these schemes have also been similar. Here are the top ten stocks holdings of respective nine NPS managers (portfolio of newly launched Axis NPS has not yet been available) in the portfolio of Scheme-E under Tier- II account. Portfolio data as on October 31, 2022.

3/11

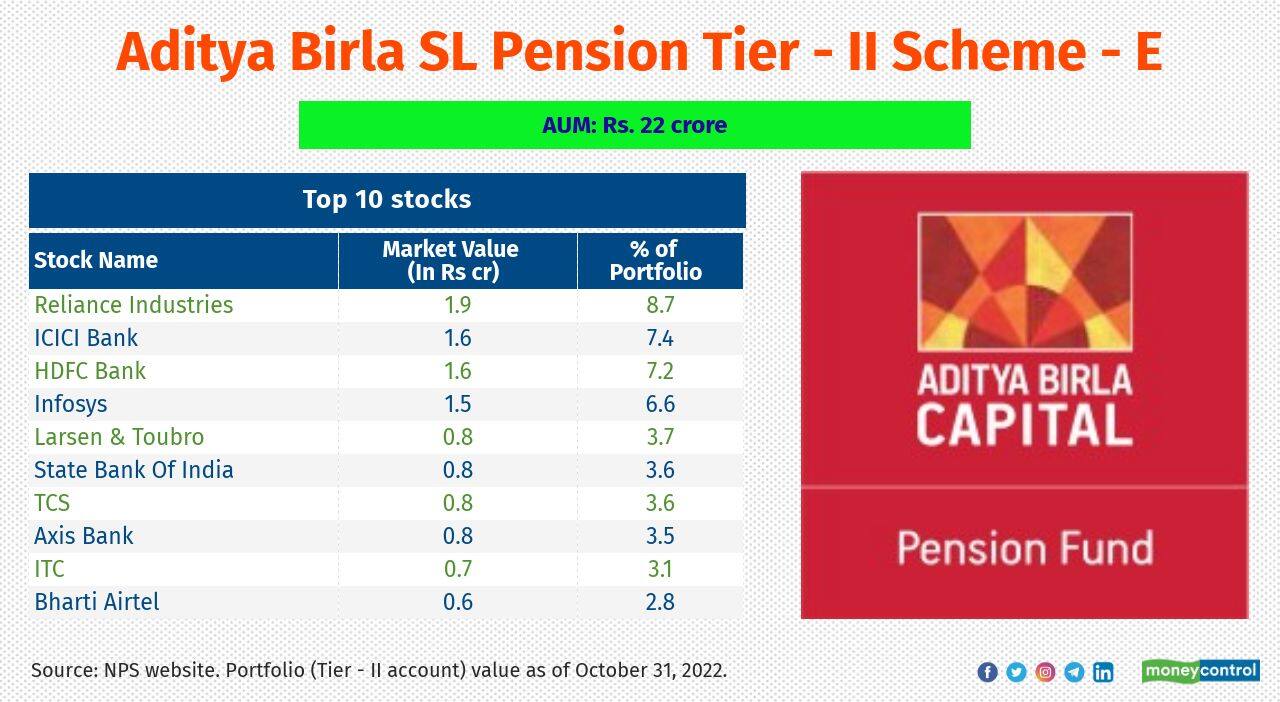

Aditya Birla SL Pension Tier - II Scheme – E

5-year return (CAGR): 11.9%

Top 3 sectors: Oil &Gas, Banks & Finance and Infrastructure

5-year return (CAGR): 11.9%

Top 3 sectors: Oil &Gas, Banks & Finance and Infrastructure

4/11

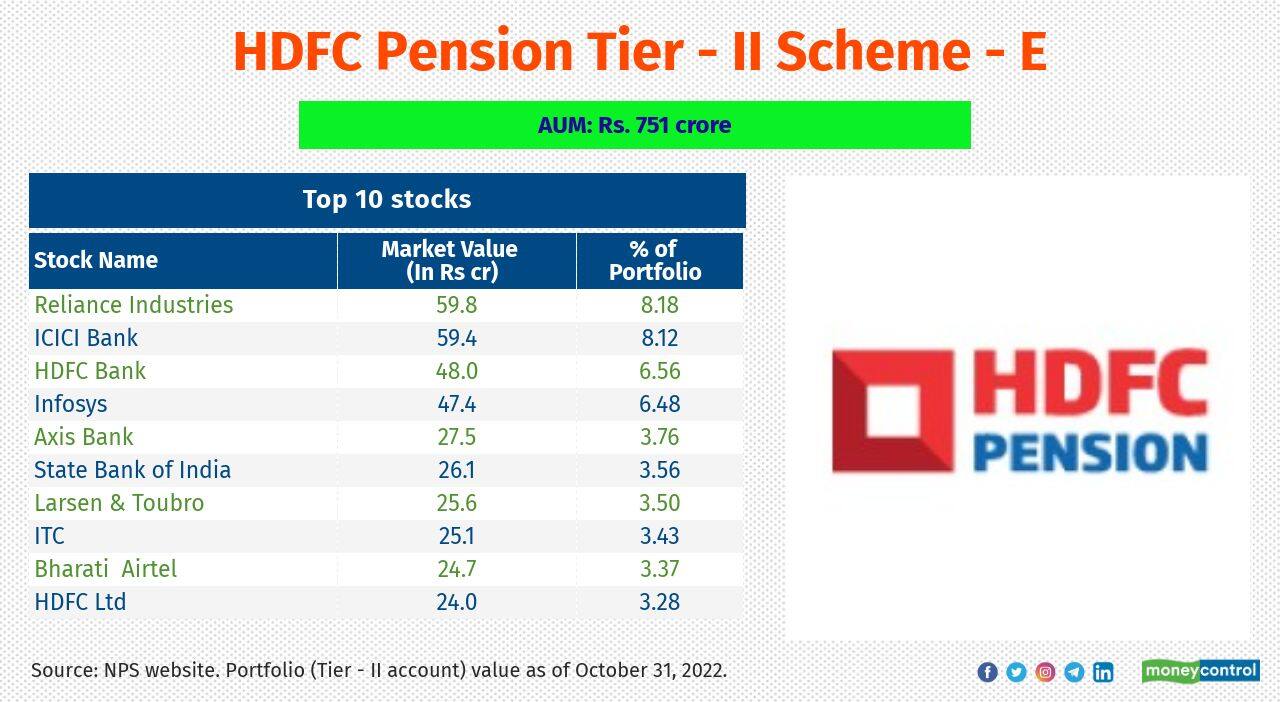

HDFC Pension Tier - II Scheme – E

5-year return (CAGR): 12.8%

Top 3 sectors: Banks, petroleum and Software

5-year return (CAGR): 12.8%

Top 3 sectors: Banks, petroleum and Software

5/11

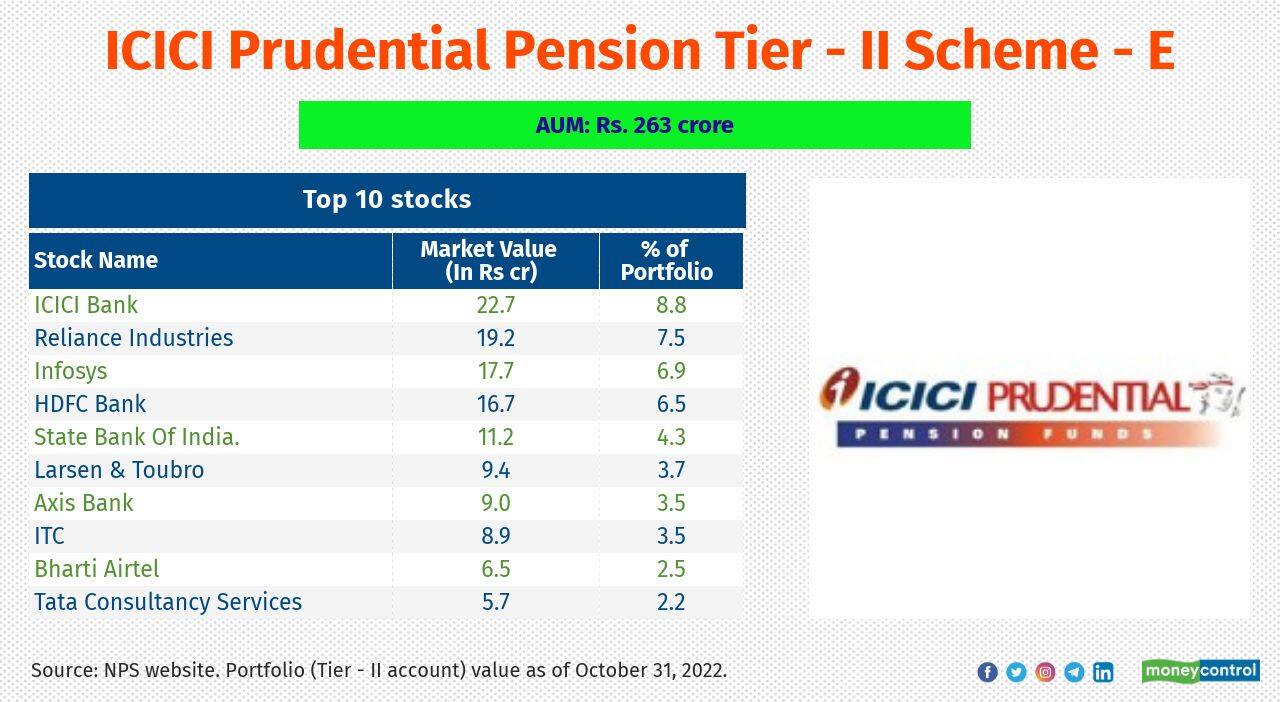

ICICI Prudential Pension Tier - II Scheme – E

5-year return (CAGR): 12.3%

Top 3 sectors: Banks, Software and petroleum

5-year return (CAGR): 12.3%

Top 3 sectors: Banks, Software and petroleum

6/11

Kotak Mahindra Pension Tier - II Scheme – E

5-year return (CAGR): 11.7%

Top 3 sectors: Banks, Software and petroleum

5-year return (CAGR): 11.7%

Top 3 sectors: Banks, Software and petroleum

7/11

LIC Pension Tier - II Scheme – E

5-year return (CAGR): 11.5%

Top 3 sectors: Banks, Software and Oil & Gasx

5-year return (CAGR): 11.5%

Top 3 sectors: Banks, Software and Oil & Gasx

8/11

Max Life Pension Tier - II Scheme – E

5-year return (CAGR %): NA

Top 3 sectors: Banks, FMCG and Software

5-year return (CAGR %): NA

Top 3 sectors: Banks, FMCG and Software

9/11

SBI Pension Tier - II Scheme – E

5-year return (CAGR): 11.8%

Top 3 sectors: Banks, Software and petroleum

5-year return (CAGR): 11.8%

Top 3 sectors: Banks, Software and petroleum

10/11

Tata Pension Tier - II Scheme – E

5-year return (CAGR %): NA

Top 3 sectors: Financial Services, FMCG and Healthcare

5-year return (CAGR %): NA

Top 3 sectors: Financial Services, FMCG and Healthcare

11/11

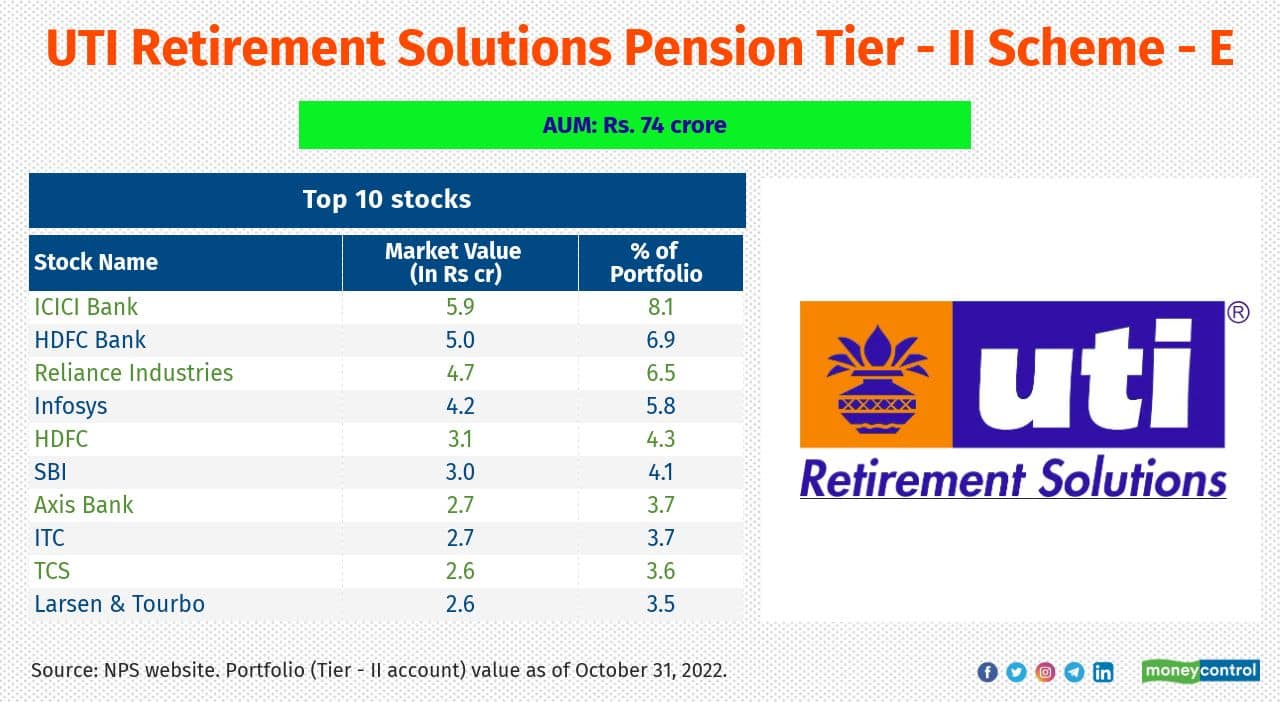

UTI Retirement Solutions Pension Tier - II Scheme – E

5-year return (CAGR): 12.1%

Top 3 sectors: Banks, Software and petroleum

5-year return (CAGR): 12.1%

Top 3 sectors: Banks, Software and petroleum

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!