The magic of long-term investing: These PMS strategies deliver up to 23% annual returns through 10 years

Most have held major allocation to mid- and small-cap stocks and followed a concentrated investment approach

1/13

Equity, as an investment asset class, has not disappointed investors who stay invested for the long term. Portfolio management services (PMS) strategies too have rewarded long-term investors handsomely. Here, we list the top PMS strategies in terms of their returns over the last 10 years, as per data from PMSBazaar.com. Most in the list have held major allocation to mid- and small-cap stocks. Returns displayed here are as per the Securities and Exchange Board of India-defined time-weighted rate of return (TWRR) method. Returns and portfolio values are as of October 31, 2022. The cash component is not mentioned in the break-up below to round it off to 100%. Source: PMSBazaar.

2/13

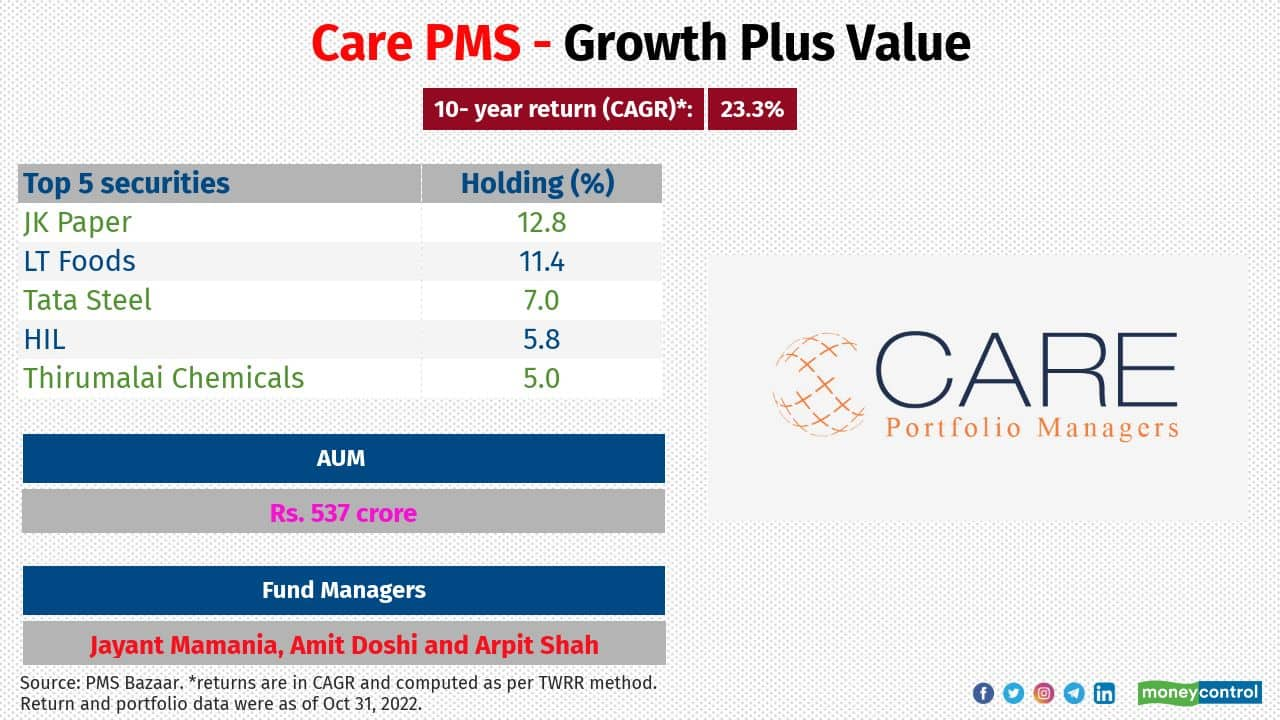

Care PMS - Growth Plus Value

Category: Small & Midcap

Inception date: July, 19, 2011

Large, mid- and small-cap stocks breakup (%): 16:1:76

Investment attributes: This strategy follows a bottom-up approach to identify companies with growth potential, strong financials and good management with attractive valuations. It is agnostic to sectors and market cap

Category: Small & Midcap

Inception date: July, 19, 2011

Large, mid- and small-cap stocks breakup (%): 16:1:76

Investment attributes: This strategy follows a bottom-up approach to identify companies with growth potential, strong financials and good management with attractive valuations. It is agnostic to sectors and market cap

3/13

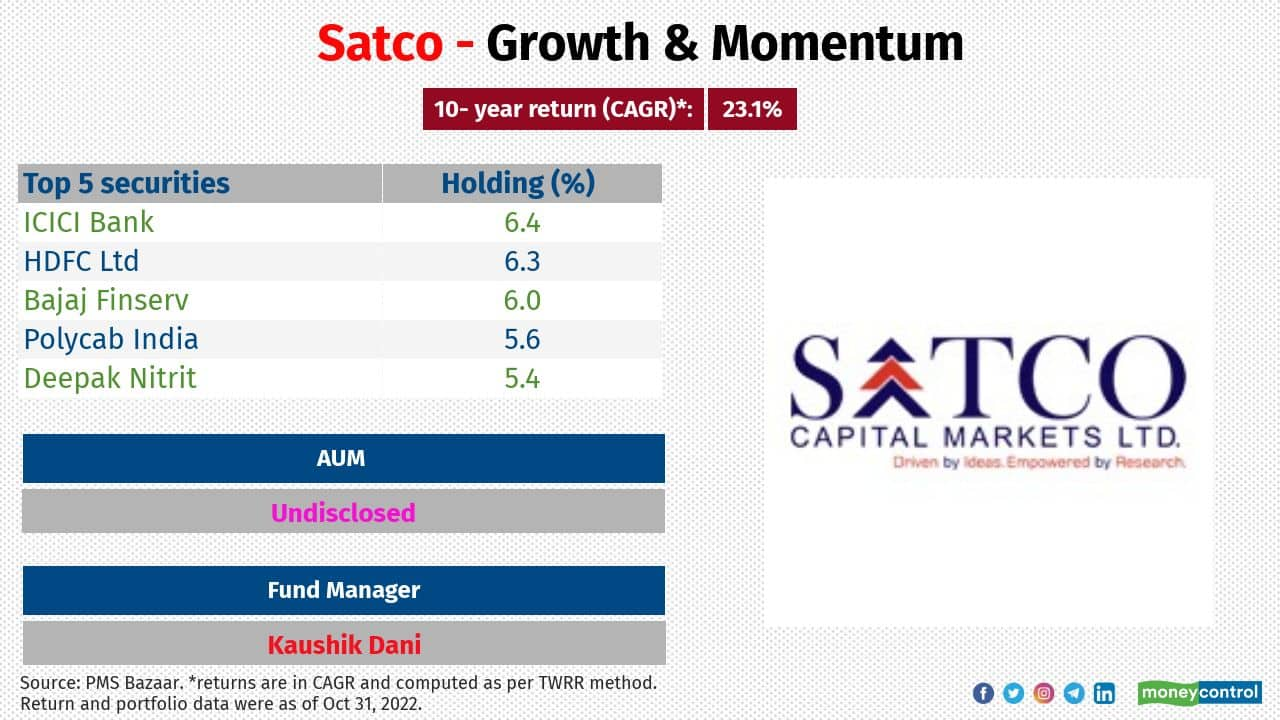

Satco - Growth & Momentum

Category: Multi-cap

Inception date: January 1, 2012

Large-, mid- and small-cap stocks breakup (%): 25:38:27

Investment attributes: It holds a concentrated portfolio of a maximum of 25 stocks across market capitalisation. It is low on churning ratio

Category: Multi-cap

Inception date: January 1, 2012

Large-, mid- and small-cap stocks breakup (%): 25:38:27

Investment attributes: It holds a concentrated portfolio of a maximum of 25 stocks across market capitalisation. It is low on churning ratio

4/13

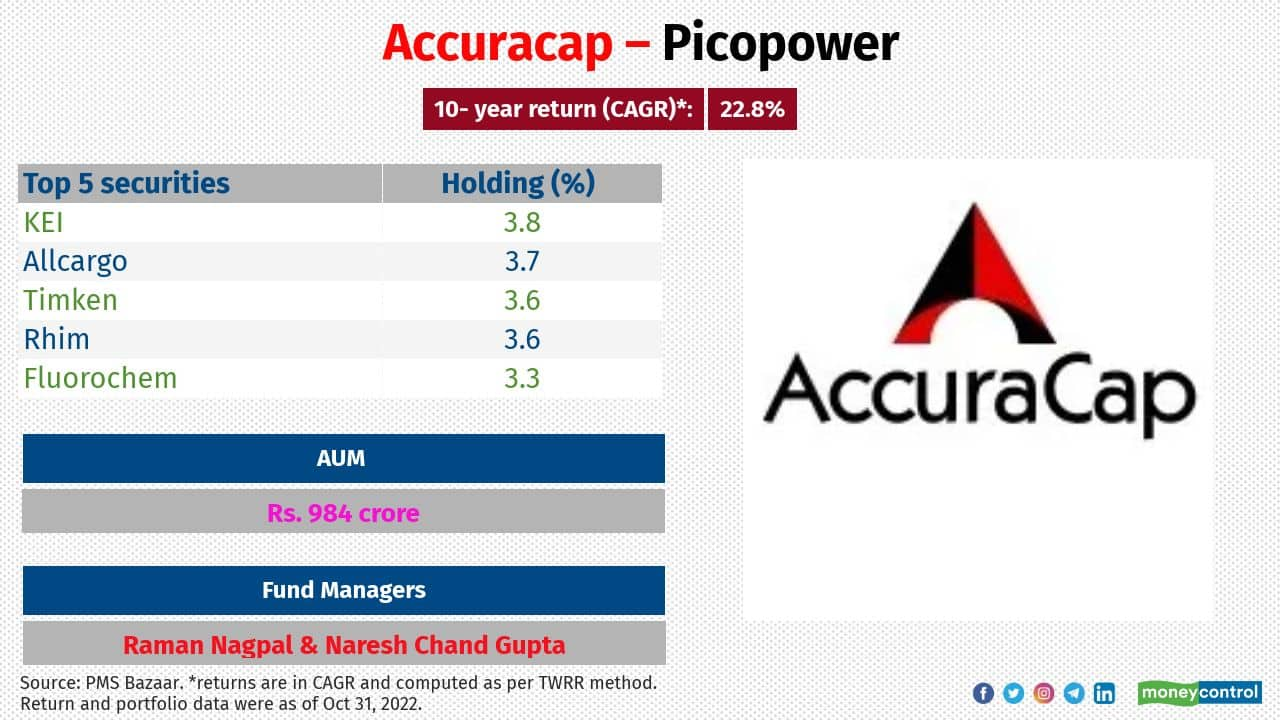

Accuracap – Picopower

Category: Small & Midcap

Inception date: October 10, 2011

Large-, mid- and small-cap stocks breakup (%): 0:23:62

Investment attributes: It is a small-cap-oriented plan that selects stocks using artificial intelligence. It avoids public sector and initial public offering stocks and follows a buy-and-hold strategy, and rebalances the portfolio once a year

Category: Small & Midcap

Inception date: October 10, 2011

Large-, mid- and small-cap stocks breakup (%): 0:23:62

Investment attributes: It is a small-cap-oriented plan that selects stocks using artificial intelligence. It avoids public sector and initial public offering stocks and follows a buy-and-hold strategy, and rebalances the portfolio once a year

5/13

Bellwether Capital - Long Term Growth

Category: Multi-cap

Inception date: April 23, 2004

Large-, mid- and small-cap stocks breakup (%): Undisclosed

Investment attributes: It holds a concentrated portfolio of 12-15 stocks

Category: Multi-cap

Inception date: April 23, 2004

Large-, mid- and small-cap stocks breakup (%): Undisclosed

Investment attributes: It holds a concentrated portfolio of 12-15 stocks

6/13

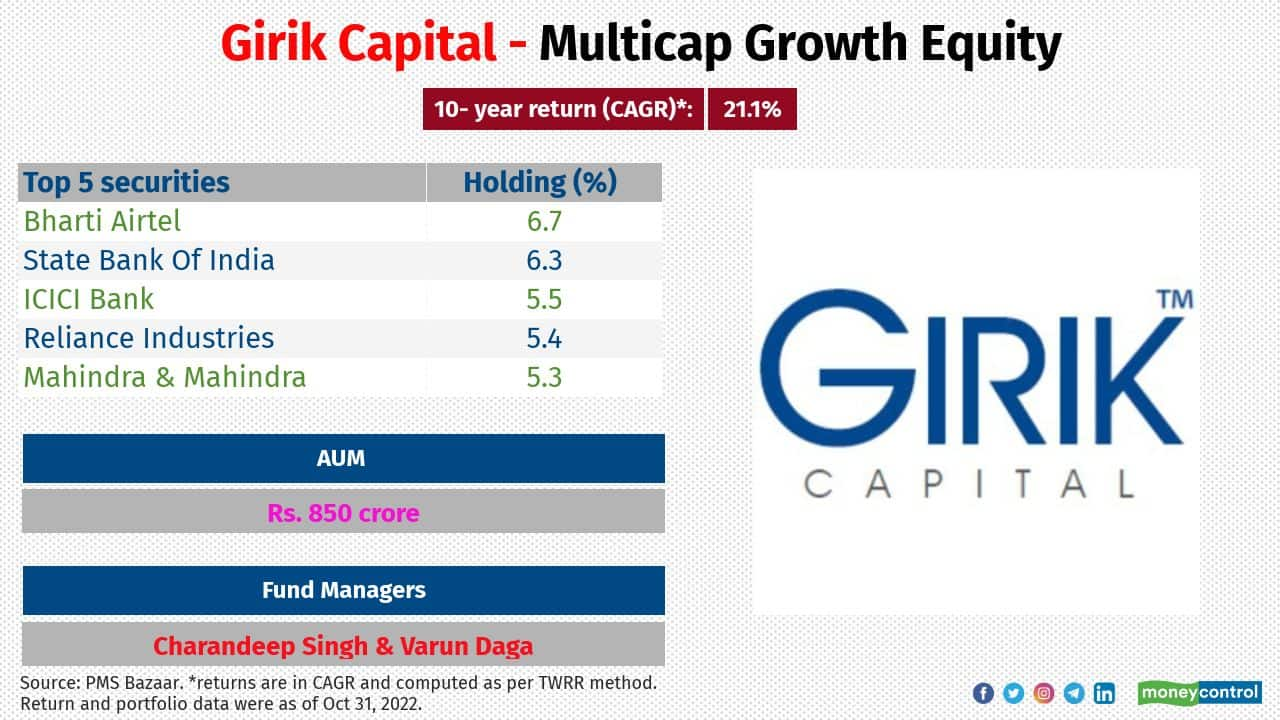

Girik Capital - Multicap Growth Equity

Category: Multi-cap

Inception date: December 3, 2009

Large-, mid- and small-cap stocks breakup (%): 56:14:22

Investment attributes: It aims to identify “early leaders or winners” much ahead of their largest earnings growth curve

Category: Multi-cap

Inception date: December 3, 2009

Large-, mid- and small-cap stocks breakup (%): 56:14:22

Investment attributes: It aims to identify “early leaders or winners” much ahead of their largest earnings growth curve

7/13

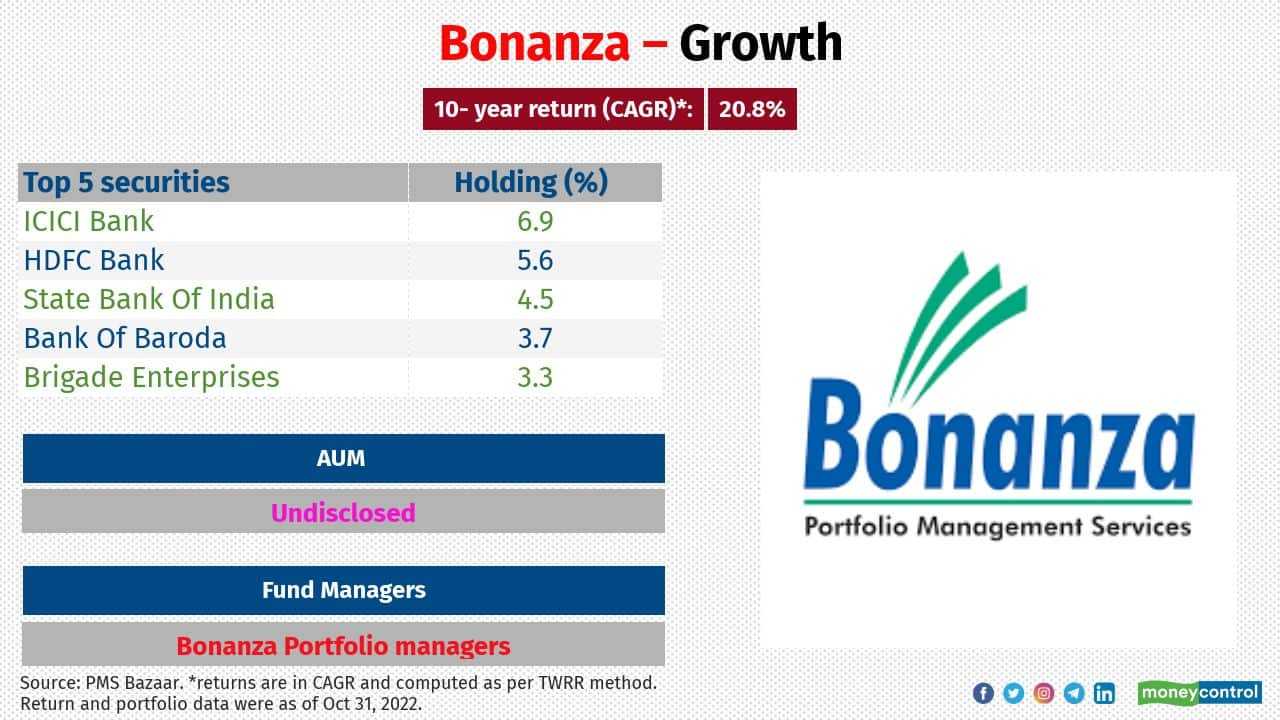

Bonanza – Growth

Category: Large & mid-cap

Inception date: April 6, 2010

Large-, mid- and small-cap stocks breakup (%): 50:20:6

Investment attributes: It chooses stocks with excellent growth records but is currently on a high growth and momentum trajectory

Category: Large & mid-cap

Inception date: April 6, 2010

Large-, mid- and small-cap stocks breakup (%): 50:20:6

Investment attributes: It chooses stocks with excellent growth records but is currently on a high growth and momentum trajectory

8/13

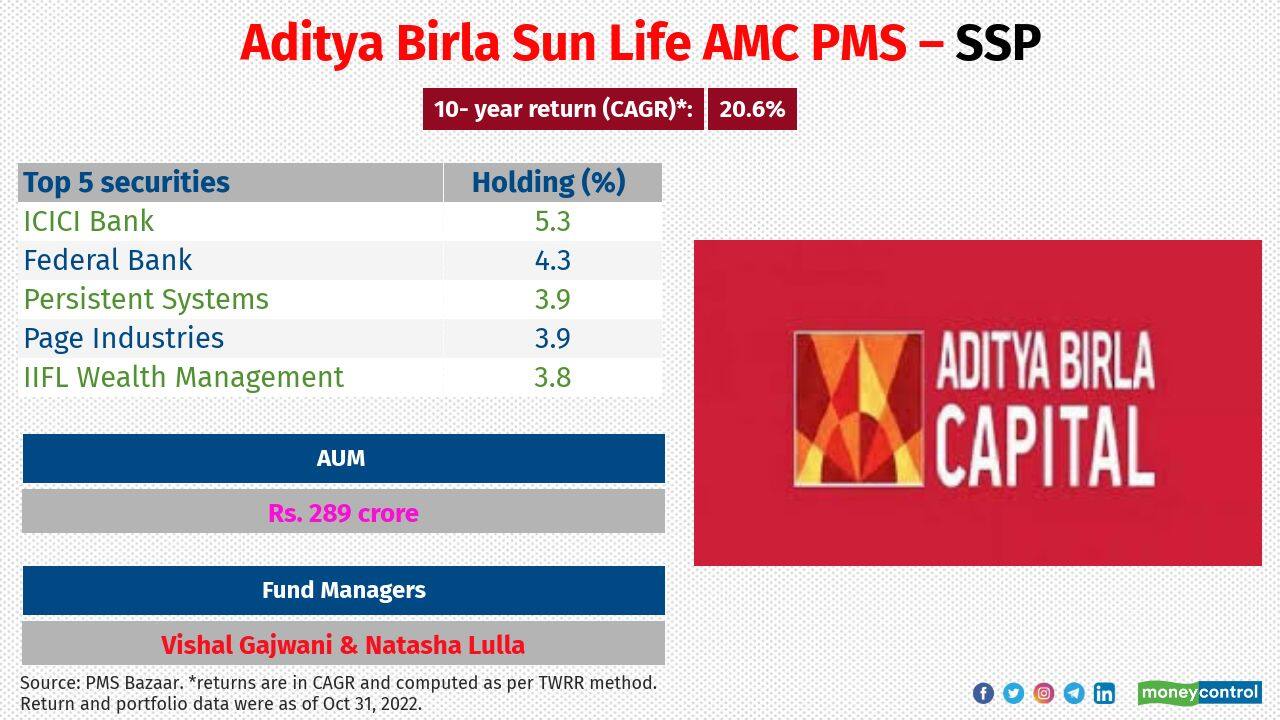

Aditya Birla Sun Life AMC PMS – SSP

Category: Small & Midcap

Inception date: October 6, 2009

Large-, mid- and small-cap stocks breakup (%): 12:44:38

Investment attributes: The objective of SSP is to create long-term wealth creation in focused sectors where 80 percent of the portfolio is invested in 4 to 6 sectors with effective screener to identify future winners

Category: Small & Midcap

Inception date: October 6, 2009

Large-, mid- and small-cap stocks breakup (%): 12:44:38

Investment attributes: The objective of SSP is to create long-term wealth creation in focused sectors where 80 percent of the portfolio is invested in 4 to 6 sectors with effective screener to identify future winners

9/13

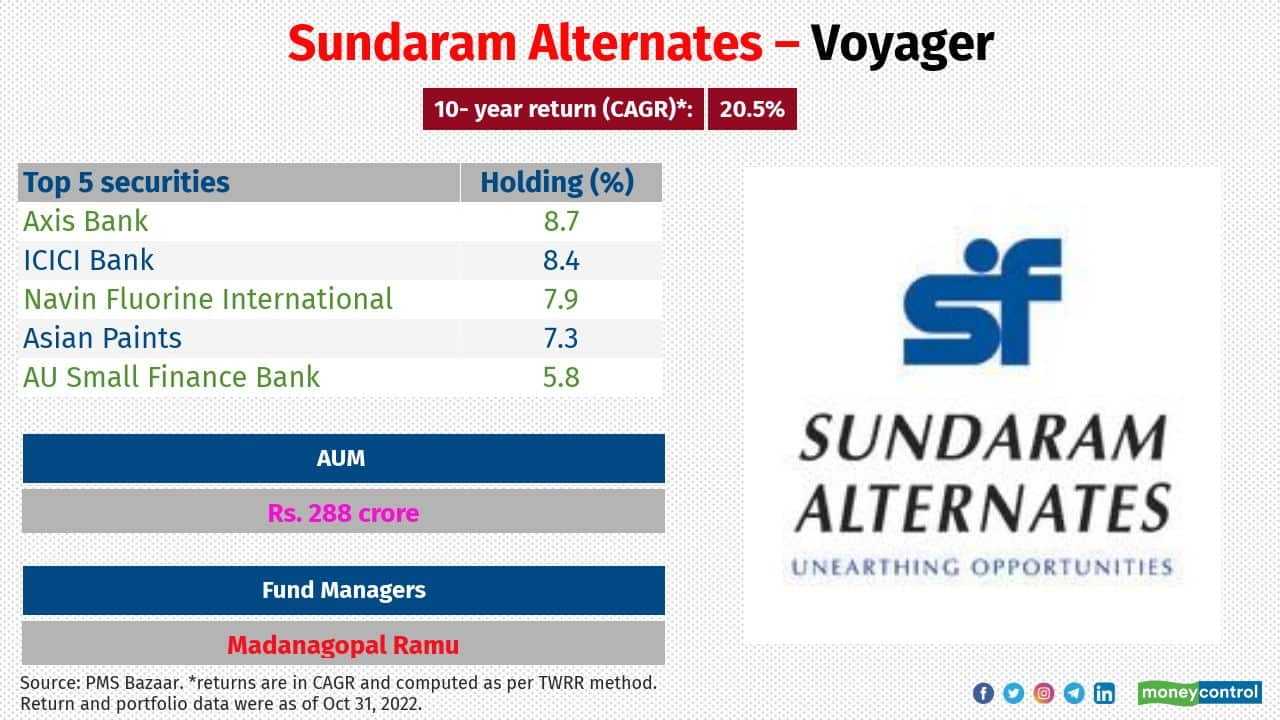

Sundaram Alternates – Voyager

Category: Multi-cap

Inception date: October 11, 011

Large-, mid- and small-cap stocks breakup (%): 45:22:21

Investment attributes: It follows a CORE and satellite portfolio approach

Category: Multi-cap

Inception date: October 11, 011

Large-, mid- and small-cap stocks breakup (%): 45:22:21

Investment attributes: It follows a CORE and satellite portfolio approach

10/13

Right Horizons - Minerva India Under-Served

Category: Small-cap

Inception date: April 8, 2011

Large-, mid- and small-cap stocks breakup (%): Undisclosed

Investment attributes: It comprises a portfolio of 10-20 companies identified from the small- and micro-cap space

Category: Small-cap

Inception date: April 8, 2011

Large-, mid- and small-cap stocks breakup (%): Undisclosed

Investment attributes: It comprises a portfolio of 10-20 companies identified from the small- and micro-cap space

11/13

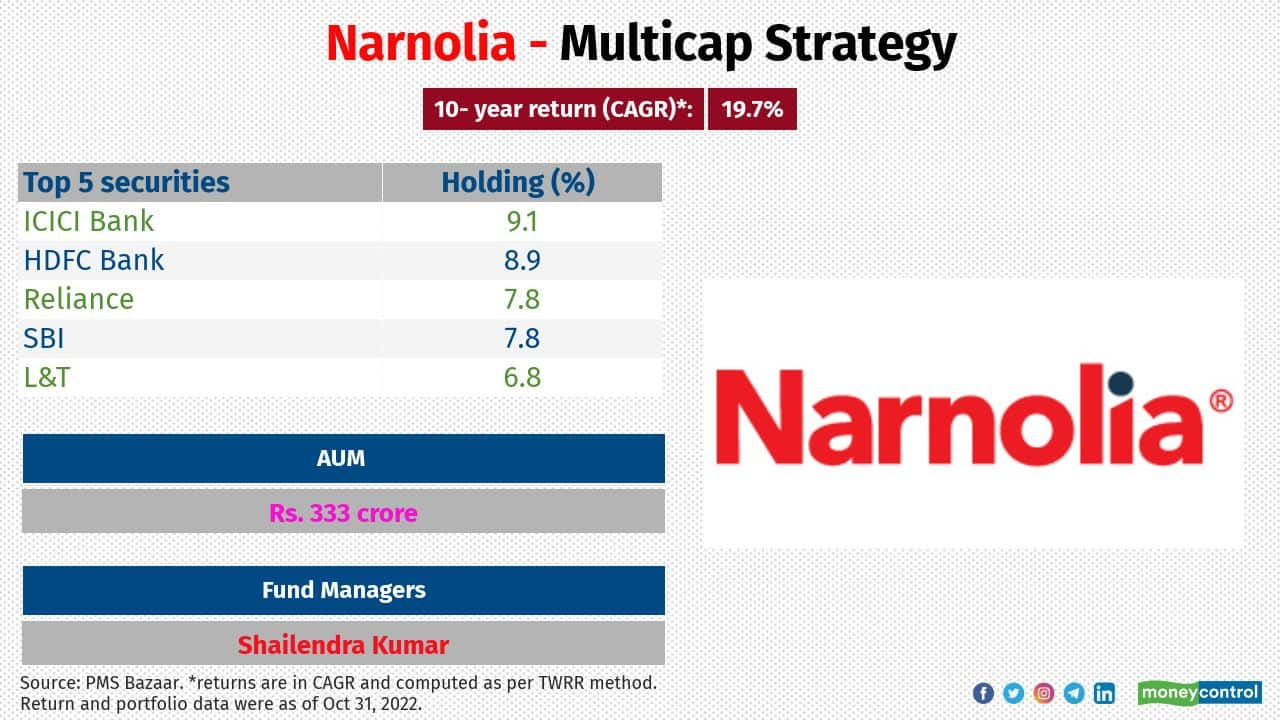

Narnolia - Multicap Strategy

Category: Multi-cap

Inception date: March 27, 2012

Large-, mid- and small-cap stocks breakup (%): 75:12:12

Investment attributes: It uses a proprietary model to identify stocks considering fundamental and quantitative multiple years’ data

Category: Multi-cap

Inception date: March 27, 2012

Large-, mid- and small-cap stocks breakup (%): 75:12:12

Investment attributes: It uses a proprietary model to identify stocks considering fundamental and quantitative multiple years’ data

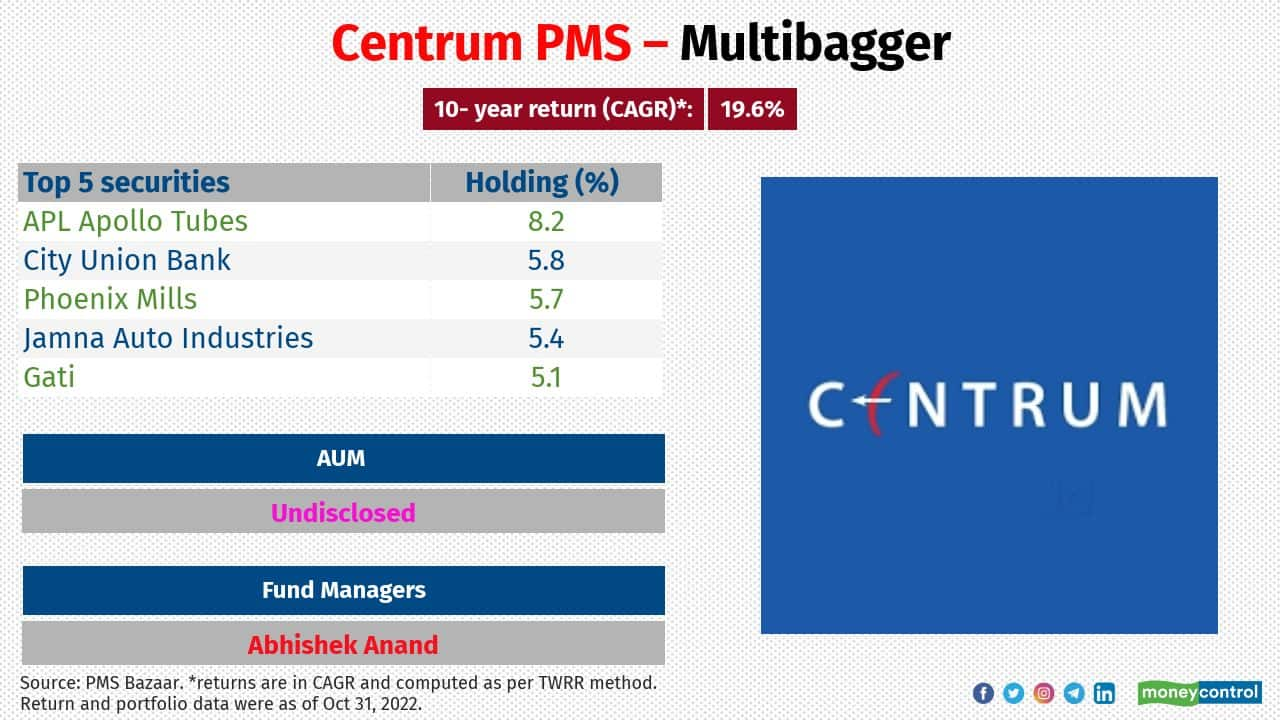

12/13

Centrum PMS – Multibagger

Category: Mid-cap

Inception date: March 5, 2012

Large-, mid- and small-cap stocks breakup (%): 19:35:41

Investment attributes: It looks for stocks that are poised for a turnaround due to factors like a change in management, demand-supply scenario, improved business environment and favorable government policies, among others

Category: Mid-cap

Inception date: March 5, 2012

Large-, mid- and small-cap stocks breakup (%): 19:35:41

Investment attributes: It looks for stocks that are poised for a turnaround due to factors like a change in management, demand-supply scenario, improved business environment and favorable government policies, among others

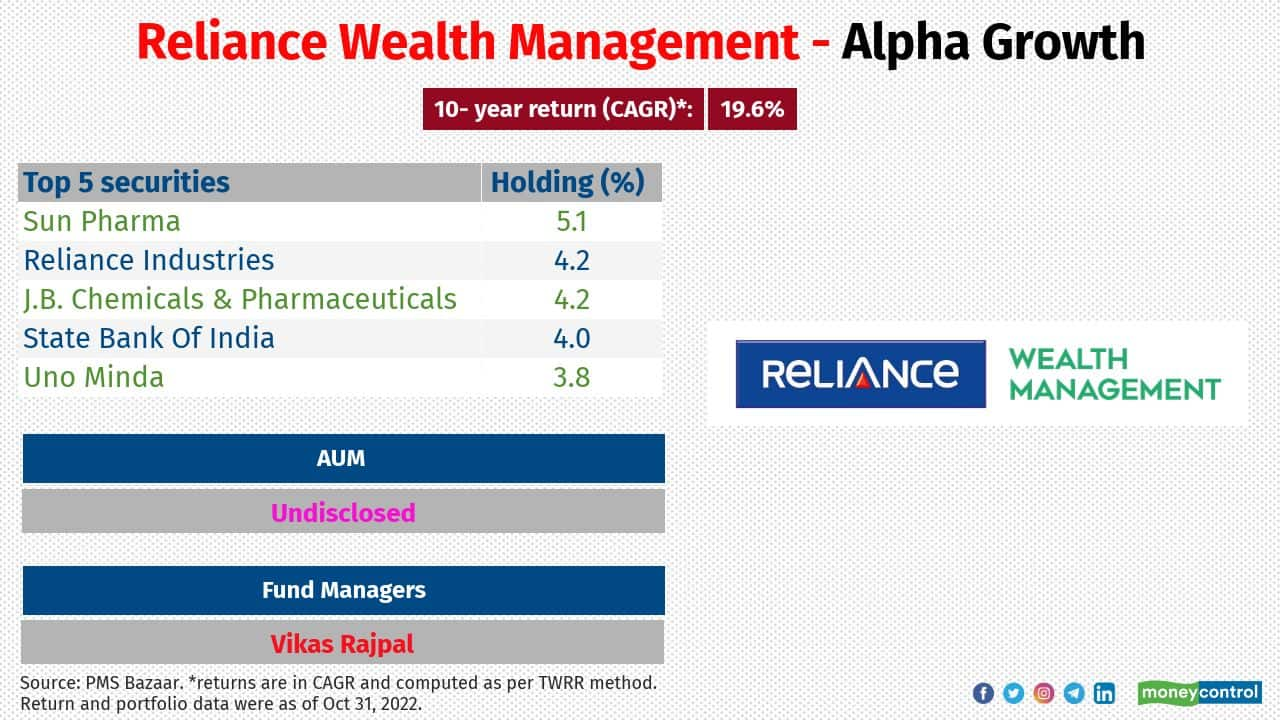

13/13

Reliance Wealth Management - Alpha Growth

Category: Multi-cap

Inception date: January 22, 2008

Large-, mid- and small-cap stocks breakup (%): 43:18:31

Investment attributes: It has managed with a well-balanced portfolio containing stocks across market capitalisation

Category: Multi-cap

Inception date: January 22, 2008

Large-, mid- and small-cap stocks breakup (%): 43:18:31

Investment attributes: It has managed with a well-balanced portfolio containing stocks across market capitalisation

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!